October 3, 2025

CNBC just named Signet one of the 100 Best financial advisors in the U.S.! This reflects our team’s commitment to fiduciary excellence and personalized client care.

March 3, 2026

With the S&P 500 nearing 6900, market strength is broadening into cyclicals and mid-caps. Learn why current economic dynamics favor selectivity.

March 3, 2026

With Q4 profit growth hitting double digits, market leadership is expanding. Discover why small-cap and value companies are outperforming mega-cap tech.

February 23, 2026

The top 10 S&P 500 stocks now comprise nearly 40% of the index. We analyze the hidden danger in “diversified” funds and how to protect your wealth.

February 2, 2026

Corporate profits remain robust as leadership expands beyond tech. Discover why small-cap and value stocks may offer prudent growth amidst guidance uncertainties.

January 29, 2026

With gold correcting from $5,600 and silver from $120, we evaluate the structural case for holding hard assets amidst shifting Federal Reserve policy.

January 1, 2026

Bond laddering is back. Discover how this timeless strategy seeks to help retirees and investors generate predictable income as Fed policy shifts in 2026.

January 1, 2026

As inflation eases and the Fed eyes rate cuts, investors brace for policy shifts and global reacceleration. Read Signet’s 2026 economic outlook.

December 18, 2025

Learn how Signet’s model portfolios support retirement goals with personalized strategies for growth, income, and risk management. Watch the short video and request your free portf…

December 18, 2025

AI isn’t done yet. But what’s next for the 60/40 portfolio and income strategies? Explore 2026 investment themes from Signet’s Chief Investment Strategist Steve Tuttle.

December 1, 2025

U.S. consumer spending stays strong despite inflation. The Fed pauses, markets weigh AI gains, and global growth risks remain. Explore our latest insights.

December 1, 2025

Market volatility tests more than your portfolio — it tests your advisor. Learn what strategic guidance looks like when it counts.

November 3, 2025

Worried about private credit risk? We explain why recent defaults are isolated, not systemic — and how quality managers avoid those pitfalls.

November 3, 2025

The Fed eases rates as job growth slows and tariffs rise. Discover how Signet positions portfolios for inflation, volatility, and opportunity.

October 27, 2025

Discover Signet’s Q4 2025 portfolio positioning, with increased exposure to AI, gold, and global defense. Watch now or request your free portfolio review.

October 27, 2025

Explore how Signet’s Model Portfolios help you build, preserve, or draw down wealth with confidence. Watch the video and request your free portfolio review.

October 3, 2025

As gold hits new highs, investors and central banks alike are boosting demand. Discover why gold is a strategic hedge in today’s uncertain market.

September 30, 2025

The Fed cuts rates as job growth slows and inflation diverges. Discover what this means for markets, housing, and investors heading into Q4.

September 18, 2025

The Fed has cut rates and cash yields are falling. Explore smart strategies to replace idle cash and pursue income and diversification.

September 4, 2025

As inflation data diverges and the Fed eases its stance, markets respond to earnings and growth. Discover how Signet is positioned amid tariffs and rotation.

August 28, 2025

Looking for yield with less risk? Discover how structured notes provide defined outcomes, income potential, and protection in volatile markets.

August 21, 2025

Learn how investors are using private real estate, REITs, and credit strategies to access income, growth, and portfolio resilience in today’s market.

August 7, 2025

Wall Street sees a pullback ahead — but it may be a buying opportunity. Here’s why staying invested could be your smartest move this August.

July 31, 2025

Explore the long-term investment themes shaping tomorrow’s markets — from AI and inflation to global shifts and rising debt.

July 31, 2025

Discover why global growth is holding steady, despite rising tariffs and sentiment shocks. Plus, what the Fed’s pause means for your portfolio.

July 9, 2025

Fed stays hawkish despite easing inflation. Explore how oil prices, tariffs, and geopolitical shifts shape economic expectations.

June 3, 2025

Steve Tuttle explains how easing tariffs, strong earnings, and cooling inflation fueled a historic May rally in the S&P 500. Will the momentum last?

June 3, 2025

Eugene Yashin breaks down the latest inflation data, Moody’s downgrade, and how tariffs and fiscal policy are shaping economic growth this year.

May 14, 2025

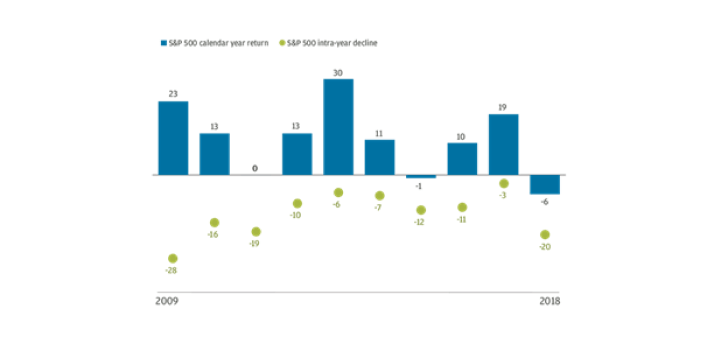

April’s scary market headlines led many to sell. Here’s how staying calm and focused could have preserved — or even boosted — your portfolio.

May 1, 2025

Steve Tuttle breaks down how tech concentration could derail your investment strategy — and why global returns and bond exposure deserve attention.

May 1, 2025

Is a recession coming? Get the latest on consumer sentiment, rate cuts, trade tensions, and how investors can prepare for the road ahead.

April 1, 2025

Explore effective strategies to manage your investments amid tariff-induced market volatility in 2025.

April 1, 2025

Discover how to navigate the 2025 market rotation with Eugene Yashin as he contrasts the AI boom with traditional sectors, offering guidance for robust portfolio management.

March 13, 2025

Steve Tuttle shares vital strategies for handling 2025’s market dips. Learn why staying invested and diversifying could safeguard your financial future.

March 5, 2025

Considering a Roth conversion? Discover how it could lower your future taxes and provide you with financial freedom in retirement.

March 4, 2025

Gain insights from Eugene Yashin on what to expect in the financial markets and how to adapt your financial strategies.

February 24, 2025

Adjust your portfolio for 2025. Learn which sectors are poised to lead beyond the tech giants for diversified growth.

January 31, 2025

Eugene Yashin analyzes the current state of US economics and inflation, focusing on the Federal Reserve’s strategies for 2025. Discover how upcoming policies could impact your inve…

January 30, 2025

Learn how private credit can help diversify your investments and bolster your retirement planning, with potentially high returns and sustainable income.

January 3, 2025

Get the latest insights on US economic growth, inflation trends, Fed rate cuts, and global central bank policies. See what’s ahead for markets in 2025.

December 2, 2024

Discover the benefits of infrastructure investments, from income generation to inflation hedging, and the rising trend of sustainable projects.

