US economics and COVID

The US economy continues to expand as the third quarter ends. The business activity improved following an uneven path earlier in the period. Industrial production increased, while housing starts and building permits saw some improvement as well. The most encouraging positive surprise came from a strong showing in retail sales, which were expected to decline by 0.8% but rose instead by 0.7% according to Value Line. This was especially impressive as it came against a backdrop of rising COVID-19 cases and supply chain issues.

There are a lot of things swirling in the air though: debt ceiling issues, the Fed announcing tapering as early as this November, and problems with China’s property market to mention a few.

Treasury Secretary Yellen warned that the Treasury will likely exhaust its cash and extraordinary measures in October. Goldman Sachs thinks the potential government shutdown is unlikely, but the outcome is uncertain. However, their analysis shows that the equity market performance around 14 government shutdowns since 1980 and debt limit showdowns in 2011 and 2013 shows no major consistent reaction of the S&P 500 to these fiscal catalysts.

During their last meeting, the Fed announced that they will start tapering bond purchases in November 2021 and the yields went up on the announcement. Over the last week of September, we saw some market jitters over rising yields. However, we understand that the Fed’s announcement is an acknowledgment of the strong US economy, and they wouldn’t make the move unless they thought the US economy was ready.

Global economics

JP Morgan has revised lower current-quarter global growth over the past two months to a still-strong 5% per annum. The latest data point to further downgrades as persistent bottlenecks, Delta-wave infections, and surging inflation slow consumer spending particularly hard. Nevertheless, they still forecast global GDP to expand by a healthy 6.1% this year.

China’s economic growth slowed this quarter, which is not all surprising since they tried to restrain their real estate market, which is linked to 20% of Chinese GDP according to Goldman Sachs. This year alone Chinese authorities issued more than 400 new property regulations that are largely tightening in nature. The housing activity is contracting in 2021, which pressures highly leveraged real estate developers, like Evergrande. Of greater significance than near-term drags are the challenges China’s issues pose to the global expansion. JP Morgan expects policymakers in China to allow deleveraging of property sector debt but is confident that they will actively manage the restructuring and effectively limit financial spillovers through supports for consolidation, funding, and banks.

Stock market and portfolio management

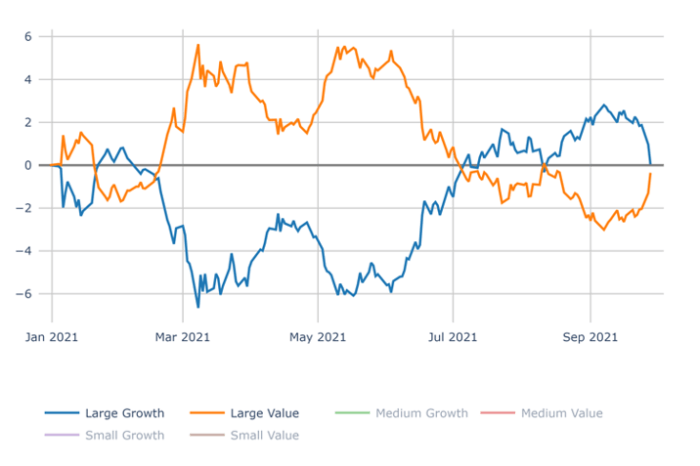

In June the market rotated into Large Cap Growth leadership (see Large Growth vs. Value graph below) due to the Delta fear factor and concerns about inflation and the Fed’s tapering. With the economy expected to grow slower than in the explosive first half of the year, the market relied on the recipe of the last few years – the safety bet on high Mega Cap Growers. Cyclical, Value, and Smaller stocks all took a breather.

