US economics, inflation, and the Fed

Inflation may have peaked over the summer, but more work might still be needed to achieve the target envisioned by the Federal Reserve. Specifically, the latest reports suggest that consumer price inflation has begun to decelerate. However, inflation still runs well above the Federal Reserve’s 2% target rate, as measured on the PCE (Personal Consumption Expenditures) Price Index. As a result, some economists wonder if the central bank can adequately address the situation, which reflects a complicated set of issues (wage pressures, a constrained labor force, supply-chain disruptions, military hostilities, alternative energy adoption). The Fed has implemented four consecutive 75-basis point interest rate increases this year. Most market observers think a 50-basis point hike will be passed in December, indicating a softer stance.

There was a barrage of Fed speakers recently and Jim Bullard, a notable hawk, believes we need to get to a 5.0-5.25% range on Fed funds at a minimum, but that he could see a possibility of getting to 7% to curb inflation. Wharton Business School Professor Jeremy Siegel has no idea what data Mr. Bullard is evaluating when claiming to be more hawkish than ever. The professor is on the other side and would not be surprised to see the Fed reversing course next year from uber hikes back to rate cuts. And while this is not Professor Siegel’s official prediction, he would not be surprised to see a 2% Fed funds rate by the end of 2023 with an economic slowdown that is likely.

Global economy

With tighter financial conditions delivering a developed markets’ housing slump and the winter aggravating China’s COVID and Europe’s natural gas problems, the near threat of a global recession remains elevated. J.P. Morgan (JPM) continues to see the imminent risk of the US or global economy sliding into recession at some point in 2023 with a 32% probability rate. The most important offset to these drags is the rapid fading of last year’s adverse supply-side shocks. This development is clearly seen in the slide in global CPI gains, which JPM expects to reach 3.5% per year next quarter — more than a 6% drop from its pace in the first half of 2022. For the US, this boost should combine with a moderating fiscal policy drag to boost consumption growth to a roughly 2.5% average pace this quarter and next.

In Asia outside of China, a normalization in mobility should boost service-sector activity, most notably in Japan, which JPM expects to move to the top of the developed markets growth table. In all, JPM expects growth to be sluggish — they forecast a sub-par global GDP growth rate of 1.5% per year through the middle of next year with pronounced sectoral weakness in tech and construction spending.

However, JPM thinks it is a mistake to rule out a soft-landing scenario (20% probability) in which recession is avoided. Under this scenario, sluggish growth and the removal of supply-side constraints are sufficient to push inflation down towards 2% without a sharp deterioration in labor markets. With growth running at a modest pace, central banks can begin to normalize policy in late 2023, laying the groundwork for an extended global expansion.

Stock market earnings season results and 2023 outlook

With 94% of S&P 500 companies reported, 61% beat 3Q earnings (vs. 74% avg. last 4Qs), and 63% beat revenue estimates (vs. 72%). Sectors with the highest percentage of companies beating earnings projections include Technology (76%), Industrials (74%), and Healthcare (69%), though they were all below their past 4Q trend. In fact, the percentage of companies beating earnings within the S&P 500 has been in steady decline after peaking in 2Q21 at 88%.

With the slowing in earnings growth and the cost of money no longer next to nothing, the consensus among market participants is that the US stock market will produce more muted returns compared to the last decade.

The weighted average cost of capital (WACC) for US firms late last year was close to the lowest level in history. Today, following a determined effort by the Federal Reserve to curb elevated inflation, financial conditions have tightened dramatically. The WACC has spiked by 200 bp to 6%, the highest level in a decade and the largest 12-month rise in 40 years according to Goldman Sachs (GS). It will likely remain near the current level in 2023. Sharply reduced valuation for public and private firms is one painful consequence.

GS estimates 2023 S&P 500 EPS could remain flat at $224, which could limit gains for the index next year and also forecasts an unchanged P/E multiple of 17x. GS believes investors should remain cautious in the near term:

- Own defensive sectors with low interest rate risk (Health Care, Consumer Staples, and Energy).

- Own stocks with leverage to decelerating inflation.

- Avoid unprofitable long-duration equities.

- Own firms with resilient margins.

- Avoid stocks with vulnerable margins if the recent decline in SG&A reverses.

We believe this environment bodes well for our investment framework: own profitable companies with strong and sustainable fundamentals.