December 2, 2024

Eugene Yashin reviews the shifting global economy, US policy changes, and their implications for stocks, bonds, and long-term growth strategies.

November 12, 2024

Post-election rally explained: Learn how reduced risk, institutional demand, and seasonal trends are driving US equities higher.

November 5, 2024

Eugene Yashin provides insights into the Fed’s rate cut strategy, exploring the ripple effects on job stability, inflation, and market performance.

October 24, 2024

Explore how presidential elections impact the stock market. Discover why sound investment decisions should be based on data, not political rhetoric.

October 14, 2024

Goldman Sachs raises S&P 500 year-end targets and earnings estimates for 2025 and 2026, signaling strong growth prospects for the stock market.

October 8, 2024

Goldman Sachs raises S&P 500 year-end targets and earnings estimates for 2025 and 2026, signaling strong growth prospects for the stock market.

October 4, 2024

Discover why late 2024 may bring a bullish stock market boost, with seasonal patterns, post-election optimism, and economic factors supporting positive returns.

October 2, 2024

The Fed starts cutting interest rates as inflation cools. Explore how easing monetary policy, consumer debt, and labor market slowdowns impact the US economy.

September 16, 2024

Explore why aggressive rate cuts from the Fed may not happen as anticipated. Learn how inflation and economic factors could shape monetary policy decisions.

September 12, 2024

Discover how covered call selling can help investors manage risk, generate income, and reduce volatility in uncertain stock markets. Learn the benefits and trade-offs.

September 3, 2024

As inflation slows, the Fed considers rate cuts to balance economic growth. Learn how this impacts markets and your investments.

August 29, 2024

Guide to financial planning for dementia: Practical advice on managing finances, legal documents, and finding support for those facing cognitive challenges.

August 22, 2024

Explore the benefits of private credit investments. Learn how to integrate them into your portfolio for better returns and risk management.

August 15, 2024

In a volatile market, dividend stocks offer steady income and growth potential. Learn how to build a dividend-focused portfolio with Signet.

August 6, 2024

Weather the storm in turbulent markets with strategic tips on diversification, dollar-cost averaging, and focusing on resilient sectors.

August 2, 2024

Explore the recent tech downturn and the rise of smaller companies. Understand AI investment risks and opportunities in today’s dynamic market landscape.

August 2, 2024

US economy grows 2.8% in Q2, surpassing expectations. Learn about inflation trends, Fed policies, and global market impacts for the second half of 2024.

July 3, 2024

Explore the concept of ‘enough’ in wealth management. Shift your investment strategy from growth to preservation and achieve true financial security.

July 1, 2024

Goldman Sachs explores AI’s ROI and tech hurdles. Will AI investment pay off, or is it just hype? Learn about the future of AI.

July 1, 2024

Understand the Fed’s ‘high for longer’ rate policy, easing inflation, and economic impacts. Insights on US and global trends for 2024.

June 18, 2024

Explore the effects of de-globalization on inflation and consumer prices. Understand the trade-offs and how to adjust your financial strategy accordingly.

June 3, 2024

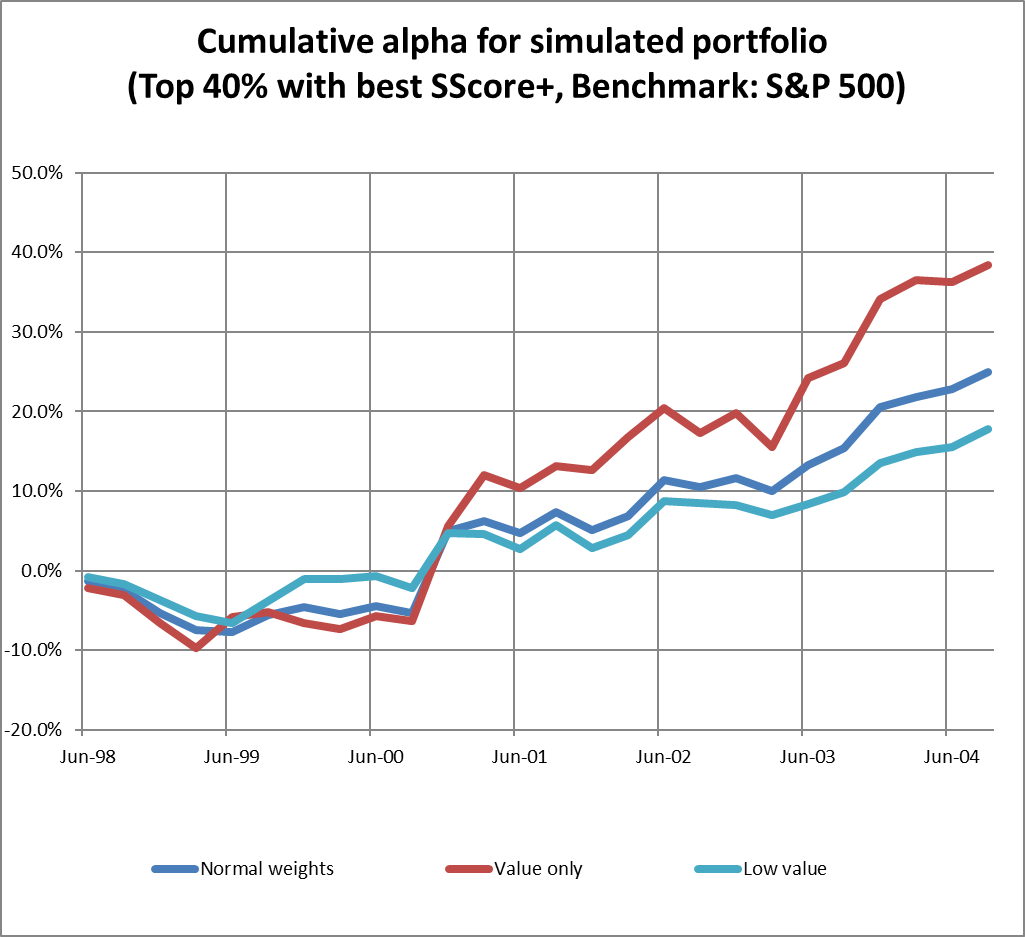

Enhance your investment strategy with multi-factor ETFs. Learn how to use research-backed factors for superior returns and risk management in your portfolio.

June 3, 2024

Explore the latest US economic insights, inflation trends, and Fed policies in Signet’s June market commentary.

May 30, 2024

Stop chasing market trends and start planning for a stable financial future. Discover how a personalized financial plan can help you achieve your goals.

May 16, 2024

Investor joy as April CPI data signals easing inflation and markets hit new highs. Explore the potential for a new bull run.

May 1, 2024

Eugene Yashin explores the latest inflation trends and Federal Reserve strategies as we delve into the challenges of reaching the 2% target.

