Wall Street is sounding the alarm — not with panic, but with prudence. Investors are being advised to brace for a near-term pullback in the stock market. After a furious rally from April’s lows, the S&P 500 appears ripe for a modest correction, potentially sliding as much as 10% in the weeks or months ahead.

This warning doesn’t come in isolation. It’s the result of a potent mix: high equity valuations paired with signs of slowing economic growth. Layer in historical trends — August and September have historically been weak for markets, each averaging a 0.7% decline according to Bloomberg — and the call for caution becomes more grounded.

But here’s where the message from Wall Street shifts tone: any dip in the market may be less a cause for concern and more an opportunity for the savvy investor.

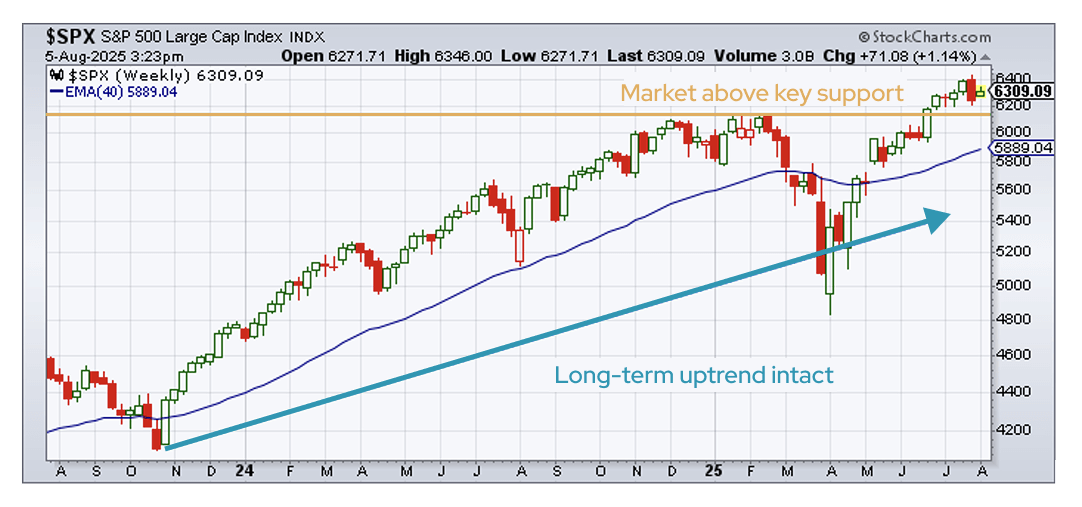

Despite concerns about short-term volatility on the horizon, the long-term bull market remains intact.

Several powerful tailwinds continue to support equities:

- The AI boom: Artificial intelligence is not just a buzzword — it’s reshaping entire industries, driving productivity, innovation, and earnings growth.

- Federal Reserve policy: Interest rate cuts are expected ahead, a shift that historically benefits risk assets like stocks.

- Corporate earnings: Many companies are continuing to deliver solid earnings, providing fundamental support to market valuations.

The key takeaway? Stay invested.

While a correction is scary, it’s also a chance to buy high-quality assets at a discount. Volatility isn’t new — but those who maintain a long-term perspective often come out ahead.

In the end, this isn’t about timing the market perfectly — it’s about being prepared, staying disciplined, and recognizing that sometimes, a dip is just a detour on the path to higher ground.

Why long-term investors should stay the course

The S&P 500 remains above both its mid-February high and its 40-week moving average. That’s a key technical signal suggesting that the long-term uptrend is still intact. In fact, from its April low to the July 31 high, the S&P 500 surged more than 30%. That’s a strong rally — one that rarely continues uninterrupted, based on history.

Healthy pullbacks are part of the process

A 10–15% pullback after such a strong move isn’t just common; it’s healthy. Corrections help reset investor sentiment, shake out overbought conditions, and create new opportunities for disciplined buyers. This kind of consolidation can strengthen the market’s foundation for the next leg higher.

Final thoughts

Investors often get caught up in the daily noise, but the stock market has never offered a smooth ride. Volatility is the price of admission for long-term growth. As we head into August, some near-term headwinds are to be expected — seasonality, macro uncertainty, and profit-taking among them.

The trend, for now, remains constructive. So keep your emotions in check, stay focused on your long-term objectives, and remember that opportunities often come disguised as short-term setbacks.

Need help building a game plan?

Speak with your advisor or schedule a portfolio review to ensure you’re positioned for both resilience and opportunity.

IMPORTANT DISCLOSURE

This is a publication of Signet Financial Management, LLC.

The information presented is believed to be factual, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Information in this presentation does not involve the rendering of personalized investment advice. It is limited to the dissemination of general information on products and services. A professional adviser should be consulted before implementing any of the options presented.

Information in this presentation is not an offer to buy or sell, or a solicitation of an offer to buy or sell the securities mentioned herein. Information on this presentation is directed toward U.S. residents only. Signet only transacts business in states where it may legally do so.