Large Growth vs. Value 2021 YTD (as of 09/28/2021)

Source — Signet FM

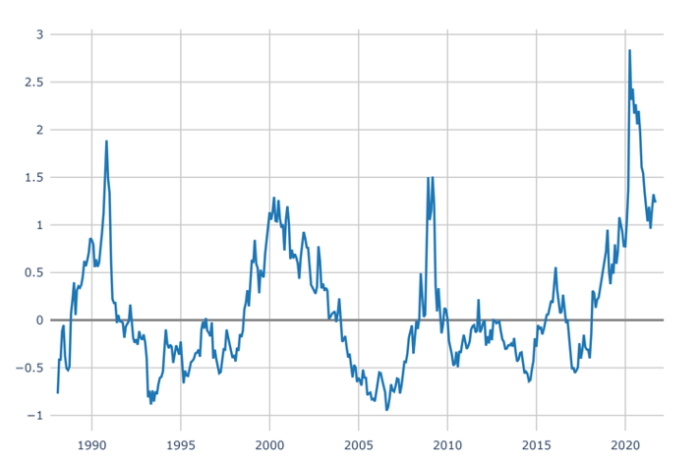

Valuation Spread (through August 2021)

Source — Signet FM

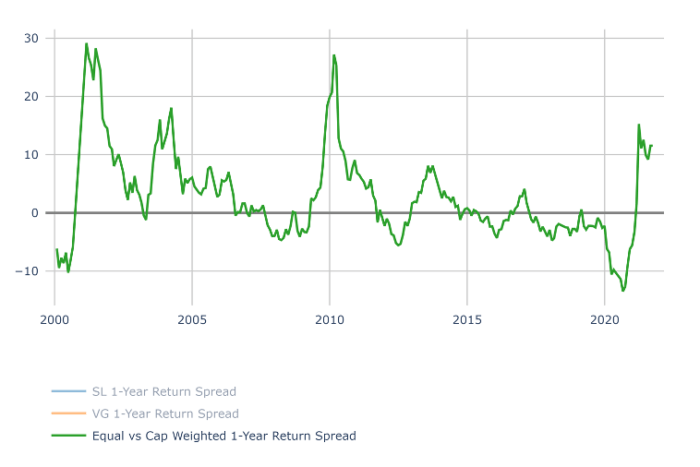

Equal vs. Market Weighted 1 Yr. Return Spread (through August 2021)

Source — Signet FM

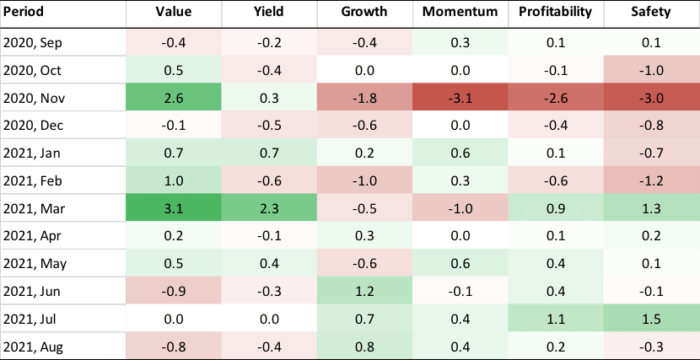

As for factor exposure, Growth, Momentum, and Profitability have been strong since June with Safety showing up strongly in July (see Factor heat map below). This preference for Growth/Quality demonstrated that the market was uncertain about the pace of the future economic expansion. Many market participants believe this move to be over-done and expect Cyclical industries to regain some ground as the economy keeps growing “slower but not slowly”, and the earnings and projections from the broader market stay healthy.

Factor Performance (Top 2 quintiles of Large Cap Universe vs. S&P 500)

Source — Signet FM

We keep our barbell posture by pairing growth with cyclical stocks. This approach is propagated throughout our active and passive strategies and makes our portfolios well-diversified, which is important for risk management.

IMPORTANT DISCLOSURE

Past performance may not be indicative of future results.

Different types of investments and investment strategies involve varying degrees of risk, and there can be no assurance that their future performance will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

The statements made in this newsletter are, to the best of our ability and knowledge, accurate as of the date they were originally made. But due to various factors, including changing market conditions and/or applicable laws, the content may in the future no longer be reflective of current opinions or positions.

Any forward-looking statements, information, and opinions including descriptions of anticipated market changes and expectations of future activity contained in this newsletter are based upon reasonable estimates and assumptions. However, they are inherently uncertain, and actual events or results may differ materially from those reflected in the newsletter.

Nothing in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice. Please remember to contact Signet Financial Management, LLC, if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and/or services. No portion of the newsletter content should be construed as legal, tax, or accounting advice.

A copy of Signet Financial Management, LLC’s current written disclosure statements discussing our advisory services, fees, investment advisory personnel, and operations are available upon request.