US economics and COVID

The US economy has been expanding formidably and is on track to post annual growth north of 6% a year, with the coming weeks likely to see an extension of the recovery of the first half. Recently we saw a pickup in consumer confidence, solid levels of manufacturing activity, and a strong monthly employment report. The June jobs report came out better than expected, with the nation adding 850,000 positions last month. That was a big improvement from the April and May tallies of 269,000 and 583,000, respectively. The unemployment rate ticked up a tenth to 5.9% because more people were looking for a job. This unemployment increase shows there is slack in the economy and that can offset some wage pressures according to Professor Siegel of Wharton Business School.

U.S. consumer price index (CPI) gained 0.9% in June, the largest rise in 13 years according to BlackRock, driven by the unusual supply and demand dynamics amid the powerful economic restart. The consensus view is that there is a higher inflation regime in the medium term because the Fed is being more patient with higher inflation levels. While the market can expect some volatility from inflation news like the June monthly numbers, many market participants still think concerns will ease as transitory factors such as bottlenecks in the supply chain work themselves out.

One would expect bond yields to go up with inflation, but the 10-year treasury yields dropped to 1.3% at the end of July due to market participants buying bonds as a hedge against a potential economy slow down related to the Delta variant of the Coronavirus or fears that the Fed will taper too soon to slow down the economic expansion. We side with Professor Siegel who believes the healthy economic expansion and inflation impulse should have the 10-year yield approach 2% by the end of the year and support equity markets.

Global economics

According to JP Morgan vaccines should mitigate the consequences from the Delta variant of Covid. As the link between new cases and hospitalizations weakens materially, so should the economic drag of the latest Delta wave. The growth bounce is already well established in the US and they believe it started in Europe last quarter. The rest of the world should follow the lead of the US and Europe on that front.

Despite weak industrial production and retail sales reports, JP Morgan still projects a robust 5% annual global GDP gain last quarter — a slight pickup from a strong 4% annual bounce in 1Q21. The overall projection for global GDP growth for 2021 is still north of 6%. They expect the global service-sector output to continue recovering and the goods-producing sector to bounce back—aided by a sizable inventory bounce.

While global core inflation estimate was raised to a 3% annual rate in the second half of the year, the acceleration in services price inflation offsets a gradual moderation in goods price pressures. The immediate pressure on central banks from elevated core inflation is limited and they will be slower to raise rates in the face of rising inflation than in the past.

