US economics and COVID

The US economy is feeling pretty well, with more and more economists expecting sequential annualized US GDP growth to be around 10% in 2Q 2021, the strongest quarterly growth rate since 1978, outside of the 3Q 2020 print following the economy’s sudden stop in 2Q 2020. This strong business expansion is confirmed by lower jobless filings, higher retail spending, especially in the “getting back to normal” categories: sporting goods stores, clothing outlets and restaurants. Moreover, we are witnessing a healthy industrial output and a boom in homebuilding. The recovery has been supported by the pandemic relief money from the government, much of which has been used to fund retail purchases according to Value Line.

While vaccination and fiscal support prop up the economy in the short-run, the improvements in productivity assure long lasting secular economic growth on the home soil. While productivity growth was disappointing during the last cycle—averaging +1¼% annually vs. the long-term average of just over 2% — Goldman Sachs forecast much better progress in the early 2020s. Specifically, they expect three drivers of lasting productivity gains in the wake of the pandemic recession:

1) an accelerated demand shift to ecommerce and other higher-productivity segments;

2) the digitization of the workplace (cost- and time-savings from remote computing and virtual meetings); and

3) a boost from creative destruction, with some unprofitable firms shrinking or closing down.

They forecast the contribution to productivity growth in the post-pandemic economy from each channel based on survey data and the experience so far during reopening. This is a very important development for sustainability of the US economic growth, which is frequently overlooked and overshadowed by more pressing immediate effect measures.

Global economics

While the US is currently booming and China decelerating back toward trend, Europe could become the next engine of global economic acceleration. While Europe’s path has been rocky, JP Morgan believe the region is on track to become a booster to the US that drives a broad-based global growth boom by midyear. Three ongoing developments reinforce this view.

First, the restrictions put in place to counter the second wave have been effective in containing the virus while limiting damage to economic growth.

Second, the delayed vaccination rollout has tempered their sights on current-quarter European growth, but not their confidence that a firming in growth is underway.

Third, the pace of vaccination is picking up smartly. After having vaccinated only 8% of its population through mid-March, the Euro area vaccination rate is on track to reach 50% by midyear. This development should allow restrictions to be relaxed and amplify the normalization of activity already underway. While Europe’s coming bounce does not have the fiscal stimulus fuel that is driving US consumption spending higher, there is considerable pent-up demand set to be released according to JP Morgan. Assuming that Euro area and UK consumption returns to pre-crisis levels by year-end, regional consumption will rise at a double-digit pace through the end of this year.