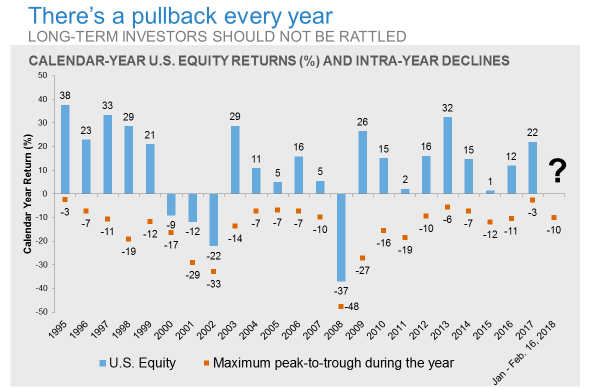

April 22, 2024

Explore the nature of stock market downturns and their impact on long-term investment goals with Steve Tuttle.

April 15, 2024

Steve Tuttle explains how combining index funds, active strategies, and a multi-factor approach can enhance returns and align with your risk tolerance for a robust portfolio.

April 1, 2024

February job growth exceeds expectations, signaling economic strength amid inflation. Learn how it affects Fed rate plans and what investors should do about it.

April 1, 2024

Explore the risks of overexposure to large-cap stocks and the benefits of alternative investing strategies for a diversified portfolio.

March 4, 2024

Stay informed on key economic updates: January’s inflation spike, the Fed’s monetary policy, global GDP growth, and S&P 500 earnings highlights.

February 29, 2024

Learn investment insights from Warren Buffett’s 2024 Berkshire Hathaway letter, highlighting the importance of clarity, patience, and fiscal prudence for success.

February 1, 2024

U.S. economy grows 3.1% in 2023, defying recession fears with a robust labor market fueling consumer spending. Explore insights on inflation, Fed policies, and the 2024 economic ou…

February 1, 2024

Explore how structured notes can stabilize your investment portfolio amidst market volatility. Learn their benefits for a balanced approach to wealth creation.

December 5, 2023

Navigate stock market fluctuations with confidence. Embrace long-term strategies, diversify with bonds, and understand the power of a well-balanced investment portfolio.

December 1, 2023

Prepare for 2024 with our market projections: economic forecasts, interest rate impacts, and investment strategies for balancing your portfolio in the upcoming year.

November 29, 2023

Explore how structured notes can amplify the performance of your 60/40 portfolio. Understand their role in risk management and potential for higher returns in your investment mix.

November 9, 2023

Diversify beyond stocks and bonds with private markets. Discover long-term growth with private credit and infrastructure.

November 1, 2023

Considering investing in bonds? Discover why current interest rate conditions might make now the ideal moment.

November 1, 2023

Strong start to Q3 earnings season, with major banks exceeding forecasts. However, the current financial landscape presents challenges, particularly with the bear steepening of the…

October 2, 2023

The U.S. inflation situation remains uncertain, with the potential for another rate hike. Read how Signet adjusts portfolio strategies to navigate this intricate landscape.

October 2, 2023

Historically, the fourth quarter offers strong stock market returns. With signs of a potential rebound and support levels, cautious optimism prevails for a favorable end to 2023.

September 5, 2023

The U.S. inflation situation remains uncertain, with the potential for another rate hike. Read how Signet adjusts portfolio strategies to navigate this intricate landscape.

August 1, 2023

Learn about Signet’s approach to investing in dividend stocks. Discover a better way to build a diversified portfolio for steady income!

August 1, 2023

The US economy shows positive signs with cooling inflation, boosting equities. With a strong consumer and solid job market, fears of a recession lessen.

July 6, 2023

Explore the dynamics of the US economy, inflation, and the impending Fed’s rate hike decision, alongside the potential impact of AI on the economy.

June 2, 2023

Earnings season proved better than expected. Inflation slowed. The Fed may be done with rate hikes. Read how Signet is positioning portfolios for the latest market developments and…

May 1, 2023

Earnings season is underway, and investors are watching closely. Find out what the latest economic data mean and how stocks are holding up against inflation

April 4, 2023

Eugene Yashin gives a comprehensive analysis of the current economic landscape and shares a macro look at the banking crisis and its implications for the markets.

March 21, 2023

The collapse of three US regional banks and the Credit Suisse selloff are drawing comparisons to the great financial crisis of 2008. We believe 2023 is different. Here’s why.

March 6, 2023

Despite the short-term softening of corporate profit data, we should expect the stock market and growth rates to start advancing even amidst a recession.

January 31, 2023

Going to all cash can make sense in some situations, but the potential downsides include among others missing the market’s best days of high returns.

January 17, 2023

The SECURE 2.0 Act is packed with 92 retirement-savings provisions and illustrates the importance of revisiting your retirement and tax planning strategy annually.

December 5, 2022

Stocks and bonds continued their rebound in November. Chief Investment Officer, Eugene Yashin, provides key insights on today’s markets and what may lie ahead.

November 1, 2022

Despite the polarization ahead of midterms, avoid the temptation to make significant changes to a long-term investment plan based on which party controls Congress.

November 1, 2022

Monetary policy tightening may give way to a recession, but share prices do not currently reflect that risk. Market analysts share their sector forecast and portfolio recommendatio…

October 4, 2022

This year is well on its way to being the worst in modern history for bond investors. But there is finally some income to be earned in the fixed-income market.

October 3, 2022

Nobody in the stock market feels good right now, which is a sign that things could change soon. The current market drop is an overreaction which investors can exploit.

September 1, 2022

Inflation remains high, yet the mighty U.S. consumer has proven resilient and earnings and projections came out stronger than had been feared.

August 31, 2022

How you react to volatile markets plays a crucial role in your long-term success. Here are a few steps to take when the market gets scary.

August 1, 2022

The stock market took notice of the slowing economy and took off from recent lows. The bearishness on earnings remains unanimous though.

July 6, 2022

Volatility can be managed. Steve Tuttle shares 4 investment strategies to manage volatility: reducing, navigating, harnessing, and monetizing.

July 6, 2022

How much further can equities adjust before the trough? What will the new cycle be like? Eugene Yashin addresses the critical issues for investors in the bear market.

May 31, 2022

The US economy contracted in Q1 and retailers reading looked discouraging, but expansion prevails in 2022 and the spike in inflation is not going long-term.

May 2, 2022

Eugene Yashin reviews 3 themes impacting investors: inflation, rates, and earnings. What equity portfolio management strategies should investors employ?

April 5, 2022

The Signet investment team thinks the hawkish pricing in short-term rates might be overdone and prefers short-maturity bonds over long-term ones.

