Yield is back. For the first time in over a decade, investors can expect income over 4% through high-yield savings accounts, CDs, and Treasury bills. The temptation to sell stocks and go to cash amidst a challenging environment is high. It seems like a good plan: hide in safe cash equivalent investments and get paid to wait for things to feel better before entering the stock market again.

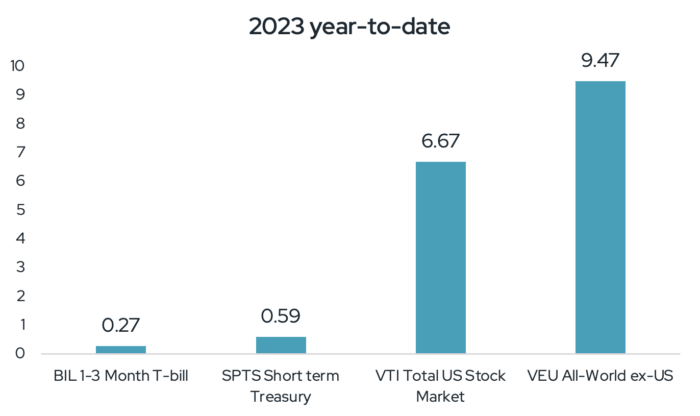

Stocks spike higher to start 2023

Recent market action provides an example of why holding stocks, even during periods of uncertainty, makes sense. Trying to time markets generally does more harm than good.

Stocks are off to a very strong start in 2023, despite a very challenging environment including high inflation, aggressive Fed rate hikes, declining earnings expectations, and geopolitical conflicts.

- The US stock market is up over 6% in January and the foreign stock market is up over 9%.

- Over the same period, “safe” cash-like investments are relatively flat, with Treasury bills up 0.27% and short-term Treasuries up 0.59%.

So if you acted on the impulse to hide in cash for a while and wait out the volatility from stocks, you most likely missed a lot of upside. Furthermore, you are probably apprehensive about getting back into stocks at these levels, after stock markets spiked higher.

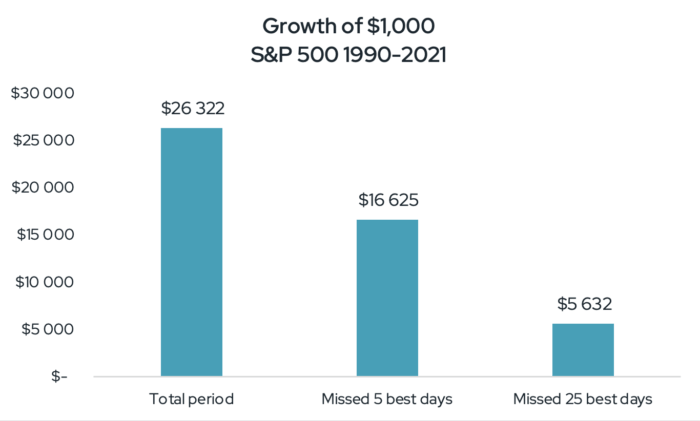

Reacting can hurt performance

This is the problem with market timing. Markets can move quickly and unexpectedly. To earn gains over time, you need to be invested on the market’s best days. And those typically come unpredictably, often around the worst ones.

Missing only a few days of strong returns can drastically impact overall performance.

Over the 30-year period ending December 31, 2021, the S&P 500 returned an annualized 10.76%. Remove the 5 best days and returns drop to 9.18% and if you missed the 25 best days and the return drops to 5.55%, according to analysis from Dimensional Funds.

No one wants to see the value of their portfolio go down. But if you’re invested for the long term with a broadly diversified portfolio, it’s not necessarily a bad thing. Lower prices can create opportunities to enhance returns. By rebalancing with discipline and patience, successful investors may be able to buy good investments at lower prices, during market corrections and bear markets.

If you are investing for a goal that is years away, letting fear keep your money out of the market is a big mistake. Given the market’s long-term historical upward trend, staying invested, even when things feel scary, has led to impressive returns for investors.

Balance is key

Signet designs portfolios to weather a range of potential outcomes. Defensive assets, such as cash equivalents and bonds, play an important role in portfolios, particularly during times of market stress and volatility. Yet when conditions improve, it is important to own assets, such as stocks, that benefit from economic expansion and earnings growth over time. The key is balancing the need for stability and safety along with the desire to achieve high returns.

To learn more about the role of cash in your portfolio, and whether you have the right mix of stocks, bonds, and cash equivalents, contact your Signet financial advisor or Steve Tuttle directly at +1 800-390-2755 or stuttle@signetfm.com.