The Fed

The January Consumer and Producer Price Indexes indicated that prices remain at elevated levels. Both came in above expectations on both a month-to-month and 12-month basis, with the latter still well above the Fed’s long-term target range of 2%.

Fed officials will likely be data-driven in making monetary policy decisions. It is not surprising that the hotter price data and strong gains in January employment and retail sales revived talks about more interest rate hikes. The market now appears to be more in line with the Federal Reserve’s thesis that the federal funds rate needs to go above the 5.00% mark and remain comfortably above that level for an extended period to effectively fight inflation. Treasury market yields jumped on this view and that took the starch out of the early-year stock and bond market rallies.

The full effect of the Fed’s restrictive monetary policy on the U.S. economy is yet to be realized. The consumer has been the backbone of the recent gross domestic product (GDP) expansion, but how long will that last?

The Federal Reserve Bank of New York recently reported that U.S. consumer credit card debt rose to a record high of $986 billion in the December quarter, with an average interest rate of 21.6% according to Value Line. This may lead to some spending hesitation down the road, which would likely add to the growing concerns about corporate profits.

Inflation and real estate

According to Professor Siegel of Wharton Business School, we’ve had a string of disappointing inflation reports from the CPI, the PPI, and this latest PCE. But what they all have in common is a backward-looking view. Forward-looking inflation indicators do not show any signs of revitalized concern. Look at any commodity benchmarks — the GSCI, the CRB, the Bloomberg commodity indexes — none of them are at levels that will feed into inflation pressure. Housing prices declined for five consecutive months measured by the Case-Shiller Home Prices Index and since the BLS survey methodology has an embedded lag, the Fed and Powell now recognize BLS housing data is distorted.

Yes, there was a window of higher activity for housing in January when mortgage rates cooled. But now mortgage rates are quickly surging back to 7%. Housing prices should come under pressure over the next few months and rental prices are also softening in real-time data. Inflationary expectations from the recent University of Michigan Consumer Sentiment survey also showed no increase but rather a tick down in the one-year inflationary expectation.

Money supply and employment

Soon we will get another reading of the M2 money supply that declined in 2022 for the first time since the Great Depression; Professor Siegel thinks this latest figure will show another monthly drop. This is not a healthy sign for the economy. The Fed would rather see this metric growing at longer run trends of 5% a year. Putting all these forward-looking indicators together, Professor Siegel still sees no reason for the Fed to panic and overtighten.

Federal forecasts show the unemployment rate increasing by 1 to 2%, causing three million people to lose their jobs. Of course, this has not shown up yet in any of the official employment statistics. But forward-looking indicators from job recruiting websites show a softness in job postings and a surge in job searchers that has yet to show up in the JOLTS data reports.

Peter Boockvar summarized the ZipRecruiter conference call and notes that ZipRecruiter’s revenue was down 15% in January, and they have many more job hunters, with a sharp pull pack in jobs listings. This could be an early sign of what is to come in the official statistics. The February employment report could show a dip in employment, which would change the tone of market conversations around the path for interest rates dramatically.

Global economy and mighty central banks

According to J.P. Morgan (JPM) developed markets’ central bankers embody a New Testament-style grace toward the world’s inflation sins. The greater than 300bp rise in policy rates delivered over the past year has been a correction from inappropriately accommodative stances rather than an attempt to smite out the expansion. While turning restrictive, central banks have signaled they want the expansion to continue and will tolerate a gradual decline in inflation to their comfort zones.

Consistent with this view, central banks are now slowing the pace of tightening. Recent developments suggest this gentle and forgiving path will prove unsuccessful. Demand is proving resilient in the face of tightening and lingering damage to supply from the pandemic is limiting the moderation in inflation. The risk of triggering a more wrathful Old-Testament-style central bank reaction is on the rise. The transmission of the rapid shift in policy still underway also raises the risk of a recession not intended by central banks.

Asset prices are sensitive to shifting probabilities around recession timing and rate paths. Currently, JPM assesses the probability of a 1H23 recession at 15%; a soft-landing scenario at 30%; a recession sometime in late 2023 or 2024 remains most likely at 70%.

JPM considers two alternative future paths. The first (slip sliding away) sees rate hikes ending next quarter and the effect of a roughly 500bp Fed tightening building, generating a recession late this year that is concentrated in the US. The second sees resilient growth and elevated inflation pushing both the Fed and Western European central banks to turn more restrictive. Sustained tightening during 2H23 (boiling the frog) becomes a recipe for a deeper recession that starts later and is more synchronized globally.

The thrust of incoming news shifts risks toward a boiling-the-frog scenario. Recent upwards revisions to labor income and savings rates are a signal of private sector health, particularly against the backdrop of the turn upward in consumer confidence and manufacturers’ expectations across the developed markets. While retail sales are likely to step back, all indications are that core inflation and employment increases will remain elevated.

