US economics and COVID

Healthy corporate profits pushed markets higher despite many uncertainties. Ultimately, there will be resolutions to the uncertainties facing the marketplace. These include the stalled infrastructure and budget bills, as well as the pace of normalization of monetary policy set by the Federal Reserve.

Simultaneously, the economic data comes in with a mix of positives and negatives. There were strong retail sales figures offset by weakness in industrial production and homebuilding. Escalating prices for producers and consumers, along with wage inflation added to the pandemic-induced supply chain shortages, prompting some commentators to talk about stagflation. However, with diminishing COVID-related stimulus, we find ourselves in the camp that expects easing tension in the labor market, a leveling out of supply chain woes, followed by an eventual normalizing of demand, softening prices back towards the trend in 2022. Maybe we will be able to put a few pennies back in our pockets in 2022.

While the market anticipates monetary policy to become less accommodative, the fiscal news may become more supportive. According to Professor Siegel, on the positive front for the markets: President Biden’s higher tax proposals seem to have fallen into disarray as Kyrsten Sinema (D-AZ) has come out opposing a hike in corporate tax rates. It would be very positive for the stock market if tax rates were not increased next year.

Global economics

The extent of deceleration in growth and momentum since the midyear estimates is to be revealed in the upcoming 3Q21 GDP reports. GDP growth rates in China and the US may revise downward, according to JP Morgan. They believe that global GDP grew at an annual rate of 3.4% last quarter — slower than originally forecasted. In contrast, they anticipate Europe to be a “bright exception” to these downward revisions in growth rates.

Some of the drivers of the loss in momentum should soon fade as the drag from the Delta variant and supply bottlenecks abate, and China’s policy turns more supportive. In addition, the Euro area bounce points to a large boost still to come in countries (concentrated in the Asia/Pacific region) where vaccination rates and mobility are now moving substantially higher. While vaccinations continue to rise, the travel shortfall during last quarter’s holiday season will have lingering effects, as will the elevated prices of goods that have squeezed household purchasing power. Simultaneously, energy price pressures continue to intensify, and the rise in inflation is creating a paradigm shift towards faster normalization of monetary policies. The silver lining of a less pronounced growth profile is that it could prove to support a more sustainable recovery. The global GDP is still expected to advance around 5% this year by many market participants.

Stock market and portfolio management

The market experienced heightened volatility in the last two weeks of September into the first half of October. There is a struggle between investors expecting the economy and earnings to expand and those raising concerns that Delta, Fed tapering, and the debt limit could tip the markets into a correction. So far, the earnings have been strong, especially among the Financials, and markets have advanced.

