US economics and COVID

The US economy is expanding, supported by gains in retail sales, industrial production, and building permits. Housing starts are flattening, held back by shortages in materials and labor. Overall, GDP is expected to advance by 4-5% in the current quarter, easily surpassing the 2% gain secured during the preceding three months. A $1.2 trillion infrastructure bill signed by President Biden on November 15th should provide an additional, albeit minor boost in economic growth, considering these fiscal measures are spread out over several years. Presently, negotiations are underway to secure the second installment of the Administration’s agenda — the so-called Build Back Better Act. However, opposition to the social and climate spending plan is fierce, making its passage uncertain, particularly with inflation being so persistent.

Inflation is on the minds of investors and consumers alike. Consumer prices rose by more than 6% over the previous 12 months, which shook Wall Street. This was the fastest pace of inflation in three decades, led higher by soaring gas prices and exacerbated by labor shortages, rising wages, and supply chain issues. So far, corporations have managed to pass along increased input costs to consumers, preserving their profit margins. Goldman Sachs expects inflationary pressures to ease in 2022 and 2023. However, they also state that profit margins will be somewhat reduced, mostly due to higher labor costs, although they will still be very healthy from a historic perspective.

The threat of the Omicron coronavirus variant poses another risk to economic health. Hopefully, current vaccines and therapeutics can control it. Our combatting of COVID seems to gradually resemble that of the flu – in that it is reasonable to suspect that we might need different vaccines for different prevalent variants each year. The economic impact of this particular variant is unclear, but widespread shutdowns seem unlikely.

Global economics

While JP Morgan expects the global GDP to grow by 5.7% this year and 4.1% in 2022, the global expansion is in the midst of its first genuine resiliency test. Supply pressures have intensified as higher energy prices combined with persistent bottlenecks depress output and erode demand. Adding to this drag is a new COVID wave depressing mobility in Europe. This new wave poses risks for the entire Northern Hemisphere this winter. The Omicron variant is the latest threat and, like its predecessors, its economic impact is hard to assess.

Despite this stiff test, JP Morgan continues to see global growth accelerating this quarter, displaying strong underlying fundamentals that they believe will sustain potential growth next year. While European growth sags, they anticipate Asia will bounce as mobility has increased significantly along with vaccination rates. In addition to highlighting the still-substantial global growth, the impulse from service-sector normalization and global manufacturing should benefit as Asian supply constraints abate. An additional fiscal stimulus coming from Japan would show that developed market policy reactions and functions remain growth biased. Additionally, in the US a large household saving rate drop would offset a purchasing power squeeze due to higher inflation.

Central banks remain patient with this year’s pandemic-related inflation and maintain low interest rates for now. The Fed’s thinking will likely shift only gradually as inflation is set to moderate next year. The Fed remains hopeful that a positive labor supply impulse will materialize. However, JP Morgan’s 2022 forecast sees only a limited recovery against the backdrop of early retirements and depressed immigration flows. A tight labor market and higher inflation could prompt the Fed to start raising interest rates sooner than later in 2022. Other central banks from the developed markets might follow suit, with the Bank of England potentially taking the lead as early as this December. Interest rate dynamics are very important for global stock markets as we will discuss below.

Stock market and portfolio management

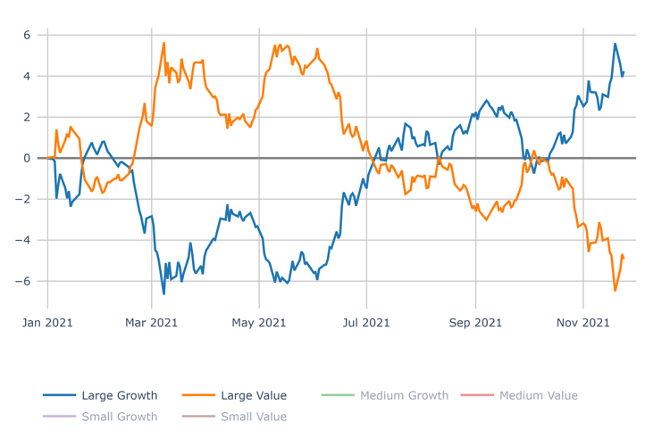

During October’s and November’s earning season we saw the majority of S&P 500 companies beat earnings projections. A good portion also provided higher guidance during their conference calls, which in turn caused many market participants to raise year-end targets for stock market indexes. Throughout the summer and fall, we saw large-cap growers, especially the IT and communications mega-caps, outperforming strongly (see Large Growth vs. Value graph below). The market so far doesn’t believe the Fed will be aggressive enough on rising interest rates to address inflation, which hasn’t slowed down and is above 6% over the last 12 months. How will the Market react going forward?

Large Growth vs. Value 2021 YTD (as of 11/24/2021)

Source — Signet FM

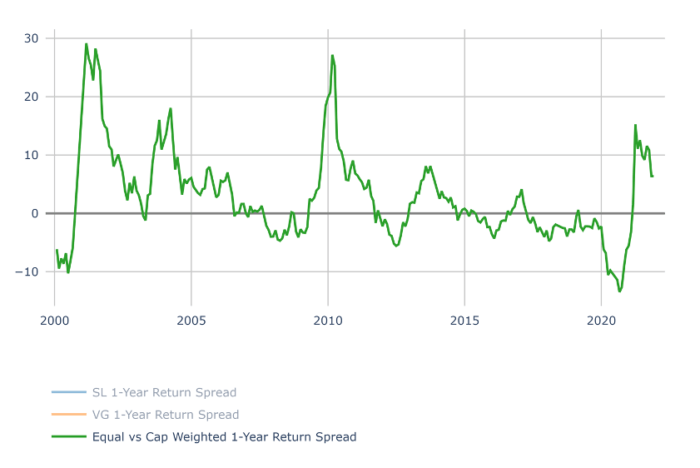

Equal vs. Market Weighted 1 Yr. Return Spread (through November 2021)

Source — Signet FM

The interest rate sensitivity of the US economy is key. With high personal savings, increasing wages, and healthy employment levels thus far, many market participants believe the US economy is resilient to mild interest rate increases. Additionally, the Fed doesn’t seem overly concerned with inflation.