April 1, 2022

The economic cycle could be at risk if the Fed tightens too much. Eugene Yashin shares what investment strategies Signet has implemented to protect clients’ portfolios against infl…

March 25, 2022

Financial planning goes beyond growing savings and cutting expenses. Here’re 5 steps to a solid financial plan.

February 28, 2022

Historically, geopolitical events do not matter much for equities, but rising oil prices spur the Fed to act more swiftly. Eugene Yashin shares the market projections.

February 1, 2022

As the markets go through corrections, creating buying opportunities for long-term investors, what should you pay more attention to? Eugene Yashin and Steve Tuttle share the marke…

December 30, 2021

Heading into the new year, look back on the positives and negatives for investors in 2021. Check out the highlights from Goldman Sachs, J.P. Morgan, and Siegel.

December 2, 2021

Interest rate uncertainty and Omicron implications unnerve the markets, while a strong economy and earnings support the existing sentiment.

November 2, 2021

Watch our video from Christopher Berté CFP® of Signet Financial Management, provide helpful steps to take when a loved one passes.

November 1, 2021

Inflation worries grow as the economy reopens. Steve Tuttle explains how to position your portfolio for financial success regardless of how much prices rise.

November 1, 2021

The market has been very volatile recently. In between higher earnings expectations and concerns about a possible market correction, what investors should do?

October 25, 2021

Amid the market volatility fear and greed can get the best of investors. These tips help control your emotions and achieve long-term success in the markets.

October 4, 2021

Delta fear factor, inflation concerns, the Fed’s tapering make investors rely on mega-cap growers, but the projections from the broader market stay positive.

September 28, 2021

Understanding when to claim Social Security is vital to your retirement. Watch Daniel DiVizio, CFP® CRC®, explain when to take action.

September 21, 2021

Financial security in retirement takes planning, commitment, and money. These 4 questions help identify your goals and needs within a retirement strategy.

September 1, 2021

Employment, industrial production, and factory usage are strengthening. Yet the Delta variant’s impact on growth and inflation could be larger than expected.

August 2, 2021

Despite the growth bounce there’re concerns around the Delta wave impacting the market and Tech serves as a safety resort against potentially slower economy.

July 27, 2021

There are many successful investment strategies that have performed well over time. Yet, capturing these returns is not easy for investors. Patience can help.

July 6, 2021

Do you want to invest for retirement? Dividend-paying stocks can help preserve your capital over long term and generate income regardless of market conditions.

June 28, 2021

GDP is on target to grow above 6% with gains in exports, a decline in jobless filings, a rebound in consumer sentiment, and rising industrial production.

June 17, 2021

Client Relationship Manager of Signet Financial Management explains what you should think about when planning for a successful retirement.

June 1, 2021

Declines in jobless filings, stability in retail sales, gains in production. How does the US economy recovery affect stock market and portfolio management?

May 14, 2021

Shawn Hirsch, CFP®, Wealth Management Partner of Signet, explains why with historically low interest rates you shouldn’t prepay mortgage and rather invest it in the market.

May 3, 2021

Amid earnings season, a critical question now is whether the entirety of the economic recovery has already been discounted in the stock and bond markets.

April 28, 2021

Tax policy impacts corporate earnings and the stock market. However, over the long haul, other factors have more influence on the stock market performance.

April 1, 2021

With economic growth projections and huge liquidity we expect inflation to kick in. Read how we adjust our postures to address the changing environment.

March 23, 2021

Every correction seems like the start of a downturn. Yet market corrections don’t lead to lengthy bear markets. Read how Signet handles market volatility.

March 9, 2021

Real assets can hedge against inflation in the current environment. Find out what two types of real assets Signet advisors focus on for a balanced portfolio.

March 9, 2021

Chief Investment Strategist of Signet Financial explains why commodities and real estate are worth investing in during the current market environment.

March 1, 2021

The vaccination results suggest efficacy of conventional public health measures. Read how great news on vaccines supports markets and limits downside risk.

February 25, 2021

Losing a loved one is never easy, but financially preparing is just as important to ensure that your family can grieve peacefully.

February 16, 2021

Can investors secure more returns? Seeking to avoid significant declines is also important, learn more with Shawn Hirsch, Wealth Management Partner of Signet Financial Management.

February 16, 2021

With President Biden now in the White House supported by a narrow Democrat majority in Congress, new policies could impact how markets and your investments react.

February 5, 2021

Do you know how make things easier for your family when you pass? See how end of life planning can positively help your heirs and ease burden.

