US economics, inflation, and the Fed

Inflation in the US and around the globe remains elevated and has shown minimal signs of easing. At home, this was evident in the September reports on producer (wholesale) and consumer prices. Indeed, the Producer and Consumer Price Indexes rose 8.5% and 8.2%, year over year, respectively. The most worrisome aspect was that core prices, which exclude the more volatile food and energy components, remained elevated for both measures. Likewise, the latest consumer sentiment reading from the University of Michigan showed that expectations for inflation over the next year rose to 5.1%, from September’s 12-month low of 4.7%.

According to Value Line, the latest inflation and jobs data give the Federal Reserve no reason to pause on the monetary policy tightening front. The expectation is that the central bank will hike the benchmark short-term interest rate by 0.75%, to 3.75%-4.00%, at its November Federal Open Market Committee (FOMC) meeting, the fourth-consecutive aggressive increase. The higher lending rates, which recently saw the rate on the average 30-year fixed mortgage jump above 7.00%, are weighing on the housing and homebuilding sectors.

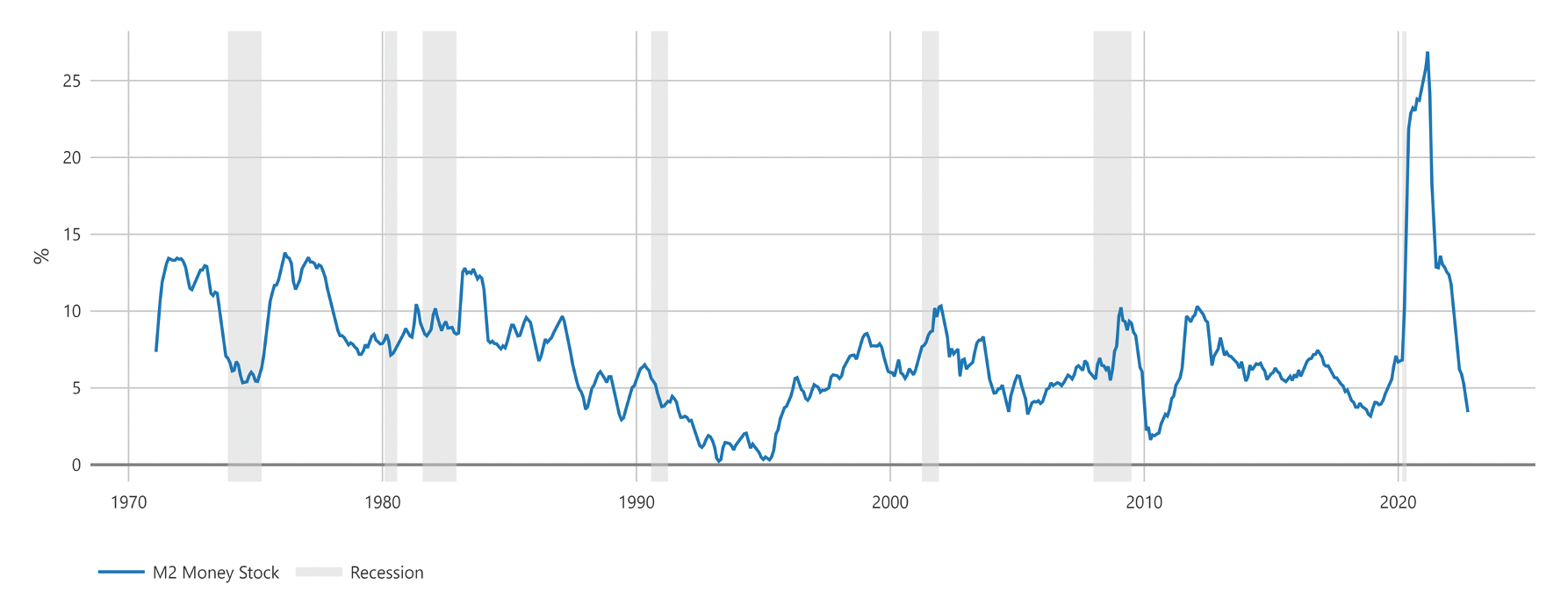

Wharton Business School Professor Jeremy Siegel (who talked about inflation risk in 2020 well before others) is adamant about the Fed falling behind the game again — this time tightening too high. He cites the fact that a lot of leading indicators already point to much lower inflation in the not-so-distant future. To mention: slower growth in M2 money supply (see graph 1 below), slow down in rents, virtually frozen real estate market, and hence depressed construction. Professor Siegel is concerned that the Fed could push the economy into a recession if they are not cautious about increasing rates in the next few months.