Stock market earnings season results and 2023 outlook

Fourth-quarter earnings season has been uninspiring. The results have been better than some feared. However, profits are still forecast to have declined by mid-single digits during the final three months of 2022. The near-term profit outlook is also underwhelming, with far more companies issuing negative than positive forecasts for the next few quarters. With S&P 500 companies trading at around 18 times earnings, valuations look a bit elevated under the circumstances, and this leaves stocks susceptible to selling on any unsettling news. In this environment, investors should maintain a portfolio consisting mostly of high-quality equities.

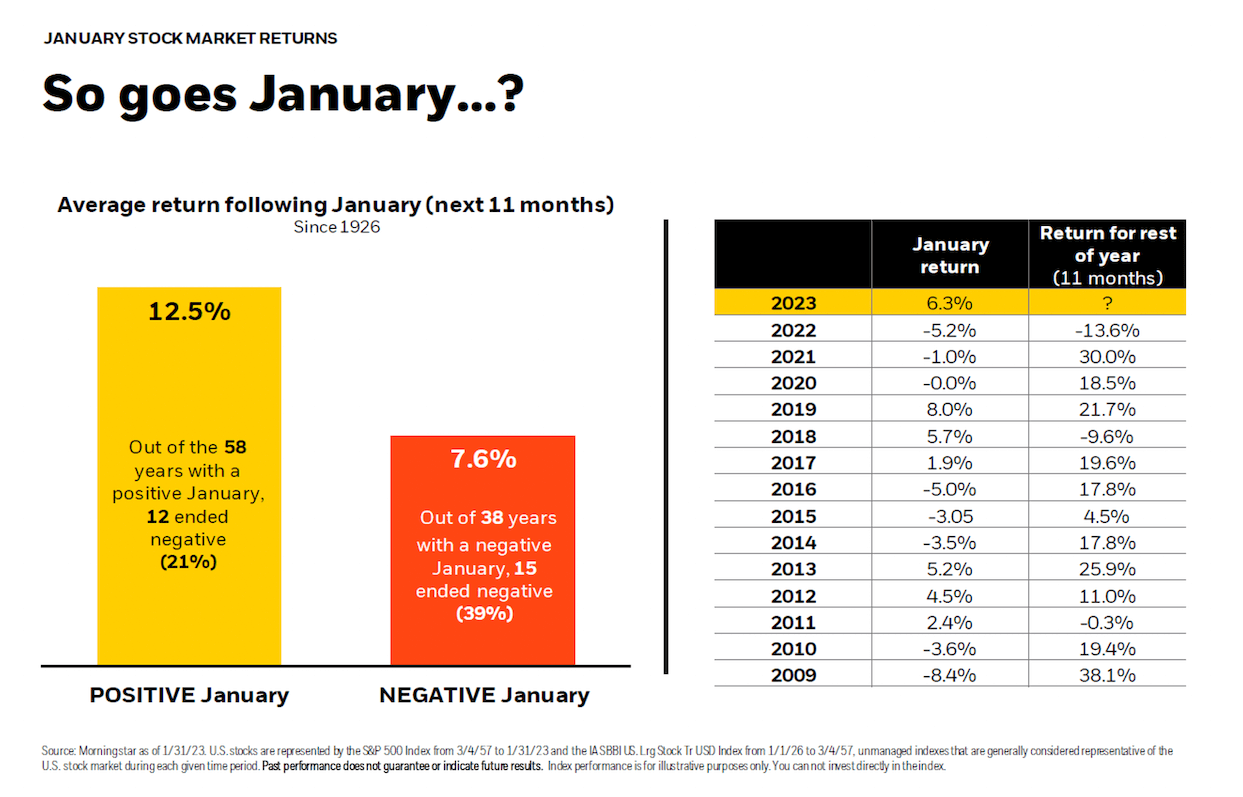

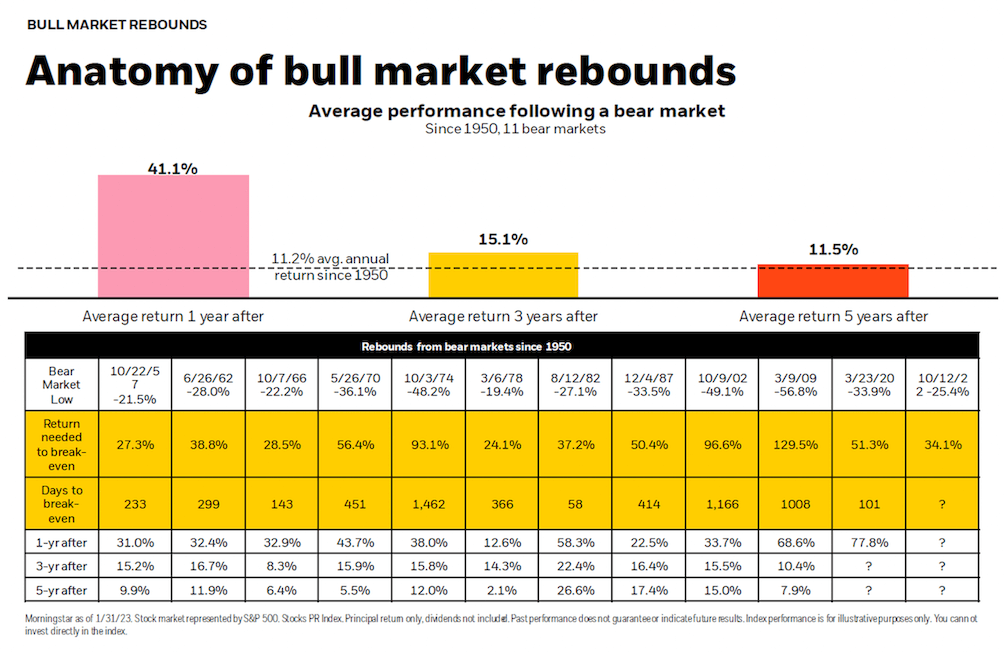

Nevertheless, according to BlackRock (see two illustrations below), if history is any indicator, the odds are on the bull’s side and the markets have more chances to advance rather than decline in 2023.

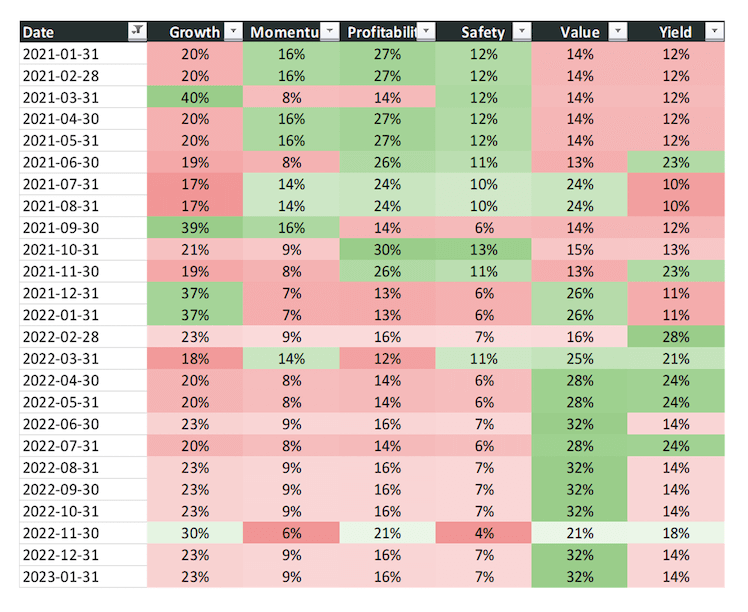

Valuation takes a center stage

Value factors become much more important going forward according to Signet’s proprietary market projections. Looking at the heatmap of factor group weights, we can see that Value more than doubled its weight in our 1 Year Macro Score in 2022-2023. That’s a very bullish sign.

Despite the short-term softening of corporate profit data, we should expect the stock market, particularly profitable companies at reasonable valuations, and growth rates to start advancing even amidst a recession.

Remember, the stock market is a leading indicator and it already priced in a recession last year. Usually, the markets start their long-term advance during an economic downturn, which could be very counter-intuitive — you hear about a softer economy on the news, but the markets are flying higher. We are strong believers in the resilience of the US economy and never bet long-term against the stock market. Keep the faith!