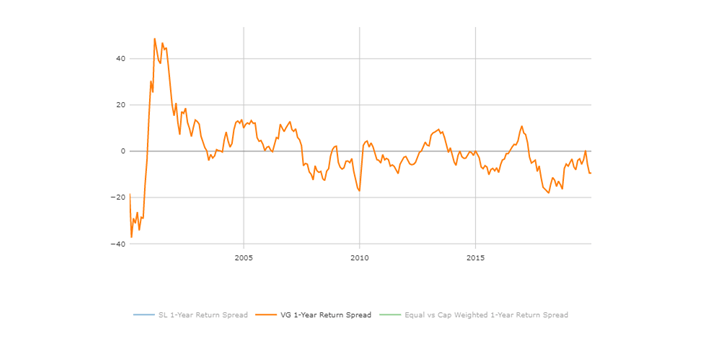

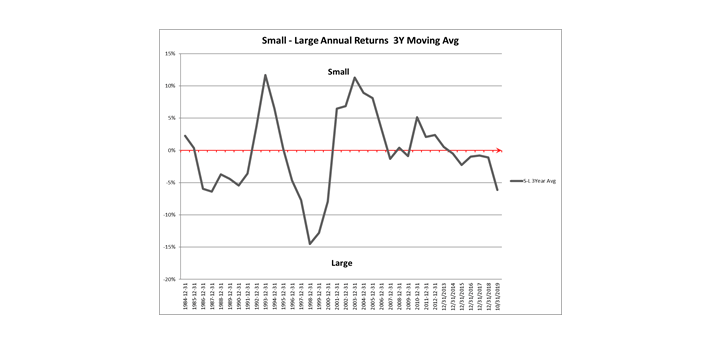

February 1, 2021

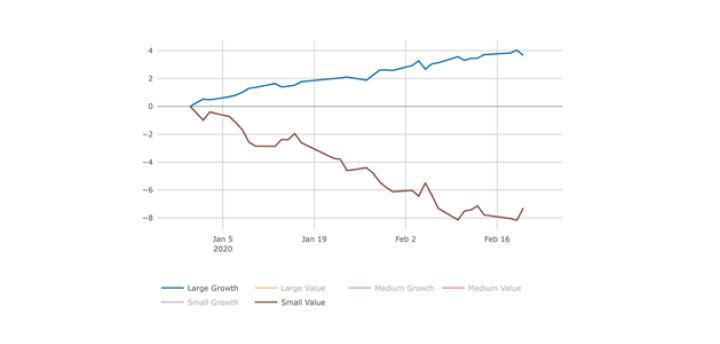

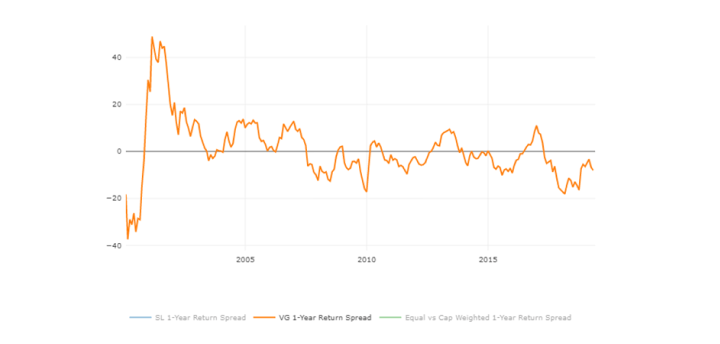

Eugene Yashin highlights the strong performance of smaller stocks, value stocks and indicates sector opportunities for investors with a long-term perspective.

February 1, 2021

The GameStop and AMC Entertainment story has dominated headlines recently. Steve Tuttle on why this won’t have a big, lasting impact for long-term investors.

January 27, 2021

Divorce can have a significant impact on one’s finances as well as that of the family’s. Becoming better educated and speaking with a qualified advisor is critical to helping navig…

January 22, 2021

Direct Indexing seeks to replicate the benefits of index investing through a carefully constructed portfolio of individual stocks.

January 14, 2021

2020 was a year of major upheaval. Here’re universal and timeless investment guidelines from Signet advisors to help you improve your financial situation.

January 14, 2021

Retirement takes planning and commitment. Watch Client Relationship Manager, Dan DiVizio, provide advice on preparing for the retirement you deserve. Checkout these tips to prepare…

January 1, 2021

Eugene Yashin on how the $900bn COVID relief package combined with the Fed commitment to long-run monetary policy should support the markets going forward.

December 21, 2020

Watch Signet investment advisor explain how clients can boost through tax returns with tax loss harvesting and other essential tips.

December 9, 2020

It’s a tough year for tax planning without knowing for sure which party will control the Senate. However here’s how Signet advisors help clients save taxes.

December 1, 2020

Stocks hit record highs on growing evidence of effective vaccines emergence. Eugene Yashin reviews global and US economics, stock market and portfolio changes.

November 19, 2020

Eugene highlights small cap strategy and why the current environment offers a compelling case for new opportunities in small caps.

November 19, 2020

Roth IRAs can provide federal tax free income in retirement and greater flexibility when it comes to distributions.

November 13, 2020

Investing after the US Election may pose crucial questions for you and your portfolio. Learn what our Signet advisors have to discuss.

November 1, 2020

Some investors think putting their money with multiple financial advisors means better results. This is not necessarily the case. It can make things worse.

November 1, 2020

On the eve of elections, Eugene reminds investors of a key lesson from 2016: avoid making big bets that rely on one particular outcome to perform well.

October 8, 2020

In a joint study with Duke University’s Fuqua School of Business, Signet investigates how patent disclosure impacts stock price of the focal patent company.

October 1, 2020

President Obama and President Trump pursued different policies while in office. Yet results in the financial markets were awfully similar during their terms.

October 1, 2020

Stock markets have cooled off recently and the economy provides stability. The volatility is creating pockets of opportunity for long-term investors.

September 10, 2020

Notwithstanding the recent volatility, we are still finding many attractive opportunities to enhance returns and manage risk.

September 1, 2020

Sector investing is an underrated strategy for investors, while it complements a core portfolio by seeking to enhance returns or diversifying portfolio risks.

September 1, 2020

COVID infections spread however on the third quarter economic front, surveys result as positive. New weekly jobless filings and ongoing claims remain high.

July 31, 2020

How are the upcoming elections likely to shape financial markets? More on investing during 2020 elections with Shawn Hirsch & Steve Tuttle.

July 31, 2020

US economy improves with strength in retail spending, industrial output, and housing. COVID infections cause unemployment, high jobless filings remain.

July 1, 2020

Careful asset placement helps save on taxes. Asset location seeks to identify the right type of investment to own in retirement plans vs. taxable accounts.

June 29, 2020

In Q2 2020 US equities staged a remarkable recovery from the Q1 decline rewarding investors who were able to stay invested. More in Signet’s market overview.

June 5, 2020

With every crisis comes opportunity. Watch Eugene’s video on the rapidly changing dynamics within the stock markets and how we are positioning portfolios to benefit. Brought to you…