Graph 1: Money Supply in the US

Source: the US Federal Reserve

Global economy

JP Morgan also points to rising policy rates as the dominant factor in the recent sluggish growth and increasing recession risks. However, near-term growth forecasts also need to factor in the significant supportive shift in fiscal policies now underway. It is difficult to measure fiscal impulses given the numerous complex policies being implemented and the multiple forces that impact realized budget outcomes.

On the surface, it appears that fiscal policy turned firmly restrictive this year. The IMF forecast sees the deficit for major advanced economies dropping from 8.7% of GDP in 2021 to 4.4% this year. Part of this move reflects the revenue windfall from macroeconomic surprises. Despite IMF real GDP growth forecasts this year having been revised down by 0.9%, labor income gains and rising inflation have moved deficits sharply lower. Much of the fiscal tightening occurred in 1H22 as COVID-related programs and spending were curtailed. US government transfer payments to households fell sharply at the start of the year while G4 spending on goods and services contracted by 0.5% on an annual basis.

JP Morgan sees a turnaround in this fiscal impulse across the board. In part, this reflects a fading of 1H22 spending drags. This is perhaps most evident in the US, where government spending is set to rebound and disposable income will be boosted by a large social security cost of living adjustment worth $106bn starting in January.

Outside the US, the fiscal shift largely reflects relief measures to offset the blow of higher energy prices and an additional credit impulse in China in response to weak housing activity and depressed service spending related to COVID. The fiscal impulse is not enough to offset the drag from the large, synchronized tightening of monetary policy.

In contrast to monetary policy’s long and variable lags, fiscal supports are felt more immediately. The combination of this support and the purchasing power lift from falling inflation (outside Europe) underscores JP Morgan’s view that the global expansion will be able to weather the monetary tightening storm for at least a few more quarters.

Stock market and economic sectors

Goldman Sachs’ sector take

Goldman Sachs (GS) recently published their medium-term sector forecast based on the combined outlook of slowing economic growth and rising interest rates. The stock market has priced the recent economic slowdown but share prices do not currently reflect the risk of a US recession that many portfolio managers expect during the coming year. They revised their sector recommendations accordingly. The relative performance of Cyclicals vs. Defensives has closely tracked the decelerating growth environment.

However, the current earnings yield gap, a representation of the equity risk premium, is actually below average, indicating investors are not overly concerned about market risks. GS’s overweight sector recommendations are generally defensive and reflect the significant risks to earnings and valuation in an environment of elevated inflation and interest rates. Their underweights are more cyclical, as they seek to minimize sensitivity to a continued economic slowdown.

Overweights:

- Health Care, Consumer Staples, and Telecom Services provide defensive exposure and exhibit relatively low vulnerability to the risk of higher real interest rates.

- Energy captures the upside to GS commodity price forecasts and represents a hedge against stagflation.

- The Consumer Durables and Apparel industry group within the Consumer Discretionary sector offers a counter-balance of exposure to a group within a cyclical sector. This group trades at historically low valuations relative to both the S&P 500 multiple and 10-year yields.

Underweights:

- Industrials, Materials, Autos, Media, and Semiconductors tend to underperform when economic growth slows.

- Technology Hardware should struggle if rates rise further and currently trades at elevated valuations.

