2023 has offered something for bulls and bears alike. Which will prevail in the year’s final months?

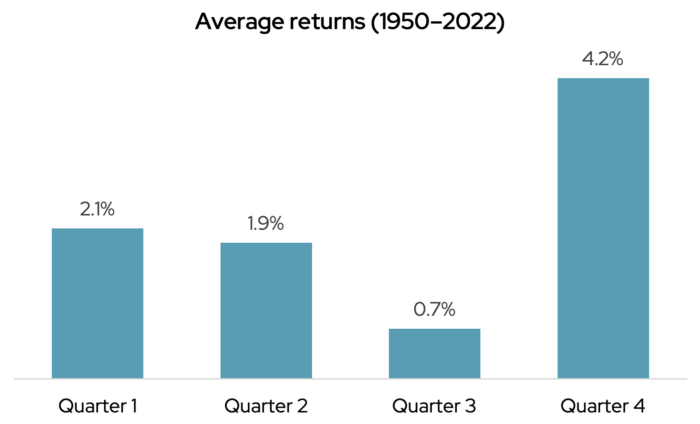

US stocks typically post their best returns in the final three months of the year. We are optimistic for a strong finish in 2023 as well.

There is good reason to be optimistic for a rebound and continued strength into year end. The fourth quarter has historically been the strongest quarter for US stocks. It is often associated with positive returns and a potential rebound from any weakness experienced in the third quarter. Additionally, the fourth quarter has been up nearly 80% of the time, according to BlackRock.

Why stocks could rally in the fourth quarter

The chart below shows the S&P 500 Index average quarterly returns since 1950.

Source: Carson Investment Research, YCharts 12/30/2022

S&P 500 nears test of support

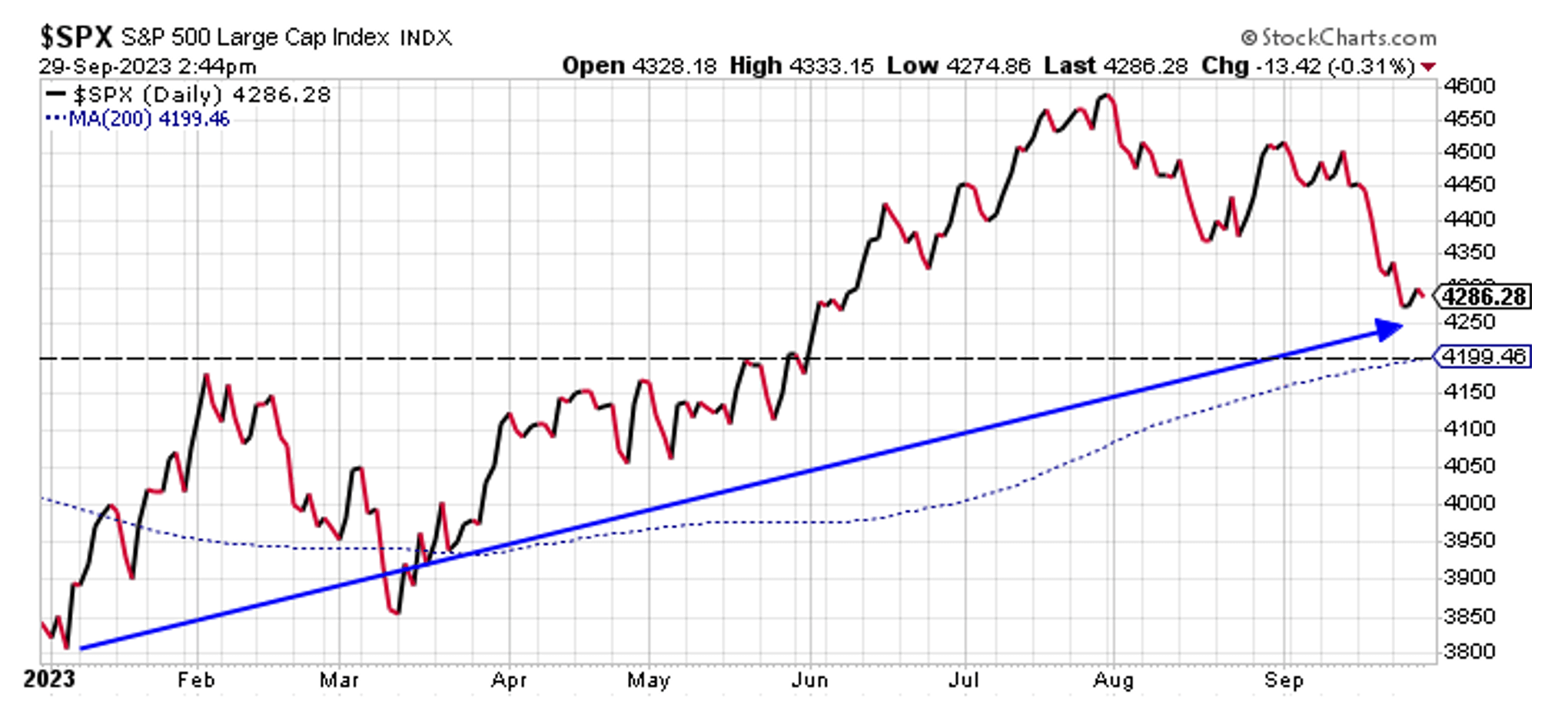

Stocks pulled back in August and September. This is not uncommon, as these months are among the weakest historically.

We view this type of weakness as normal and likely necessary for stocks to catch their breath before a new surge higher.

Even after the recent correction, stock markets generally maintain strong year-to-date gains. The chart below shows the S&P 500 index maintains nice gains in 2023. It is nearing a price level of around 4200, which could provide support and a logical place for a rebound. 4200 is the level of the 200-day moving average and near previous peaks in February and June.

Source: Stockcharts.com, 9/29/2023

Here is the good news

We are cautiously optimistic for the fourth quarter 2023. The market has generally defied expectations and the economy is stable. This argues for staying invested.

We believe there is an opportunity to uncover attractively priced stocks and lock in nice yields with bonds.