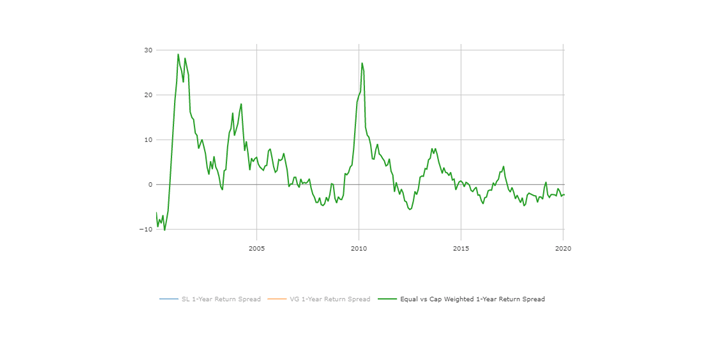

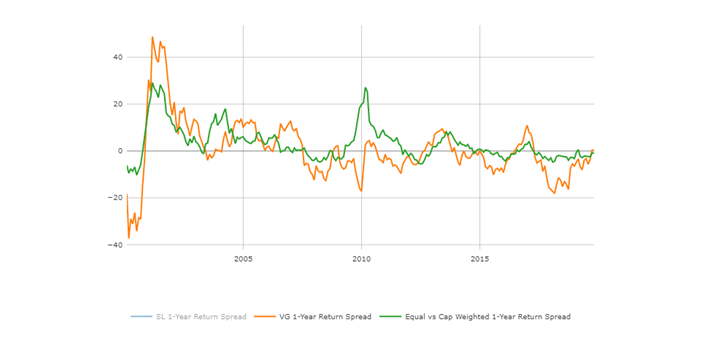

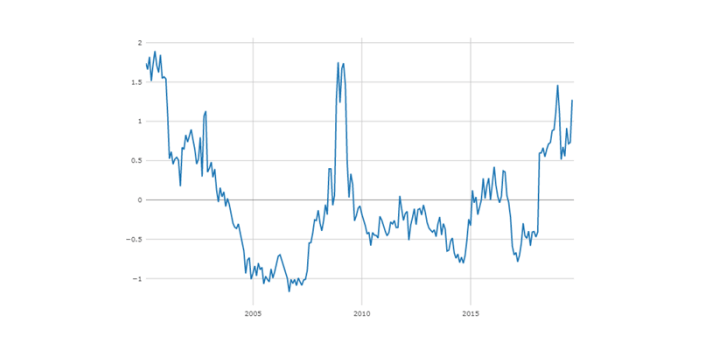

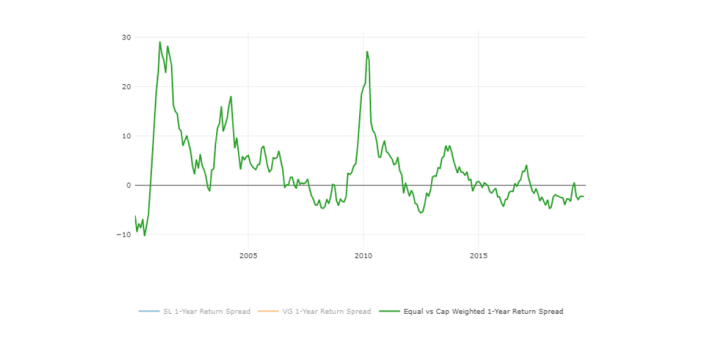

June 1, 2020

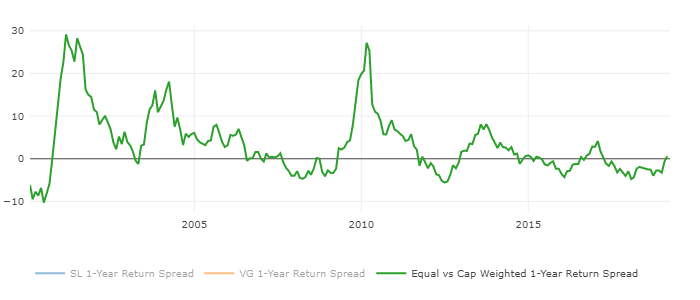

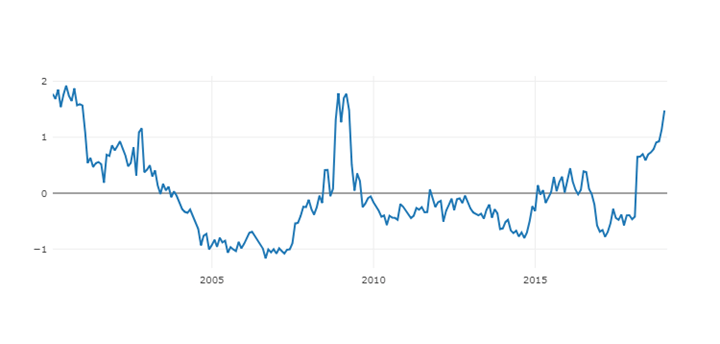

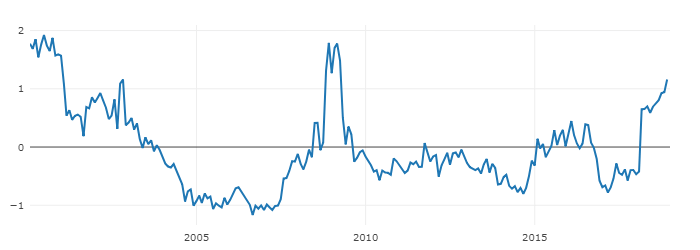

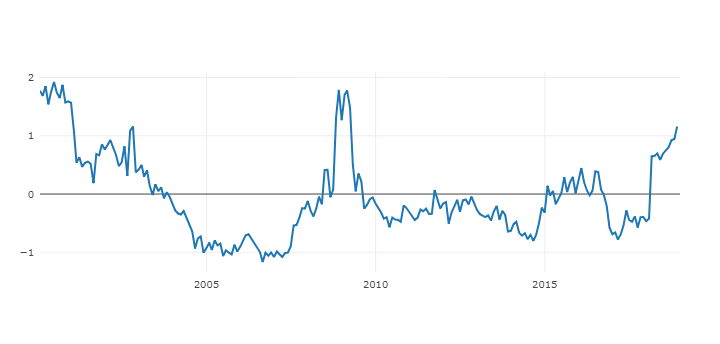

No single factor works all the time. Steve Tuttle highlights the performance of factor investing and shows why portfolio diversification is so important.

June 1, 2020

In Q2 of 2020, US equities staged a remarkable recovery coming from the Q1 decline by rewarding those investors who were able to stay invested.

May 1, 2020

As Signet carefully monitors risks, we deem tax-exempt municipal bonds are generating tremendous interest from investors. See the analysis for our optimism.

May 1, 2020

April was the best month for stock markets since 1987. What are the implications for investors? Read our latest update on the economy and financial markets.

April 9, 2020

Steve Tuttle, Chief Investment Strategists of Signer Financial Management, discusses the important developments in the financial markets. We expect market volatility to continue, b…

April 1, 2020

COVID pandemic short-term dynamics are rapidly changing causing many unknowns. Signet explains what to focus on to improve financial standings post crisis.

April 1, 2020

While the markets are dominated by fear, we do not succumb to hysteria. We act with cool heads when we rebalance and compassionate hearts when we speak to you.

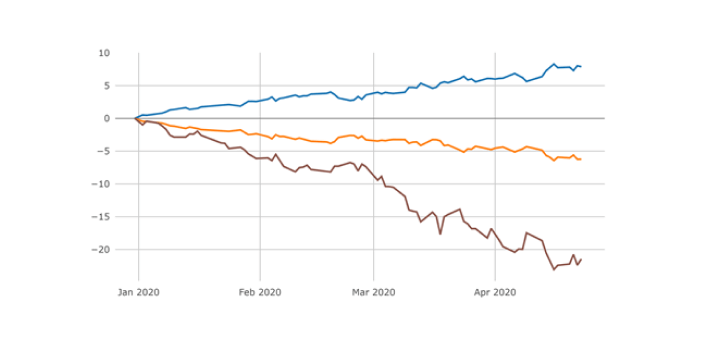

March 10, 2020

Watch Eugene break-down the US equity markets and review current stock positioning for our portfolios. While starting 2020 on a high note, markets became very volatile mid-February…

March 1, 2020

Coronavirus places a brake on economic growth, however studied predictions comprise of resilient recovery in global growth rates around midyear time frame.

February 26, 2020

Steve Tuttle comments on market volatility and what to do if you are worried. Hint: don’t let coronavirus fears rattle your investment plan.

February 1, 2020

Coronavirus concerns hit markets, Steve Tuttle reviews why fears may be overblown, and could lead to opportunity to enhance returns for long-term investors.

February 1, 2020

US economy holds a healthy stance with decline in jobless claims and increases in housing start. Stock market performances exceed expectations.

