US economics, inflation and geopolitics

The Fed is determined to contain inflation with everything in its toolbox. During its March meeting, the Fed signaled a large and rapid increase in its policy rate over the next two years and struck a hawkish tone, indicating it is ready to go beyond normalizing to try to tame inflation. As expected, the Federal Reserve kicked off its hiking cycle with a quarter-point increase — the first since 2018. The Fed also projected the fed funds rate to reach 2.8% by the end of 2023. Whether the Fed will fully deliver on rate hikes will depend on its assessment of the impact on growth and employment — nothing is set in stone.

A strong jobs market, which included the addition of an estimated 1.16 million nonfarm payroll jobs during the first two months of 2022, gives the central bank more room to focus on the other half of its dual mandate, specifically promoting stable pricing. The Labor Department reports showed that both consumer and producer prices jumped markedly in February, with respective 12-month increases of 7.9% and 10.0%.

The ongoing war in Ukraine and the retaliatory sanctions against Russia are causing significant disruptions in the global oil supply. Resulting in higher energy costs may lead to a slowdown in economic growth, as consumers are forced to defer spending on other discretionary products and services. This may offset some of the near-term boost the economy gets from an improving health situation, as concerns about the COVID-19 Omicron variant fade.

Global economics

According to JP Morgan, central banks are facing a difficult challenge in setting a policy to promote low and stable inflation alongside full employment. On the surface, they are displaying limited sensitivity to near-term downside growth risks as they guide toward significant policy tightening this year. At the same time, central banks appear to believe that their actions will not result in subpar growth in order to contain rising medium-term inflation risks. However, the reality is that central bank tightening likely will impact both near-term growth and medium-term inflation outcomes that depart from their tolerance zones. Despite hawkish near-term guidance, developed markets’ central banks remain averse to developments that would risk recession this year. JP Morgan lowered its US and global GDP forecasts for 2022 from 3.6% to 3.3% and from 4.2% to 3.4% respectively.

Portfolio management

Currently, US economy rate sensitivity is the key consideration for portfolio management. The economic cycle could be at risk if the Fed tightens too much. Market participants follow mortgage rates and housing demand dynamics to assess the impact of higher interest rates on the economy. So far, low inventories and high demand are offsetting higher mortgage rates.

Recently, Goldman Sachs (GS) published a study citing tactical strategies, which improved diversified multi-asset portfolios during past periods of higher inflation and/or slower economic growth. At Signet we have already implemented most of these enhancements in our portfolios. Here are some highlights from the study:

• Real assets

Allocations to real assets look more attractive with higher inflation. Broadly defined, real assets are mostly physical assets with an intrinsic value due to their substance or properties. This includes commodities and real estate. In the event of high and rising inflation periods, real assets can offer both the opportunity for uncorrelated returns and competitive real return potential.

Signet investment team added a real assets tactical tilt to multi-asset portfolios in 2021.

• Value–Growth barbell and sector tilts

Isolating equity styles and themes can improve diversification. This strategy combines broader diversification with market rotation. Factor or style investing has become popular since the seminal paper from Fama and French (1993). Especially during periods with high and rising inflation, such as the 1970s, value stocks generally outperformed growth materially in the US. The correlation between growth and value has declined sharply since the COVID-19 crisis, pointing to diversification benefits from balanced exposure to value and growth styles.

Closely related has been the outperformance of the US Technology sector last cycle, which generated strong top-line growth while many old economy sectors such as Banks, Utilities, Telecoms, and Energy faced macro and micro headwinds. With higher inflation, value stocks and sectors like Energy and Banks tend to outperform. There are risks, however. As inflation expectations increase, so does the potential for disappointments and negative growth shocks, e.g., due to excessive monetary policy tightening. Investors need to balance inflation and growth risk, which suggests exposure to quality, low volatility, and dividend stocks.