This supports large-cap growers, which have been positively correlated with the bond market recently. However, eventual rate hikes by the Fed could benefit value sectors stocks such as financials and energy, which are negatively correlated with bonds performing well.

In our actively managed equity strategies, we maintain a barbell approach. On one hand, it makes sense to keep exposure to large growers of the GARP nature (growth at a reasonable price) in areas such as IT, Communications, and some Consumer Discretionary. These are the cohort of large growers which should outperform their expensive peers in a rising long-term interest rate environment. Additionally, the market treats this group as a safe haven against a potential economic slowdown. On the other hand, since we are still in the expansion phase in the economic cycle, we find cyclicals like Consumer Discretionary, Financials, Energy, Industrials, and REITs attractive, especially with many (Financials and Energy) providing a natural hedge against inflation and likewise a hedge against a potential rise in interest rates.

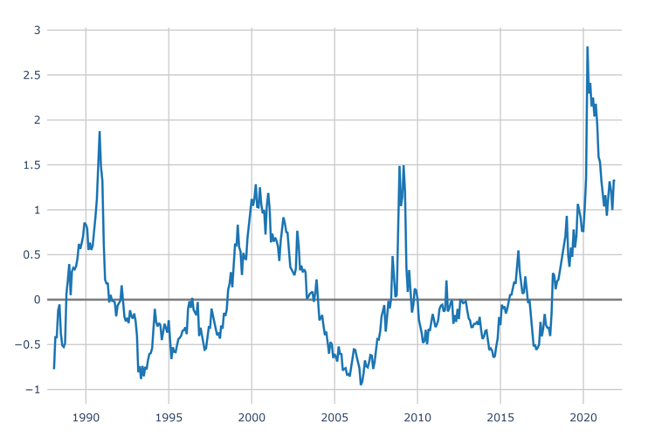

Consumer Staples and Utilities are less attractive now. Valuation spreads have been gyrating over the last six months (see Valuation Spread graph below) but remain elevated, indicating the difference between expensive and cheap companies is still considerable.

Valuation Spread (through October 2021)

Source — Signet FM

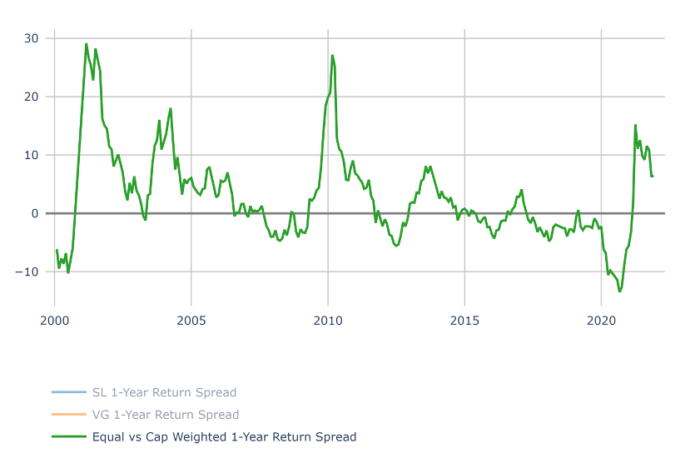

Factor Performance (Top 2 quintiles of Large Cap Universe vs. SP 500)

Source — Signet FM

We believe this creates an opportunity for value stocks. We also keep adequate Large/Mid/Small cap exposure in the portfolios, emphasizing Mid-Caps due to their advantageous factor and performance characteristics during the current segment of the economic expansion.

In conclusion, when inflation is growing from low levels as it is now, it is typically beneficial to stocks since companies tend to pass the higher input prices to the consumer. With our macro forecast supporting cyclical sectors in addition to IT and Communications, super-strong earnings, and the overall economy being supported by healthy consumption (established in turn by a substantial personal saving rate) we remain bullish and see more room for fundamentally strong stocks to grow.

The information and opinions included in this document are for background purposes only, are not intended to be full or complete, and should not be viewed as an indication of future results. The information sources used in this letter are WSJ.com, Jeremy Siegel, Ph.D. (Jeremysiegel.com), Goldman Sachs, JP Morgan, Empirical Research Partners, Value Line, BlackRock, Ned Davis Research, First Trust, Citi research, and Nuveen.

IMPORTANT DISCLOSURE

Past performance may not be indicative of future results.

Different types of investments and investment strategies involve varying degrees of risk, and there can be no assurance that their future performance will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

The statements made in this newsletter are, to the best of our ability and knowledge, accurate as of the date they were originally made. But due to various factors, including changing market conditions and/or applicable laws, the content may in the future no longer be reflective of current opinions or positions.

Any forward-looking statements, information, and opinions including descriptions of anticipated market changes and expectations of future activity contained in this newsletter are based upon reasonable estimates and assumptions. However, they are inherently uncertain, and actual events or results may differ materially from those reflected in the newsletter.

Nothing in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice. Please remember to contact Signet Financial Management, LLC, if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and/or services. No portion of the newsletter content should be construed as legal, tax, or accounting advice.

A copy of Signet Financial Management, LLC’s current written disclosure statements discussing our advisory services, fees, investment advisory personnel, and operations are available upon request.