January 24, 2020

Steve Tuttle shares insights into financial markets and how the current environment may impact investors. It paid to stay invested in 2019, lets now take a brief look at what the f…

January 1, 2020

The new law expands opportunities to save for retirement, but changes the way beneficiaries receive money from inherited IRAS. Steve Tuttle gives highlights.

January 1, 2020

US economy finishes strong as 2019 ends with record high stock markets. Political uncertainties diminish worldwide leading confident global growth in 2020.

December 1, 2019

The end of the year is viewed as a time of spending. It can also be a time to consider tax-saving strategies. Here’re the Signet advisors’ tips for retirees.

December 1, 2019

Read several reasons why the US economy is expected to accelerate in 2020 as well as corporate earnings. Global GDP growth continues at a sub-par slow pace.

November 1, 2019

What to expect as the year winds down. Signet Financial Management, LLC is a registered investment advisor with the U.S. Securities and Exchange Commission and serves as a fiduciar…

November 1, 2019

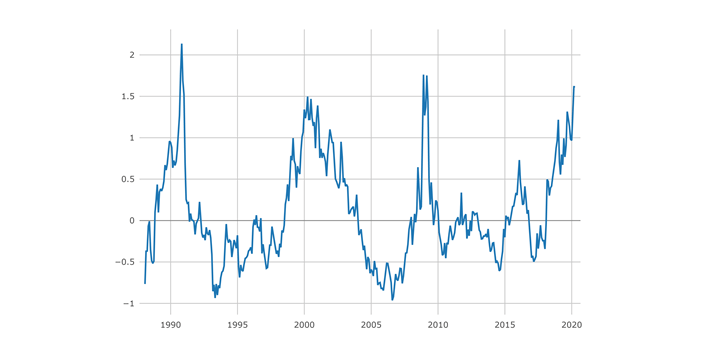

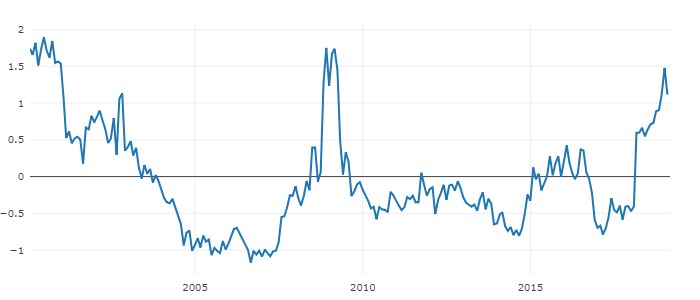

Our Chief Investment Officer, Eugene Yashin, examines major themes in global markets including regime change that is encouraging for value investors.

October 1, 2019

Post summer spending causes plateau in sales. Read up on key notes from the Federal Reserve’s policy meeting and why global expansion is stuck.

October 1, 2019

The media flurry around the elections received a boost from impeachment talk. How will the complexities that follow major political events impact markets?

September 3, 2019

A look at our analysis of stock markets and the changes we recently made to improve equity portfolios. Signet Financial Management, LLC is a registered investment advisor with the …

September 1, 2019

Rise in trade war with further tariffs from China followed by further counter measures and additional tariffs from President Trump weakens equity markets.

August 1, 2019

The S&P 500 is again near all-time highs. Psychologically, it can be tough for some investors to stay invested and buy. However, it is not a signal to sell.

August 1, 2019

Stock investors benefit from low yield environment. Eugene offers thoughts on the economy, earnings, and interest rates, and how it all affects investors.

July 24, 2019

Chief Investment Strategist, Steve Tuttle, reviews what’s been happening in the markets, where we might be headed, and what it all means for investors. Signet’s midyear inves…

July 1, 2019

Investing during retirement can be a daunting task. Steve Tuttle explains how to build a sound retirement plan that will increase your chances of success.

July 1, 2019

Is stock market really complacent? Eugene Yashin reviews the economy and markets, including a range of long-term opportunities for investors.

June 9, 2019

Watch Eugene break-down the US equity markets and review current positioning for our stock portfolios. 2019 started with market bouncing back on strong earnings, more accommodative…

June 4, 2019

Short-term bond strategies are attractive for investors seeking to enhance yield while defending against volatile markets. Here’s more about their benefits.

June 1, 2019

Stocks faced a tough May. Despite ongoing worries about the pace of global growth and the US/China trade dispute, fundamentals are still supportive.

May 14, 2019

After 2019’s strong start, stock markets stepped back as trade tensions between the US and China escalated. Investors are encouraged to expect volatility.

May 2, 2019

Watch Steve Tuttle provide an update on markets and discuss ways to navigate today’s volatile markets. Signet Financial Management, LLC is a registered investment advisor with the …

May 1, 2019

Markets indicate major improvement from Q4 of 2018 along with stronger-than-expected activity readings raising the global GDP growth estimates.

April 1, 2019

The nation’s economic locomotive slowed down in the first quarter. Growth in employment, industrial production and business fixed investment hardly advance.

April 1, 2019

Steve Tuttle discusses strategies on how to deal with higher federal tax liability from newly imposed limits on deductions for state and local taxes.

March 13, 2019

Watch Eugene break-down the US equity markets and review current positioning for our stock portfolios. 2019 started with market bouncing back on strong earnings, more accommodative…

March 4, 2019

The emotional toll from the stock market crash of 2008 still lingers for retirees. To avoid a similar calamity may of them reduce exposure to equities.

March 1, 2019

Chief Investment Officer, Eugene Yashin’s latest market review features the rebound in fundamentally sound stocks and areas of opportunity for investors.

February 1, 2019

Due to lower income tax rates the benefits to establishing Roth accounts are increasing. Here’re strategies to optimize the use of tax-advantaged accounts.

February 1, 2019

Despite historical government shutdown, our economy is forecasted to show resilience with consumer and industrial markets upholding strength for GDP upturn.

January 1, 2019

What lies ahead for the economy, markets, and investment strategies? Eugene highlights factors that drove markets in 2018 and may impact investors’ tactics.

December 4, 2018

Watch Eugene break-down the US equity markets and review current positioning for our stock portfolios. While 2018 has been challenging for investors, we believe the current environ…

December 1, 2018

Markets receive a boost from Fed comments and make progress on trade talks with China. Eugene evaluates key themes and data that could influence markets.

November 1, 2018

Updates concerning investment backdrop, GDP growth, higher inflation, advancing interest rates and yields on 10-year Treasury notes hitting seven-year high.

October 31, 2018

Watch Steve Tuttle, Chief Investment Strategist of Signet Financial explain best investing practices and concepts for 2018. The name of the game is combating adversity. Signet Fina…

October 1, 2018

On TD Ameritrade network Eugene weights in on the health of US Consumer and Personal Saving Rate. He talks about industries which could benefit from consumers being much healthier …

October 1, 2018

Economic growth looks healthy and we have a positive view towards financial markets finding investment opportunities in solid businesses that are mispriced.