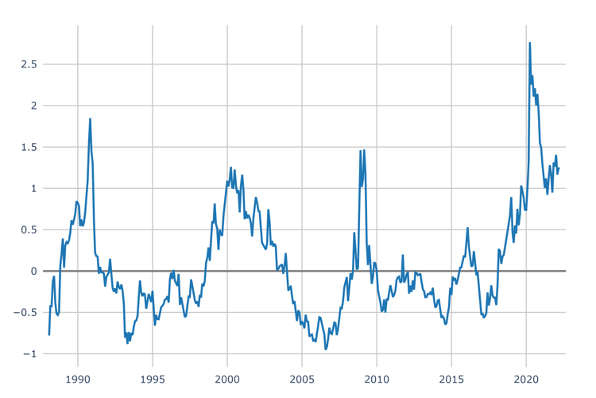

Valuation spreads have narrowed (see Chart 1 below).

Chart 1: Valuation Spread through February 2022

Source: Signet Financial Management, LLC

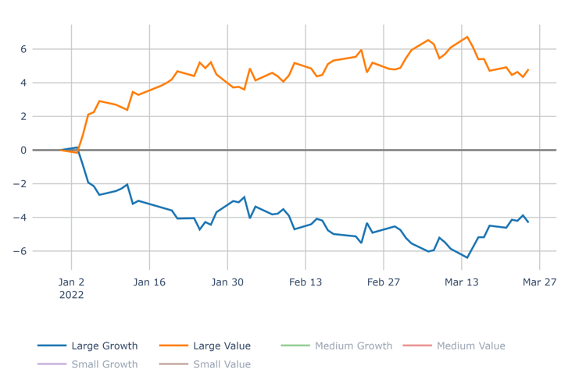

Value no longer has a huge advantage compared to Growth, as we saw in 2020-21. With slower economic growth, we might see investors crave profitable Growth companies again. So far, the rotation to Value continues with brief interruptions due to higher risk aversion (see Chart 2 below).

Chart 2: Large Growth and Value SP Indexes Alpha 2022 YTD (as of 03/25/2022)

Source: Signet Financial Management, LLC

We currently favor a barbell composition in stock portfolios, that mixes profitable Growth with cyclical Value themes and emphasizes Profitability.

• Stock-like bonds and bond-like equities

A balanced portfolio is likely to perform better if it has cheap stocks with growth and bonds that offer attractive yields after inflation. But growth stocks are expensive and there are few bonds with positive real yields and the potential to buffer equities. In the search for growth and yield, multi-asset investors can reverse roles and look at equity-like bonds, such as convertibles, or bond-like equities, such as defensive, high dividend yield stocks.

Last cycle and during the COVID-19 crisis, many high-yielding stocks disappointed investors. However, during the 1970s stagflation, high dividend yield stocks performed well. Dividend investing also impressed during the 2000s, when the Tech Bubble burst.

Both high dividend yield stocks and convertibles are positively correlated with US 10-year yields — and the correlation with the S&P 500 is usually well below 1. This points to diversification benefits for US balanced portfolios. High dividend yield stocks are attractive in multi-asset portfolios, especially for investors focused on income. However, investors need to balance the growth/yield trade-off — the highest yielding stocks often have weak long-term growth prospects and could end up as ‘value traps’. This is where skilled active management can add value.

In our high dividend and quality dividend equity strategies, the Signet team pays attention not only to dividends for current yield but also to growth and profitability characteristics.

Allocations to convertibles can be attractive for multi-asset portfolios as they allow more equity exposure with lower drawdown risk. US convertibles delivered nearly the same return as the S&P 500 since 2000 but better risk-adjusted-performance. However, convertible markets have some unique risks due to the relatively small and less liquid markets compared with equity and credit markets. The rising cost of debt, both due to higher rates and wider credit spreads, coupled with elevated equity volatility, could drive increased issuance and opportunities in convertibles.