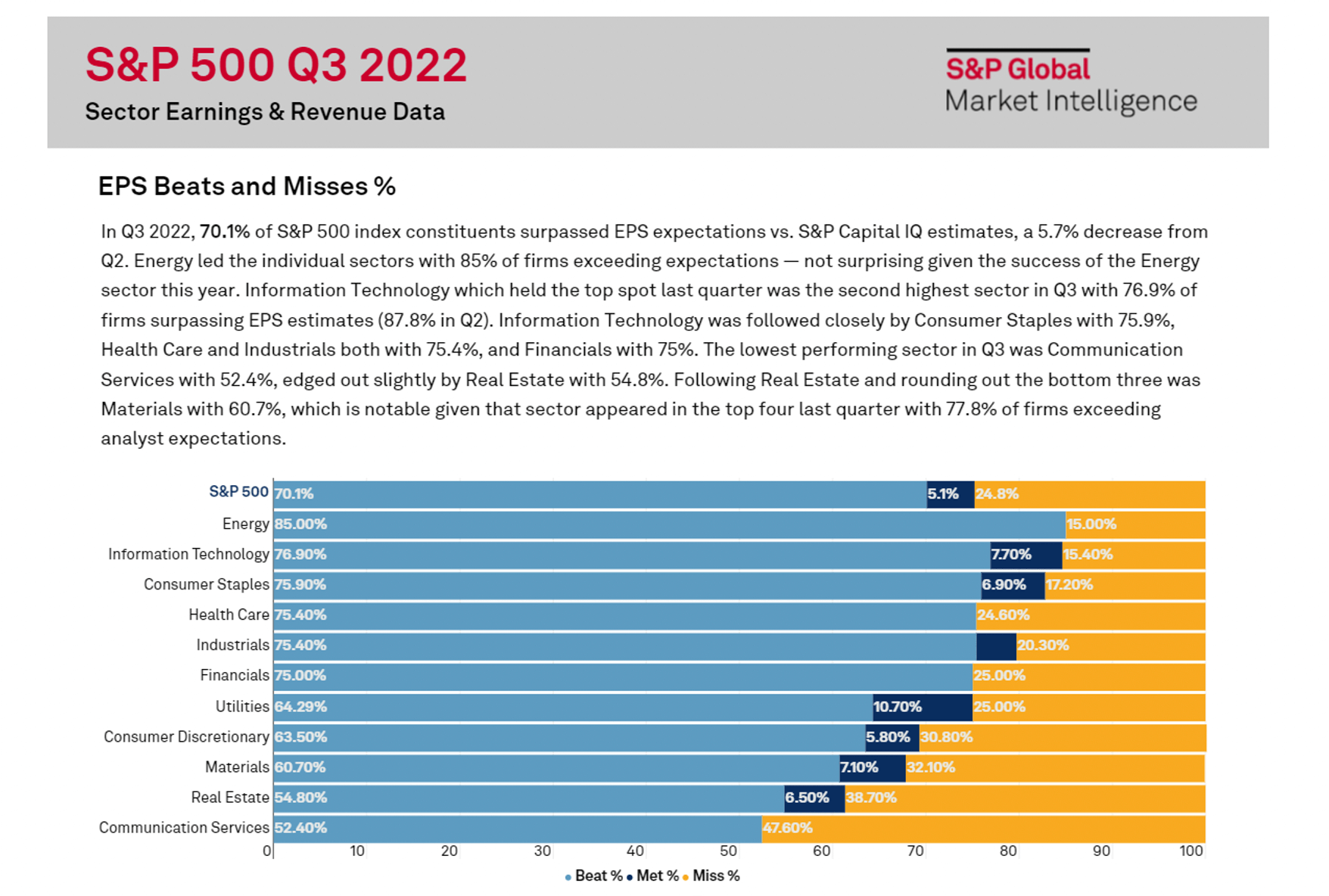

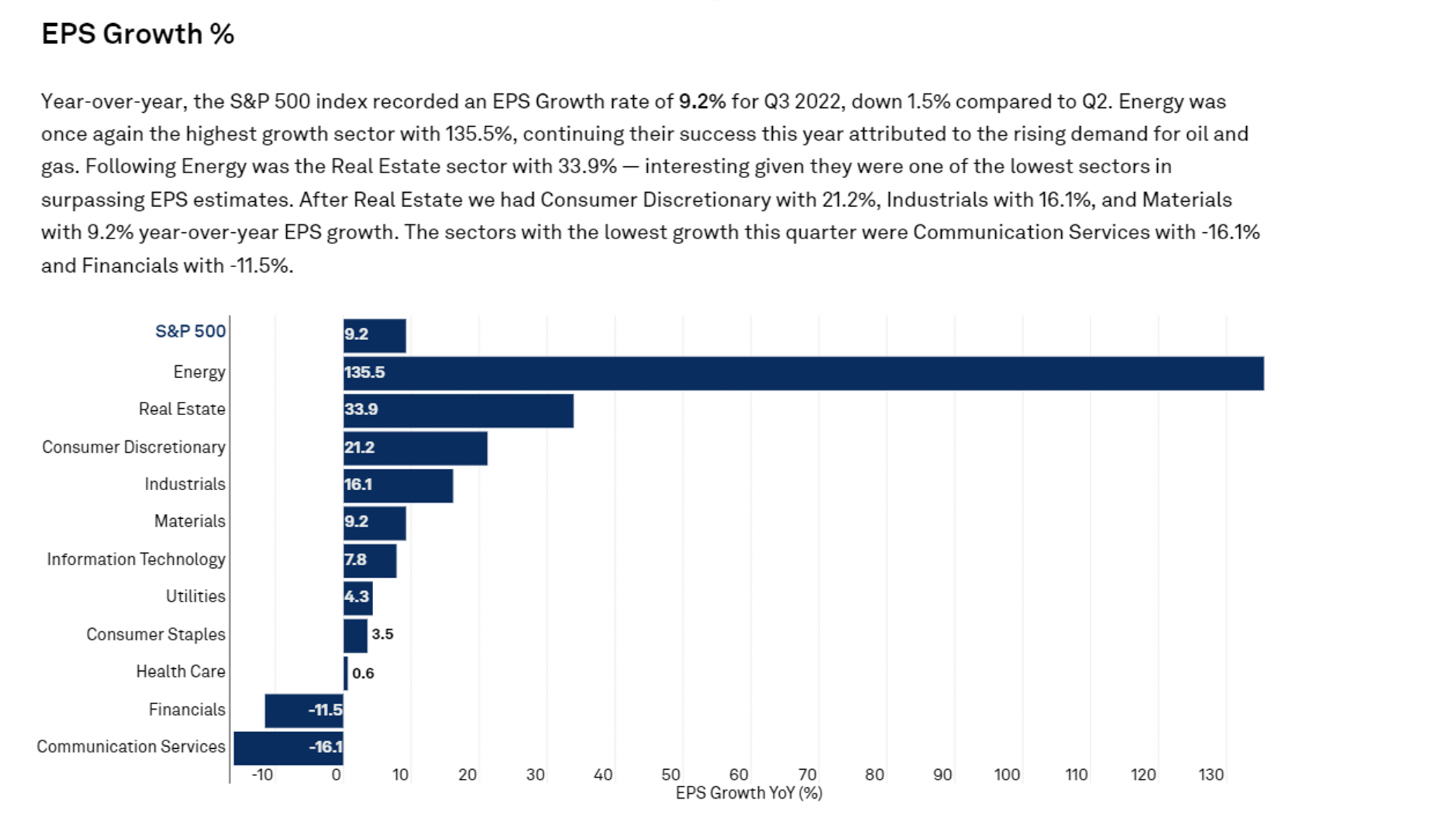

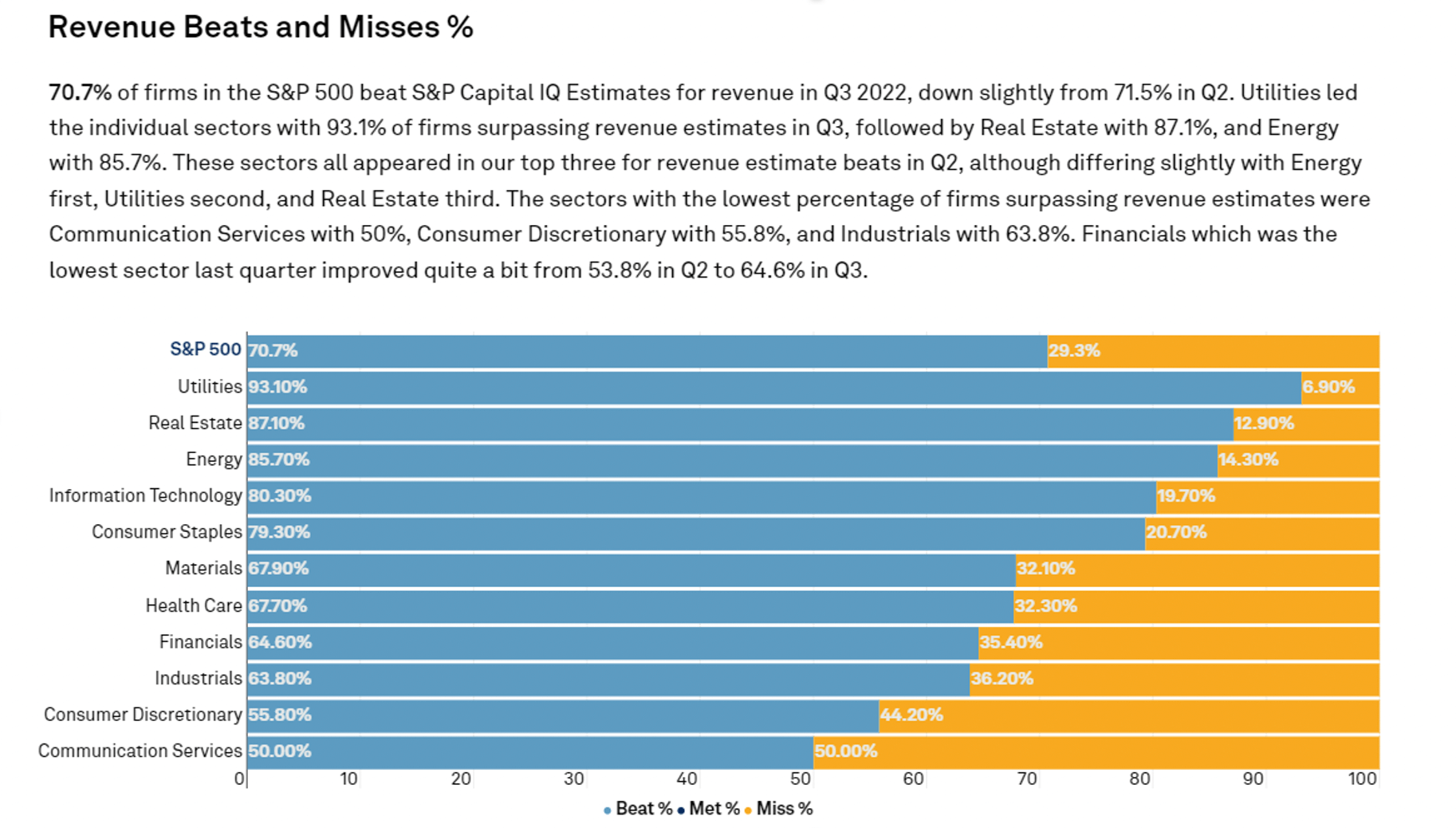

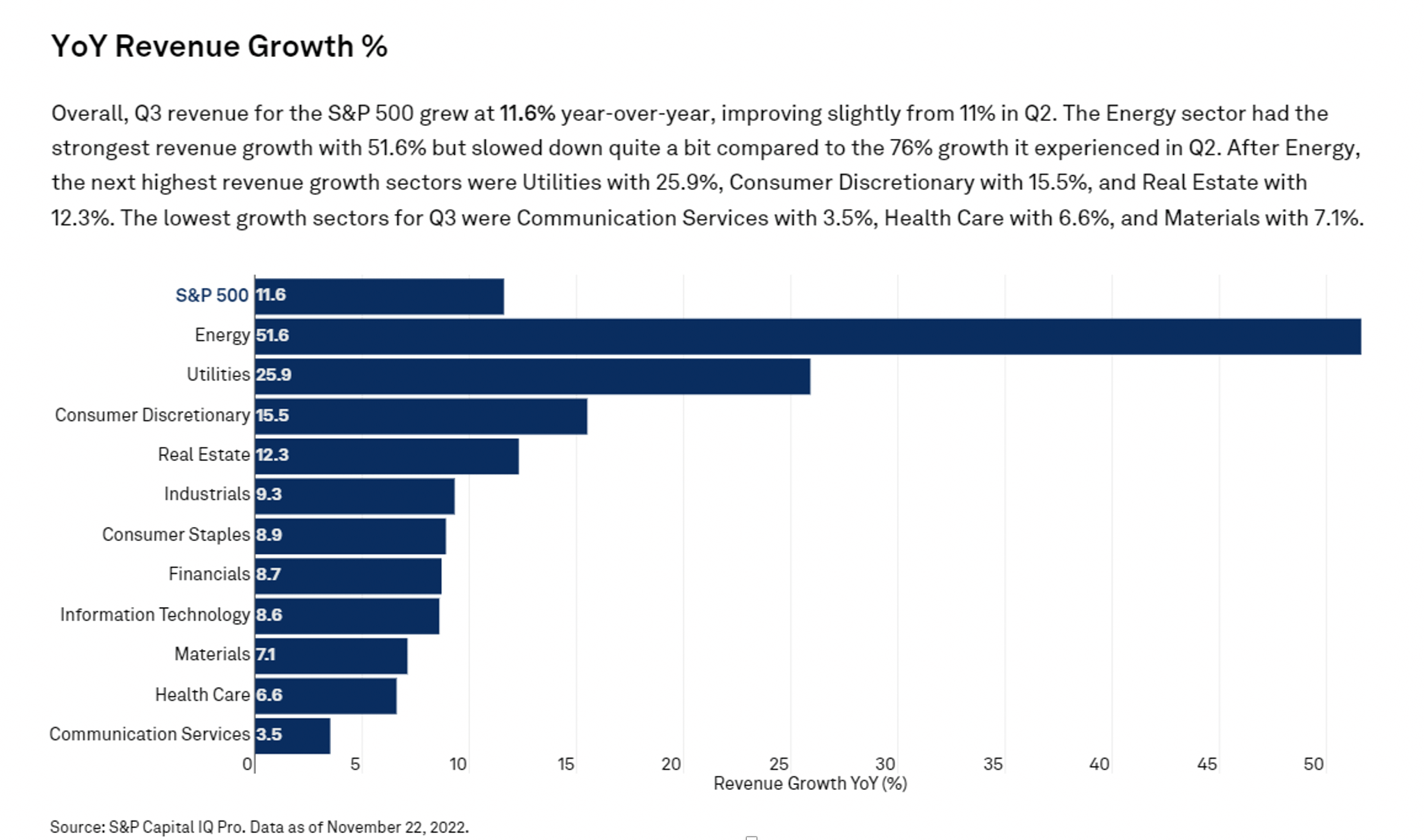

Below is data provided by S&P Global, which illustrates the health of US corporate profits:

The information and opinions included in this document are for background purposes only, are not intended to be full or complete, and should not be viewed as an indication of future results. The information sources used in this letter are: WSJ.com, Jeremy Siegel, Ph.D. (Jeremysiegel.com), Goldman Sachs, J.P. Morgan, Empirical Research Partners, Value Line, BlackRock, Ned Davis Research, First Trust, Citi research, HSBC, and Nuveen.

IMPORTANT DISCLOSURE

Past performance may not be indicative of future results.

Different types of investments and investment strategies involve varying degrees of risk, and there can be no assurance that their future performance will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

The statements made in this newsletter are, to the best of our ability and knowledge, accurate as of the date they were originally made. But due to various factors, including changing market conditions and/or applicable laws, the content may in the future no longer be reflective of current opinions or positions.

Any forward-looking statements, information, and opinions including descriptions of anticipated market changes and expectations of future activity contained in this newsletter are based upon reasonable estimates and assumptions. However, they are inherently uncertain, and actual events or results may differ materially from those reflected in the newsletter.

Nothing in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice. Please remember to contact Signet Financial Management, LLC, if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and/or services. No portion of the newsletter content should be construed as legal, tax, or accounting advice.

A copy of Signet Financial Management, LLC’s current written disclosure statements discussing our advisory services, fees, investment advisory personnel, and operations are available upon request.