September 24, 2018

Driven by fear of underperforming the market, investors tend to focus on stock market benchmarks. But benchmarking investment can take your eye off the ball.

September 4, 2018

Watch Eugene discuss the major themes impacting markets, and highlight our current positioning and outlook for stock investors. Signet Financial Management, LLC is a registered inv…

September 1, 2018

The economy and earnings still look great. Eugene Yashin provides reasons on how this bull market still has legs with its strong advances in Q2 of 2018.

August 1, 2018

Signet financial experts see light in US and global economy with factors such as GDP growth, healthy sales, industrial production upturn and factory use.

August 1, 2018

Steve shares potential opportunities and risks for investors. Signet Financial Management, LLC is a registered investment advisor with the U.S. Securities and Exchange Commission a…

July 3, 2018

Yield curve causes anxiety with some investors. Fixed income CIO, Steve Tuttle, discusses bond yields and where Signet sees income opportunities heading.

July 1, 2018

Halfway through the year, markets digest trade tensions, market volatility, Fed policy, politics, and strong earnings. Read Signet’s forecasts for 2018.

June 1, 2018

Eugene breaks-down the US equity markets, examines our current portfolio positioning, and presents our investment outlook. Signet Financial Management, LLC is a registered investme…

June 1, 2018

Volatility sets concern on geopolitical tensions, trade conflicts, inflation, and politics as domestic, global environment and corporate health look supportive.

May 1, 2018

Forecasting economic and earnings growth to remain solid. Corporate earnings results are at their best levels in years while stock prices struggle to rise.

April 30, 2018

Portfolio Manager, Steve Tuttle, discusses major themes in global financial markets & presents our outlook for 2018. Signet Financial Management, LLC is a registered investment…

April 29, 2018

See how to take advantage of rising rates to lower risk. We believe short-term bonds and floating rate notes are attractive now. Signet Financial Management, LLC is a registered in…

April 3, 2018

Today’s backdrop requires a fresh approach to bond investing. Here are the strategies that can reduce equity risk while providing liquidity and income.

April 1, 2018

Volatility is back and judging by our macro forecast, it may be with us for some time. Volatility is not bad, but it can provoke behavioral mistakes.

March 14, 2018

Insights from CIO Eugene Yashin on US Equity Markets Despite an increase of volatility so far in 2018, we believe the investing environment is generally supportive for investors. E…

March 2, 2018

Markets are not reacting well to President Trump’s plans to announce tariffs on steel and aluminum imports. What is to come for the investment environment?

March 1, 2018

Volatility returns in February, as we saw a stock market correction and impressive rebound within weeks. Read what to expect if volatility levels continue.

February 6, 2018

Steve Tuttle responds to the recent market volatility and answers some timely questions: Why are markets selling-off? Is this end of the bull market?

February 1, 2018

A strong labor market coupled with accelerating wages and personal income tax reform lead us to believe consumption will remain strong in the near future.

January 23, 2018

Steve Tuttle reviews the current investment environment and highlights how we are positioning portfolios for 2018 and beyond.

January 23, 2018

Steve Tuttle addressed 3 common concerns we’re hearing from clients: • Has the bull market lasted too long? • Are valuation too high? • Is it a mistake to invest at market highs?

January 3, 2018

Steve Tuttle shows why investors shouldn’t bet against bonds. As stock and other risk assets rise in value, bonds are an important diversifying asset class.

January 1, 2018

With global growth set to continue and employment outlook showing improvements, we are optimistic about the new year. Read Signet’s projections for 2018.

December 15, 2017

Our healthcare system is complex and difficult to navigate. Signet Financial Management provides a summary of the healthcare programs available to retirees.

December 8, 2017

Eugene Yashin shares our latest views on US Equity Markets including: • Overview: Can the bull market continue? • Economic Forecast: Is the global economy poised to accelerate? • M…

December 1, 2017

2017 has been a good year for the U.S. economy, and we believe the bull market can continue in 2018. Read Signet’s expectations for financial standings.

December 1, 2017

Even in a rising rate environment, bond ladders can mitigate downside equity risk and diversify portfolios through good and bad market cycles.

November 2, 2017

Steve Tuttle shares themes impacting financial markets and where we see opportunities for global asset allocation strategies. Q4 market insights as of November 2017.

November 2, 2017

Despite hurricanes impacting many communities, the best year showing retail spending surges, welcoming recovery. The global economy tapers down, for now.

October 4, 2017

The Impact of two powerful hurricanes along with a pause in retail sales and declining industrial production contribute to slowing down economic growth.

September 13, 2017

Signet’s quantitative assessment shows stocks that blend growth and value characteristics are well positioned for the late phase of economic expansion.

September 12, 2017

Read Signet’s overview of performance trends and risks among sectors as well as opportunities for investors for healthy earnings growth on a global scale.

September 6, 2017

Eugene Yashin, Chief Investment Officer of Signet Financial Management explains our current stock portfolio positioning for the month of September 2017.

August 15, 2017

We believe the global economy is strong in foreign markets and is helping foreign currencies against the US dollar. The US economy shows loss in momentum.

July 24, 2017

Presented by Steve Tuttle, MBA, Chief Investment Strategist.

July 3, 2017

The US economy strengthens. Unemployment is low, inflation is tame, long-term interest rates are near their low-point, and US equities show positive results.

May 1, 2017

Learn how Signet invests for income in today’s environment with Steve Tuttle, Chief Investment Officer – Fixed Income

May 1, 2017

Chief Investment Officer, Eugene Yashin, describes our analytical approach to investing.

May 1, 2017

Let’s start planning your financial future. Everyone deserves a quality plan.

May 1, 2017

A risk assessment helps align your risk with a portfolio designed to meet your unique needs.

April 3, 2017

The first quarter of 2017 was dominated by political headlines and firming economic data. Stocks have generally rallied on better global growth.

March 20, 2017

Watch Steve Tuttle and Eugene Yashin explain new opportunities and in growth (GARP) stocks as of 3/9/17

March 1, 2017

The US economy is off to a good start in 2017. Manufacturing, non-manufacturing, employment, and consumer spending data are holding up well.

February 1, 2017

Outlook and Investment opportunities in 2017, presented by Steve Tuttle and Dan DiVizio of Signet Financial Management. Signet Financial Management, LLC is a registered investment …

February 1, 2017

The global economy continues along a low-growth path, and there are a number of bright spots. US companies report the strongest profit growth in 2 years.

December 15, 2016

Uncovering growth opportunities in growth and value stocks with Eugene Yashin and Steve Tuttle of Signet Financial Management.

Watch video

Watch video