Stock market

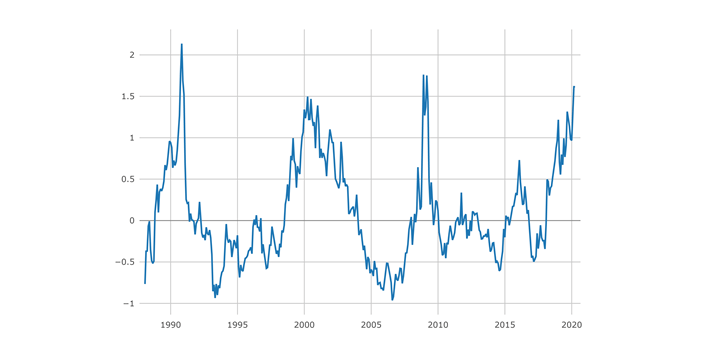

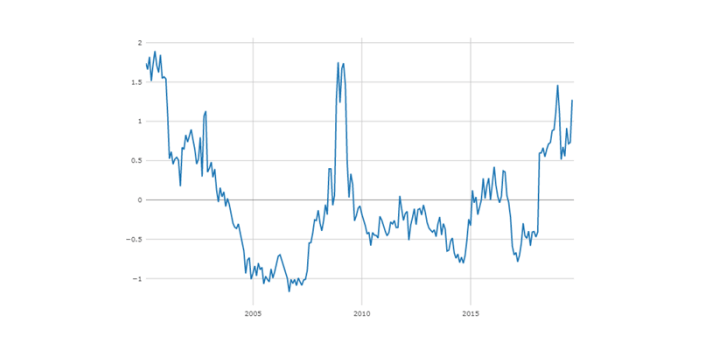

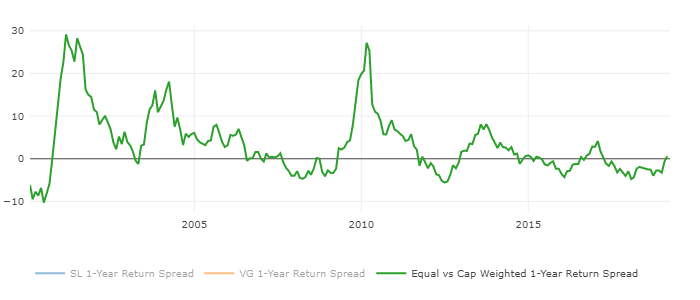

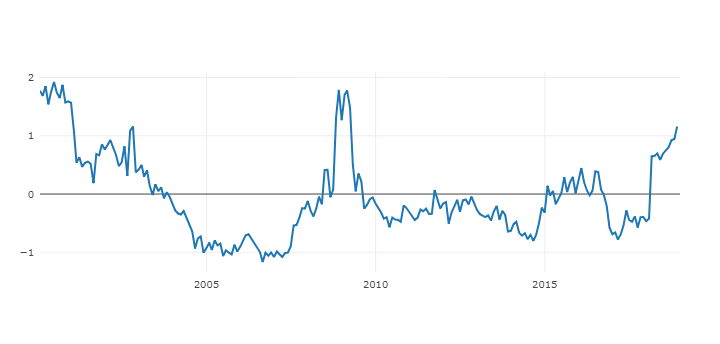

We find ourselves amid earnings season again and a strong one so far. Firms from Financial, Consumer and Tech sectors (the ones which report early) had impressive results for the most part and optimistic outlook. A critical question at the moment is whether the entirety of the economic recovery has already been discounted in the stock and bond markets. Empirical Research Partners (ERP) doubt the discounting process has run its course. We tend to agree: Valuation Spreads still look elevated (see the chart below) and Financials still look cheap.

Valuation Spreads through March 2021

Source: Signet FM

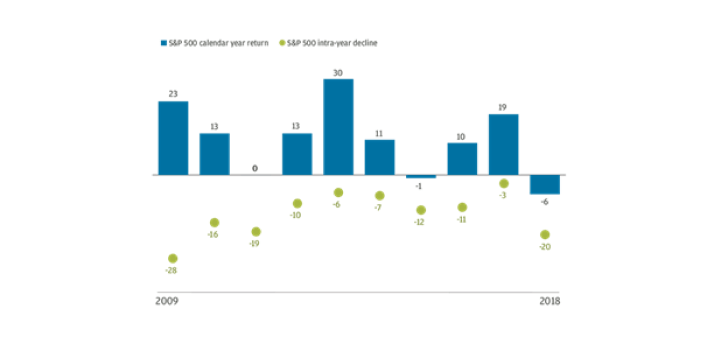

ERP point out that the unusual character of the Pandemic, that yielded a recovery that resembled those that followed natural disasters, has, along with the stimulus checks, made this turning point different from the precedents. Of note, neither underlying inflation nor median wage growth rolled over last year. Surveys suggest that nearly 40% of the stimulus payments were saved, implying that their impact on consumption should extend beyond 2021. The earnings estimates for 2021 S&P 500 earnings have risen from $175 a share to $187 in less than four months. If in fact the U.S. economy is to produce +6.0% to +6.5% real-GDP growth this year, as is widely expected, the earnings numbers are still too low.