The information and opinions included in this document are for background purposes only, are not intended to be full or complete, and should not be viewed as an indication of future results. The information sources used in this letter are: WSJ.com, Jeremy Siegel, Ph.D. (Jeremysiegel.com), Goldman Sachs, J.P. Morgan, Empirical Research Partners, Value Line, BlackRock, Ned Davis Research, First Trust, Citi research, HSBC, and Nuveen.

IMPORTANT DISCLOSURE

Past performance may not be indicative of future results.

Different types of investments and investment strategies involve varying degrees of risk, and there can be no assurance that their future performance will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

The statements made in this newsletter are, to the best of our ability and knowledge, accurate as of the date they were originally made. But due to various factors, including changing market conditions and/or applicable laws, the content may in the future no longer be reflective of current opinions or positions.

Any forward-looking statements, information, and opinions including descriptions of anticipated market changes and expectations of future activity contained in this newsletter are based upon reasonable estimates and assumptions. However, they are inherently uncertain, and actual events or results may differ materially from those reflected in the newsletter.

Nothing in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice. Please remember to contact Signet Financial Management, LLC, if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and/or services. No portion of the newsletter content should be construed as legal, tax, or accounting advice.

A copy of Signet Financial Management, LLC’s current written disclosure statements discussing our advisory services, fees, investment advisory personnel, and operations are available upon request.