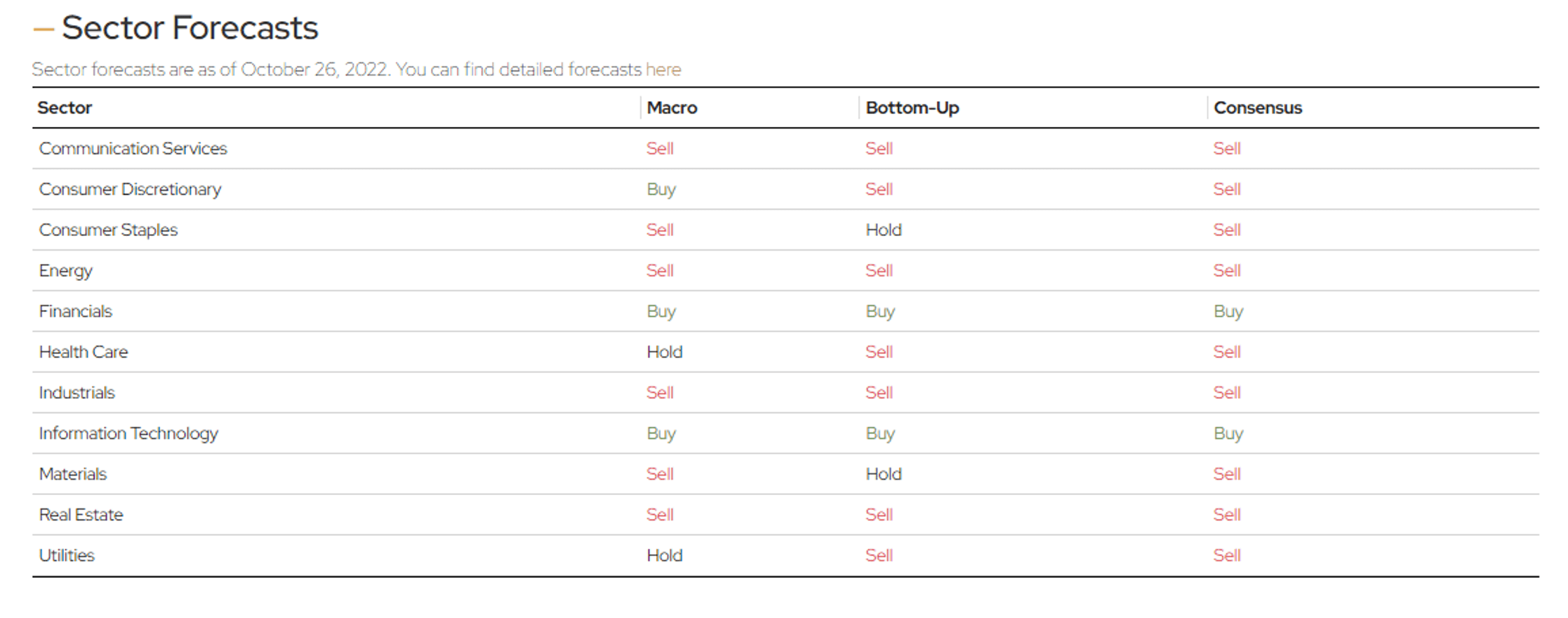

Signet’s sector take

Interestingly enough, Signet’s proprietary Sector forecast (see the table below) agrees with GS on Healthcare and Financials. However, when it comes to Technology we point in a different direction. Signet is still bullish on IT and is much more pro-cyclical.

We think that while the economy slows down it has too many things pushing its cylinders — labor health and elevated personal savings come immediately to mind. More importantly, if Professor Siegel is right, the Fed will be reversing its interest rate course sooner than the market prices it in and that could boost and revive economic growth (make a recession mild when there is one) and boost cyclicals a bit more.

Nevertheless, when we form portfolios at Signet, one of our rules of thumb is not to overdo it and diversify sensibly. We have tilts in the portfolios but usually all major economic sectors are present in our actively managed strategies. Our passive strategies inherently give very broad exposure to all sectors as well.

We are in the process of rebalancing several of our actively managed strategies and we see many opportunities, which keeps us excited and optimistic about the future!

The information and opinions included in this document are for background purposes only, are not intended to be full or complete, and should not be viewed as an indication of future results. The information sources used in this letter are: WSJ.com, Jeremy Siegel, Ph.D. (Jeremysiegel.com), Goldman Sachs, J.P. Morgan, Empirical Research Partners, Value Line, BlackRock, Ned Davis Research, First Trust, Citi research, HSBC, and Nuveen.

IMPORTANT DISCLOSURE

Past performance may not be indicative of future results.

Different types of investments and investment strategies involve varying degrees of risk, and there can be no assurance that their future performance will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

The statements made in this newsletter are, to the best of our ability and knowledge, accurate as of the date they were originally made. But due to various factors, including changing market conditions and/or applicable laws, the content may in the future no longer be reflective of current opinions or positions.

Any forward-looking statements, information, and opinions including descriptions of anticipated market changes and expectations of future activity contained in this newsletter are based upon reasonable estimates and assumptions. However, they are inherently uncertain, and actual events or results may differ materially from those reflected in the newsletter.

Nothing in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice. Please remember to contact Signet Financial Management, LLC, if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and/or services. No portion of the newsletter content should be construed as legal, tax, or accounting advice.

A copy of Signet Financial Management, LLC’s current written disclosure statements discussing our advisory services, fees, investment advisory personnel, and operations are available upon request.