US Economics and COVID

With 150 million fully vaccinated Americans, the US is the de facto locomotive of the global economy restart. Despite scattered shortages, GDP is on target to grow above 6% this year with recent data showing gains in exports, a decline in weekly jobless filings to another pandemic low, a rebound in consumer sentiment, and rising industrial production.

Heated up inflation and the Fed’s acknowledgement of the restart dynamics are the major themes these days. The Fed opened the door to a 2023 (from 2024) liftoff in policy rates and surprised the markets a bit. The Consumer and Producer Price Indexes surged by 0.6% and 0.8%, respectively, in May and prices were up 5.0% and 6.6% in the latest 12 months. Since January more mobile population pushed up prices of gasoline, airline tickets, hotels, and used cars (since production of new cars was limited by semiconductor shortages). The Fed reacted to this fact with a muted response supporting positive long-term dynamics. More importantly, since the Fed indicated that it could live with inflation higher than 2% as long as it achieves its objective, the question of whether inflation is transitory or more persistent becomes less pressing. The Fed’s latest average inflation projection for the next three years would still fall short of making up for past inflation undershoots.

Global Economics

JP Morgan’s measure of global mobility has risen nearly 6%-pts over the past four weeks, a notable pickup after remaining largely rangebound from mid-March to mid-May. These gains have been faster than expected in several regions. Mobility gains in Europe, India, and much of Latin America could push economic growth higher this quarter than previously forecast. The especially good news is that a GDP-weighted global average of new infections has been declining as mobility has risen. The lingering question is whether that will remain the case—that is, whether the link from mobility to new case counts has been broken.

For economies that are well advanced in their vaccination campaigns, JP Morgan is confident that the risks posed by rising mobility and new variants are small. There is a large gap between developed and emerging markets vaccination rates, which could lead to a wide economic performance gap this year. Progress on vaccinations has sped up recently in emerging Asia and Latin America, but JP Morgan estimates it will be later this year before these regions reach vaccination levels currently seen in the US or Western Europe. Nevertheless, projections for global GDP growth stay above 6% for the year.

Stock Market and Portfolio Management

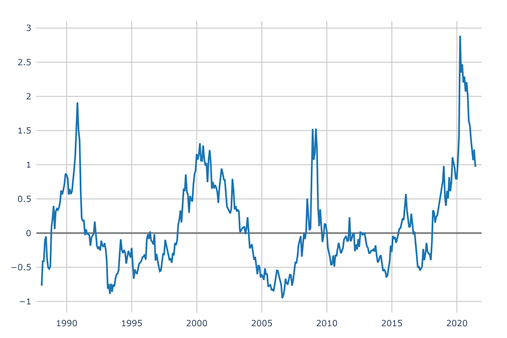

Over the last 12 months cheaper stocks (value) bounced back nicely while expensive stocks (growth) stagnated bringing down Valuation spreads below 1 standard deviation for the first time in 18 months (see chart below). Going forward, since Value does not have a huge advantage anymore, it is important for us to have nice exposure to profitability as well. The operational leverage (profitability is a result of good operational leverage) is what is going to push companies to new highs. No matter whether we are talking about metal miners or leisure and entertainment stocks, the companies with good operating leverage learned how to produce or deliver service with the least fixed costs possible. So, in our actively managed portfolios we should continue focusing on companies with good Value, Growth and Profitability characteristics going forward.

Valuation Spreads (through May 2021)

Source: Signet FM

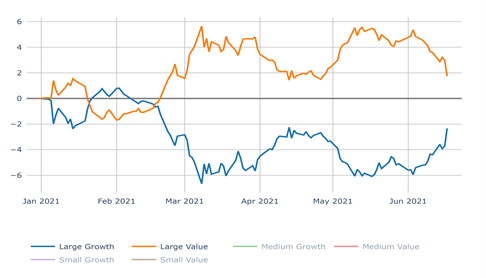

In June the 10-year Treasury Yield has been declining steadily from 1.62 to 1.45 (as of June 18th). Investors keep buying 10-year treasuries despite higher inflation expectations. The yield is supposed to go up if inflation is expected to rise but the huge demand for treasuries keeps it low (the Fed called out this phenomenon in one of their recent publications). Dropping yield and the fear that the Fed will slow down economic expansion by lifting rates too soon contributed to value and cyclicals pausing their yearlong march in June 2021.

In other words, the market experienced a partial reversal of what analysts and investors call the “reflation trade,” a bet on value companies and cyclical sectors and assets that stand to do best in an environment of solid economic expansion and quickening inflation over the last weeks (see Growth vs. Value chart below). The consensus in the market that this technically driven pullback is an opportunity to add exposure to cyclicals and commodities. Market participants expect inflation to continue and yields to grind higher, which should boost Value and cyclical stocks. We think the upcoming earnings season should confirm that cyclicals benefit from economic rebound and their lean capital spending allow them to leverage increased sales and meaningfully impact their bottom line.

Large Growth vs. Value 2020 YTD (as of 06/21/2021)

Source: Signet FM

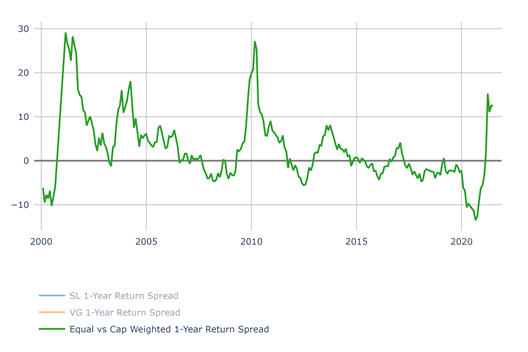

Equal vs. Market Weighted 1 Yr. Return Spread (through May 2021)

Source: Signet FM

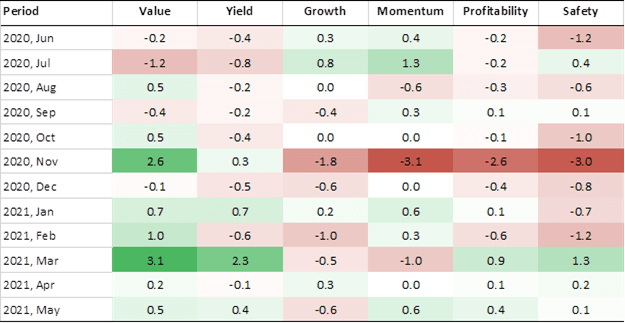

Factor Performance (Top 2 quintiles of Large Cap Universe vs. SP 500)

Source Signet FM

The information and opinions included in this document are for background purposes only, are not intended to be full or complete, and should not be viewed as an indication of future results. The information sources used in this letter are: WSJ.com, Jeremy Siegel, PhD (Jeremysiegel.com), Goldman Sachs, JP Morgan, Empirical Research Partners, Value Line, BlackRock, Ned Davis Research, First Trust, Citi research and Nuveen.