• International equities and bonds

GS expects more opportunities to diversify across regions. After more than a decade of US outperformance, global equity benchmarks and portfolios are tilted to the US. Non-US equities could offer diversification benefits, as regional equity and bond correlations are likely to be lower going forward.

In the last 30 years, there has been little benefit from regional diversification within equities or bonds, while diversification across assets was very effective. In part, this was due to increasing global economic and capital markets integration since the 1990s. In addition, larger companies generally became more global with a larger proportion of revenues derived outside home markets. Since the COVID-19 crisis, there has been a large decline in regional equity correlations. This reflects less synchronized business cycles, in part due to local COVID-19 waves and different lockdown policies, but also due to diverging fiscal and monetary policies.

GS expects less US equity outperformance in the coming years compared with the last cycle. Higher equity valuations and margins in the US could become headwinds for returns while weaker growth for non-US equities is better discounted or trend growth might pick up. In periods of elevated rates volatility, in particular, allocations to non-US equities help diversify rate shock risk — this has been the case since the start of this year. GS expects regional earnings and dividend growth differentials to narrow in the Post-Pandemic Cycle.

As for bonds, with higher inflation and desynchronized monetary policy across regions, there is more potential for return dispersion across global bond markets. While the opportunity set in developed markets fixed income is limited, there are opportunities from international bond diversification in select emerging markets.

The Signet investment team tactically adjusts exposure to foreign equity and bond markets in our multi-asset strategies.

• Private markets

Selective private equity, real estate, and debt investments can enhance the risk/reward of multi-asset portfolios. With lower returns and less diversification potential in public markets, private markets have grown materially. A key problem, however, is that they often have limited available transparent and comparable history, which makes it difficult to assess their risks and diversification benefits — they can also increase duration, leverage, and illiquidity risk in the portfolio.

Since the 1980s private equity (PE) and venture capital (VC) have offered attractive returns vs. the S&P 500, albeit mixed over time. PE broadly comprises leveraged buyouts, venture capital (early-stage PE), growth capital, distressed investments, and mezzanine capital. PE outperformed the S&P 500 in the 2000s but much less post-Great Financial Crisis — VC performed particularly strongly in the run-up to the Tech Bubble.

GS thinks private markets can offer selective, attractive investment opportunities for multi-asset investors, especially those that benefit from the smoothed performance, e.g., due to regulations. Also, private asset managers might be able to identify attractive assets that are not available in public markets. However, with increased competition there is a risk of lower returns, making manager selection more important.

The Signet investment team continues to be proactive in many aspects of portfolio management. We are constantly on the lookout for opportunities to tactically adjust our strategies as we seek optimal investment solutions for clients.

The information and opinions included in this document are for background purposes only, are not intended to be full or complete, and should not be viewed as an indication of future results. The information sources used in this letter are WSJ.com, Jeremy Siegel, Ph.D. (Jeremysiegel.com), Goldman Sachs, JP Morgan, Empirical Research Partners, Value Line, BlackRock, Ned Davis Research, First Trust, Citi research, and Nuveen.

IMPORTANT DISCLOSURE

Past performance may not be indicative of future results.

Different types of investments and investment strategies involve varying degrees of risk, and there can be no assurance that their future performance will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

The statements made in this newsletter are, to the best of our ability and knowledge, accurate as of the date they were originally made. But due to various factors, including changing market conditions and/or applicable laws, the content may in the future no longer be reflective of current opinions or positions.

Any forward-looking statements, information, and opinions including descriptions of anticipated market changes and expectations of future activity contained in this newsletter are based upon reasonable estimates and assumptions. However, they are inherently uncertain, and actual events or results may differ materially from those reflected in the newsletter.

Nothing in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice. Please remember to contact Signet Financial Management, LLC, if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and/or services. No portion of the newsletter content should be construed as legal, tax, or accounting advice.

A copy of Signet Financial Management, LLC’s current written disclosure statements discussing our advisory services, fees, investment advisory personnel, and operations are available upon request.