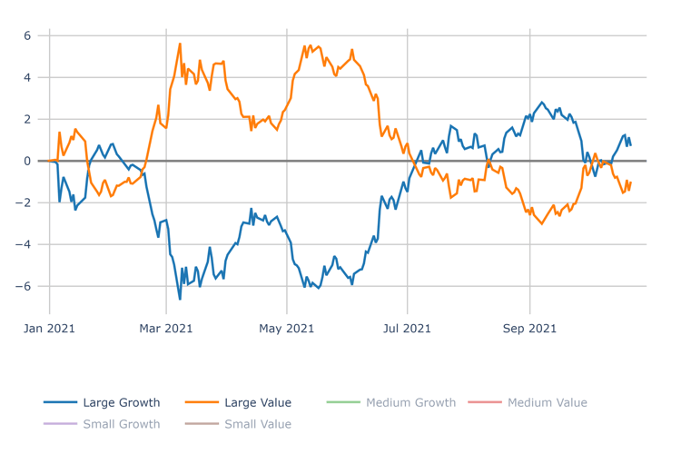

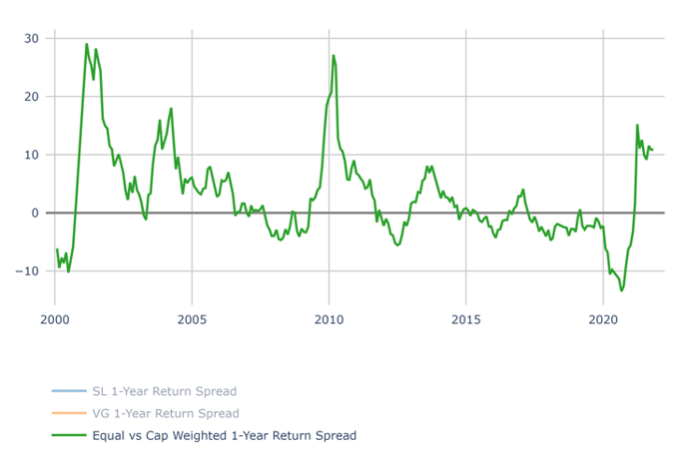

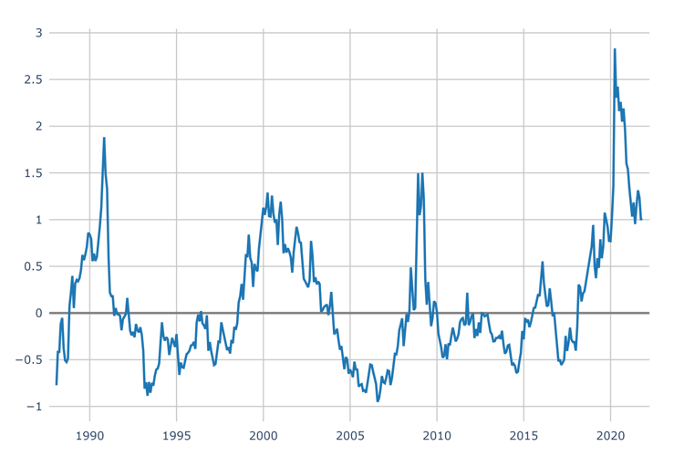

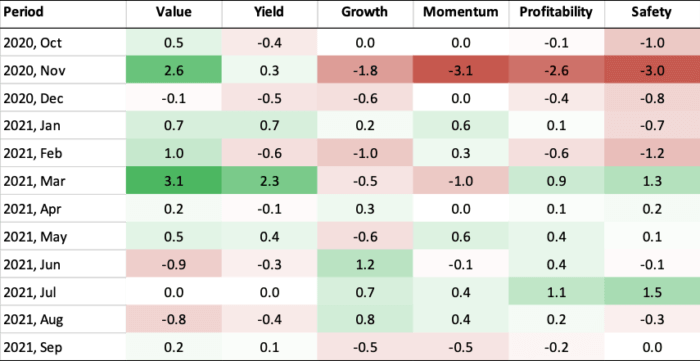

The market remains indecisive regarding its leadership concentration from a macroeconomic perspective. What is an investor to do? Prepare for a slower economy via overweighting large/mega-cap growth, or stay bullish with cyclical/value plays? Subsequently, those who are more bullish on the economy look for a broadening rally (see Large Growth vs. Value and Equal vs. Market Cap Weighted graphs below). Valuation spreads and the factor heatmap reflect a similar story — with value having a slight advantage in September but with no clear direction.

Large Growth vs. Value 2021 YTD (as of 10/26/2021)

Source — Signet FM

Equal vs. Market Weighted 1 Yr. Return Spread (through October 2021)

Source — Signet FM

Valuation Spread (through September 2021)

Source — Signet FM

Factor Performance (Top 2 quintiles of Large Cap Universe vs. SP 500)

Source — Signet FM

We are prepared for multiple scenarios. We maintain exposure to quality growth stocks, but also to more cyclical value stocks. This barbell approach is propagated throughout our active and passive strategies, providing our portfolios with diversification, an essential tool within risk management under varying conditions.

The information and opinions included in this publication are for background purposes only, are not intended to be full or complete, and should not be viewed as an indication of future results. The information sources used in this letter are: WSJ.com, Jeremy Siegel, PhD (Jeremysiegel.com), Goldman Sachs, JP Morgan, Empirical Research Partners, Value Line, BlackRock, Ned Davis Research, First Trust, Citi research and Nuveen.

IMPORTANT DISCLOSURE

Past performance may not be indicative of future results.

Different types of investments and investment strategies involve varying degrees of risk, and there can be no assurance that their future performance will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

The statements made in this newsletter are, to the best of our ability and knowledge, accurate as of the date they were originally made. But due to various factors, including changing market conditions and/or applicable laws, the content may in the future no longer be reflective of current opinions or positions.

Any forward-looking statements, information, and opinions including descriptions of anticipated market changes and expectations of future activity contained in this newsletter are based upon reasonable estimates and assumptions. However, they are inherently uncertain, and actual events or results may differ materially from those reflected in the newsletter.

Nothing in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice. Please remember to contact Signet Financial Management, LLC, if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and/or services. No portion of the newsletter content should be construed as legal, tax, or accounting advice.

A copy of Signet Financial Management, LLC’s current written disclosure statements discussing our advisory services, fees, investment advisory personnel, and operations are available upon request.