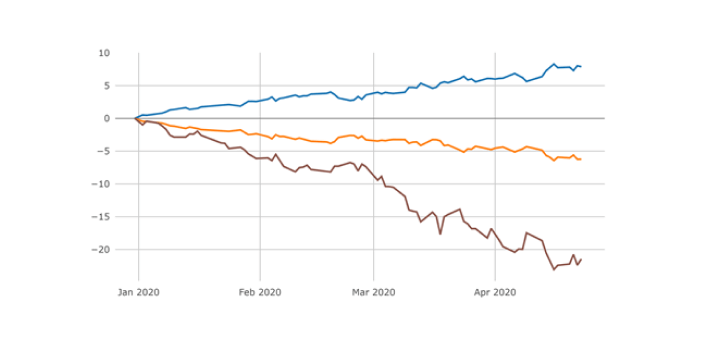

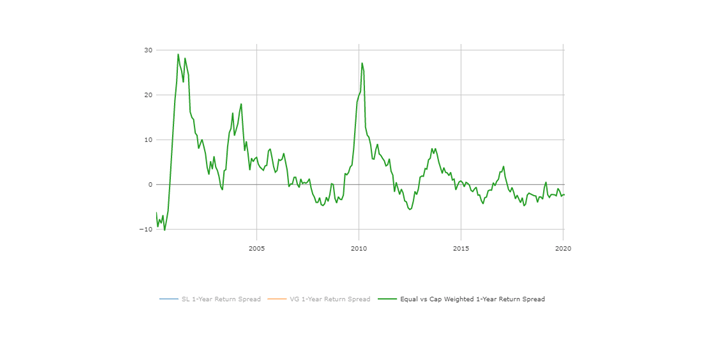

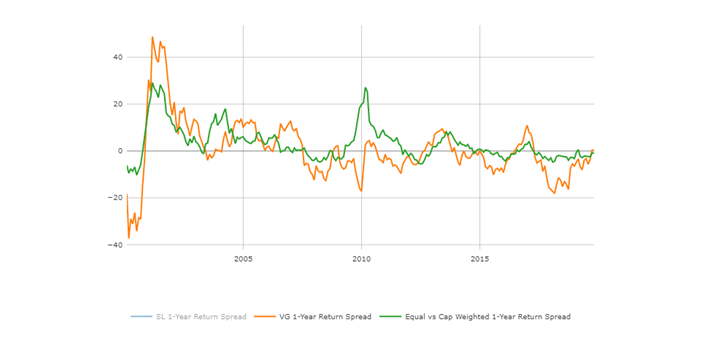

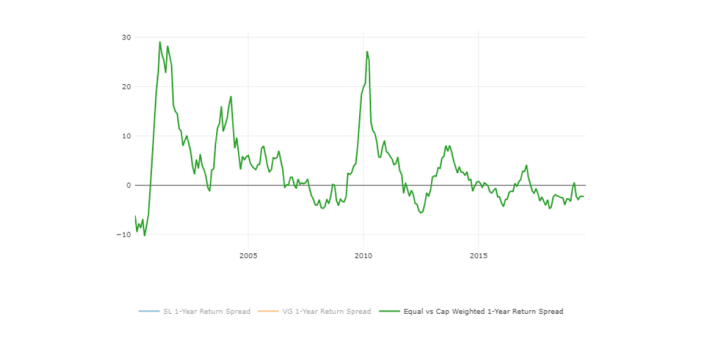

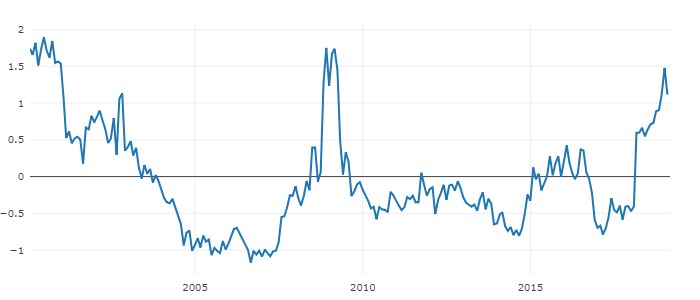

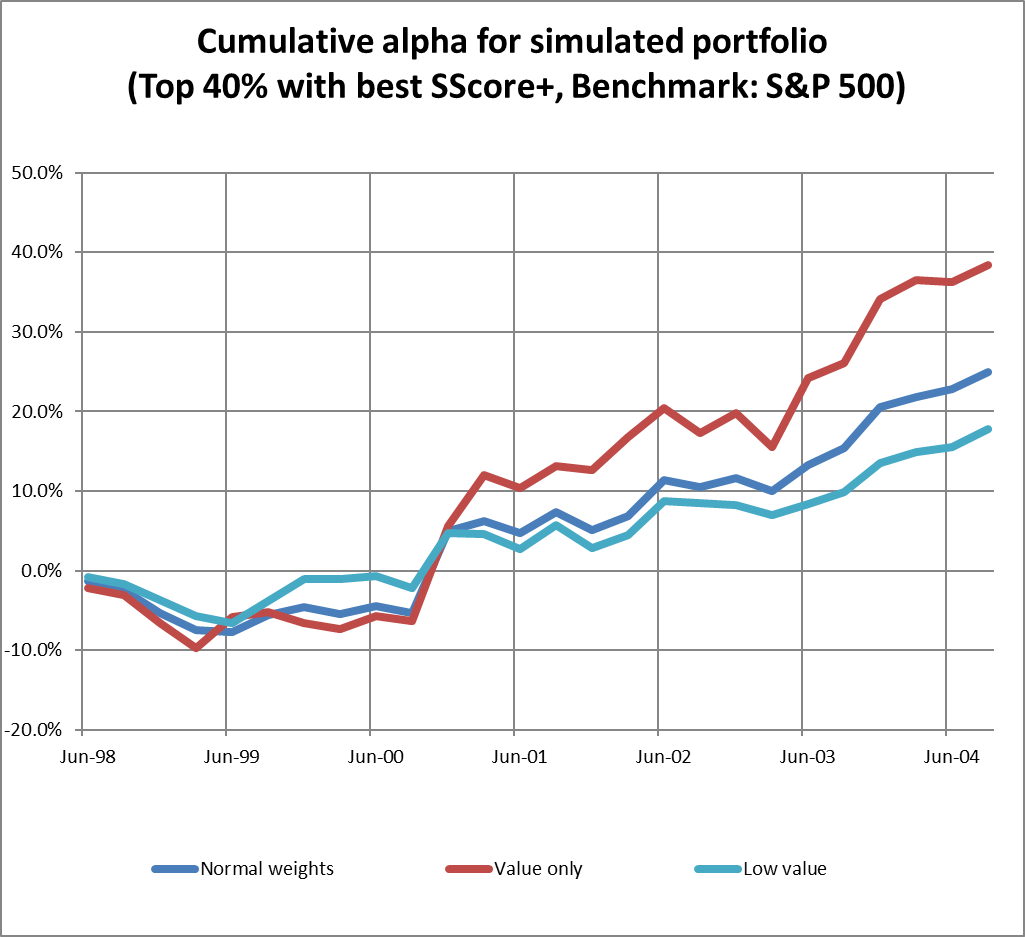

While broader market and Value have been outperforming over the last 12 trailing months (see Equal vs. Market Cap and Factor heatmap below), they resurrect from ashes after an unusually prolonged period of underperformance, so the mean reversion should take longer on this side as well.