Stock market and portfolio management

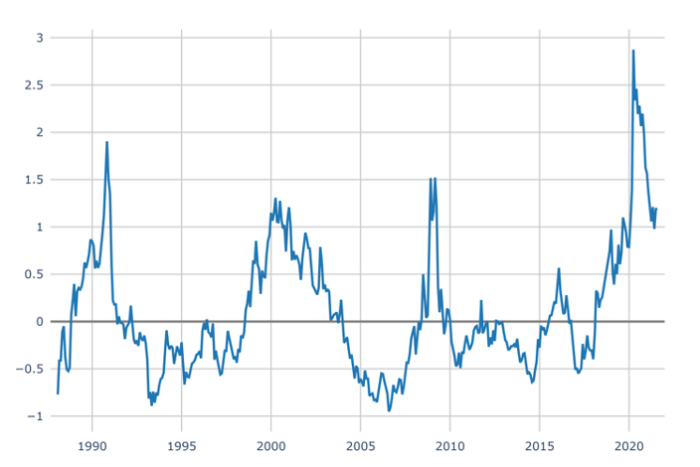

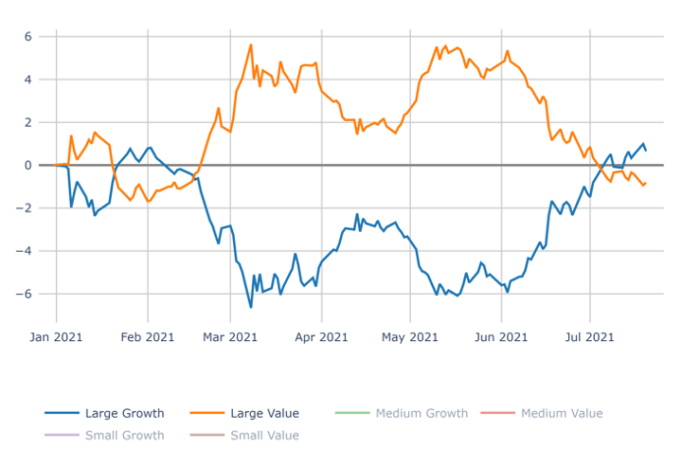

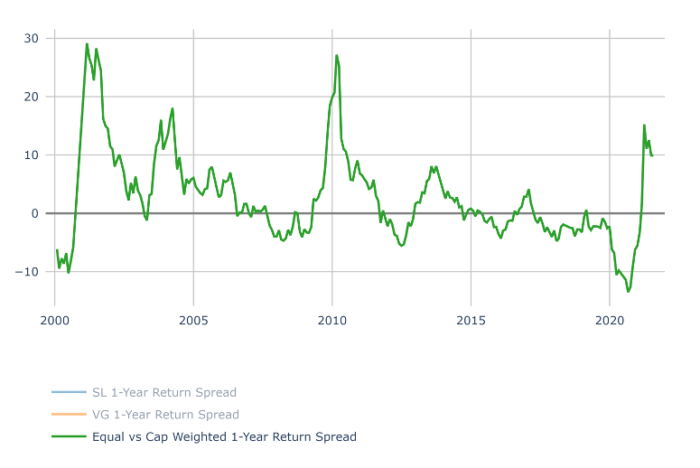

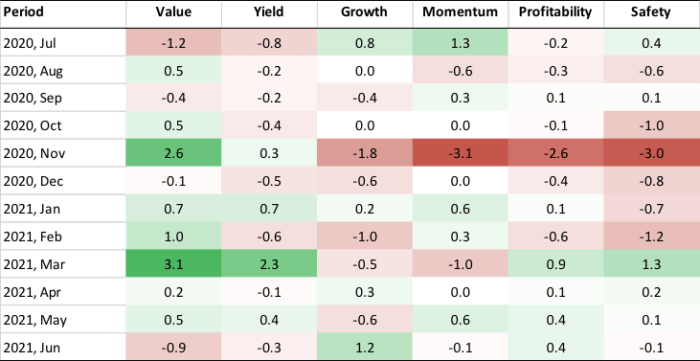

In June and early July the Tech space has been leading the market. Large Cap Growth clawed back at Value in one month and YTD, although in the Small Cap space Value maintains its dominant position. Market Cap based (driven by mega techs) index outperformed the Equally Weighted index and Valuation Spreads remain at elevated levels. Growth and Profitability were the only two factor groups in green in June (See all the charts below). All these developments are related to worry that the Fed will taper sooner and slow economic growth. We think that provoked Tech outperformance since these days Tech and Communications serve as a safety resort against potentially slower economy. On top of that foreign demand pushed long-term rates lower as investors kept buying US treasuries and that pushed the Yield Curve down despite higher inflation readings. That further supported this short-term rotation to Large Growers.

I agree with Professor Siegel that tapering could cause short-term volatility in the market, but economic growth, solid productivity and healthy corporate profits should boost the markets further. If the 10-year yield does go to 2% by the end of the year (meaning that the market still believes in the expansionary economic growth), then we should see the leadership going back to cyclicals and Value in short to medium term. That is why in our actively managed portfolios we keep healthy exposure to Financials, Consumer Discretionary, Industrials and Real Estate.

Nevertheless, with all the uncertainties around the Delta variant impacting the future economic growth it makes sense to own growing and profitable companies in the portfolio in a barbell structure as well. We also believe in GARP companies in IT, Communications, Consumer Discretionary, Healthcare and other sectors. Our portfolios well are balanced from a Growth/Value perspective. Both camps did very well in this expansion.

Valuation spreads: through June 2021

Source — Signet FM

Large Growth vs. Value 2020 YTD (as of 07/23/2021)

Source — Signet FM

Equal vs. Market Weighted 1 Yr. Return Spread: through June 2021

Source — Signet FM

Factor Performance (Top 2 quintiles of Large Cap Universe vs. SP 500)

Source — Signet FM

The information and opinions included in this document are for background purposes only, are not intended to be full or complete, and should not be viewed as an indication of future results. The information sources used in this letter are: WSJ.com, Jeremy Siegel, PhD (Jeremysiegel.com), Goldman Sachs, JP Morgan, Empirical Research Partners, Value Line, BlackRock, Ned Davis Research, First Trust, Citi research and Nuveen.

IMPORTANT DISCLOSURE:

Past performance may not be indicative of future results. Different types of investments and investment strategies involve varying degrees of risk, and there can be no assurance that their future performance will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

The statements made in this newsletter are, to the best of our ability and knowledge, accurate as of the date they were originally made. But due to various factors, including changing market conditions and/or applicable laws, the content may in the future no longer be reflective of current opinions or positions.

Any forward-looking statements, information and opinions including descriptions of anticipated market changes and expectations of future activity contained in this newsletter are based upon reasonable estimates and assumptions. However, they are inherently uncertain and actual events or results may differ materially from those reflected in the newsletter.

Nothing in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice. Please remember to contact Signet Financial Management, LLC, if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and/or services. No portion of the newsletter content should be construed as legal, tax, or accounting advice.

A copy of Signet Financial Management, LLC’s current written disclosure statements discussing our advisory services, fees, investment advisory personnel and operations are available upon request.