Equal vs. Market Weighted 1 Yr. Return Spread through March 2021

Source: Signet FM

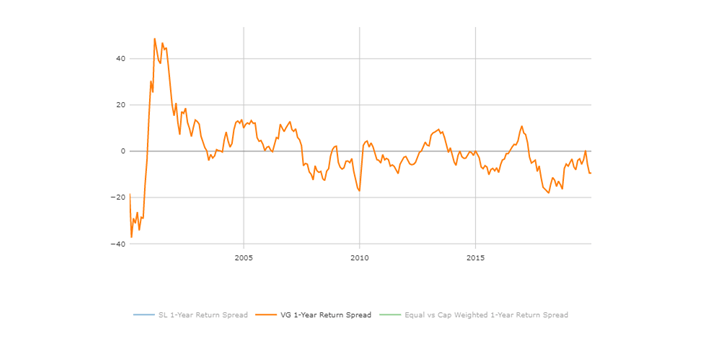

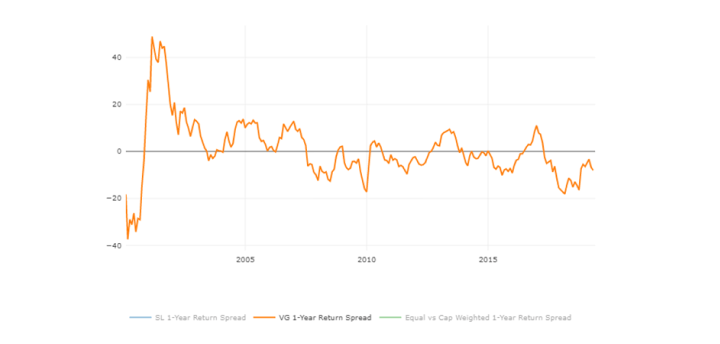

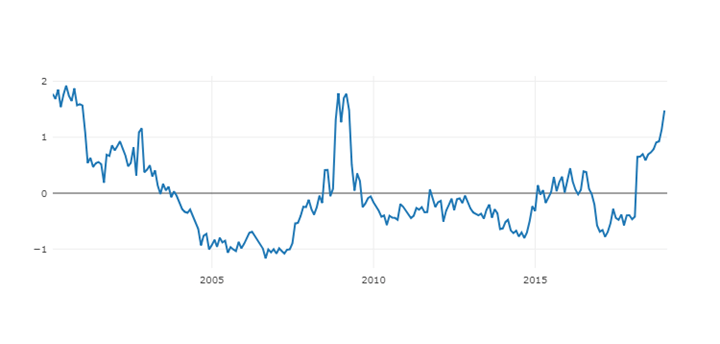

Factor Performance (Top 2 quintiles of Large Cap Universe vs. SP 500)

Source: Signet FM

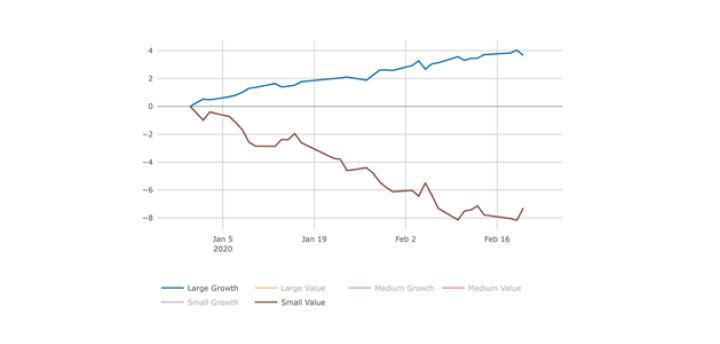

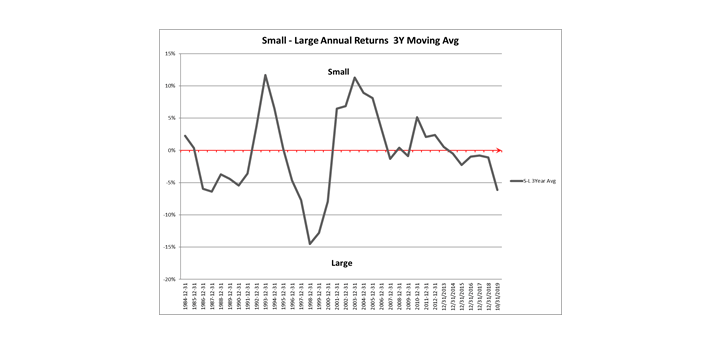

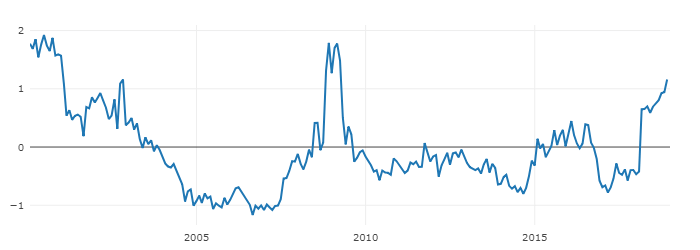

It makes sense to apply the same mean reversion logic to broader asset classes with weaker showing over the last decade, which recently started to outperform. So, we keep recommending Small, Mid-Caps and International exposure as great additions to an investment portfolio to capitalize on the recovery of the US and global economies.

Large vs. Small and Growth vs. Value 2020 YTD (as of 04/26/2021)

Source: Signet FM

All in all, when we revise our portfolios, we take into account both cyclical and secular trends – that is why our portfolios are diversified from sectoral and style posturing view. Considering all of the above said, we keep emphasizing cyclical and financial positions in our portfolios and pair them up with sound GARP positions from more secular plays in Technology and Communications.

Stay tuned!

The information and opinions included in this document are for background purposes only, are not intended to be full or complete, and should not be viewed as an indication of future results. The information sources used in this letter are: WSJ.com, Jeremy Siegel, PhD (Jeremysiegel.com), Goldman Sachs, JP Morgan, Empirical Research Partners, Value Line, Ned Davis Research, First Trust, Citi research and Nuveen.