Elevated yield levels have created a more attractive entry point for bonds.

After three years of rising interest rates and bond volatility, investors may be hesitant to invest in bonds. However, now may be a good time to invest in fixed income. Here are some reasons why:

Income generation

For the first time in over a decade, investors can earn over 5% yield through high quality bonds. Thanks to a sharp rise in rates, investors can potentially earn higher yields and generate higher levels of income.

Interest rates are stabilizing

While interest rates have been on an upward trend for the past three years, they have recently stabilized. With the Federal Reserve indicating that it may pause rate hikes, there are opportunities for investors to take advantage of higher yields with intermediate-term bonds.

Potential for capital appreciation

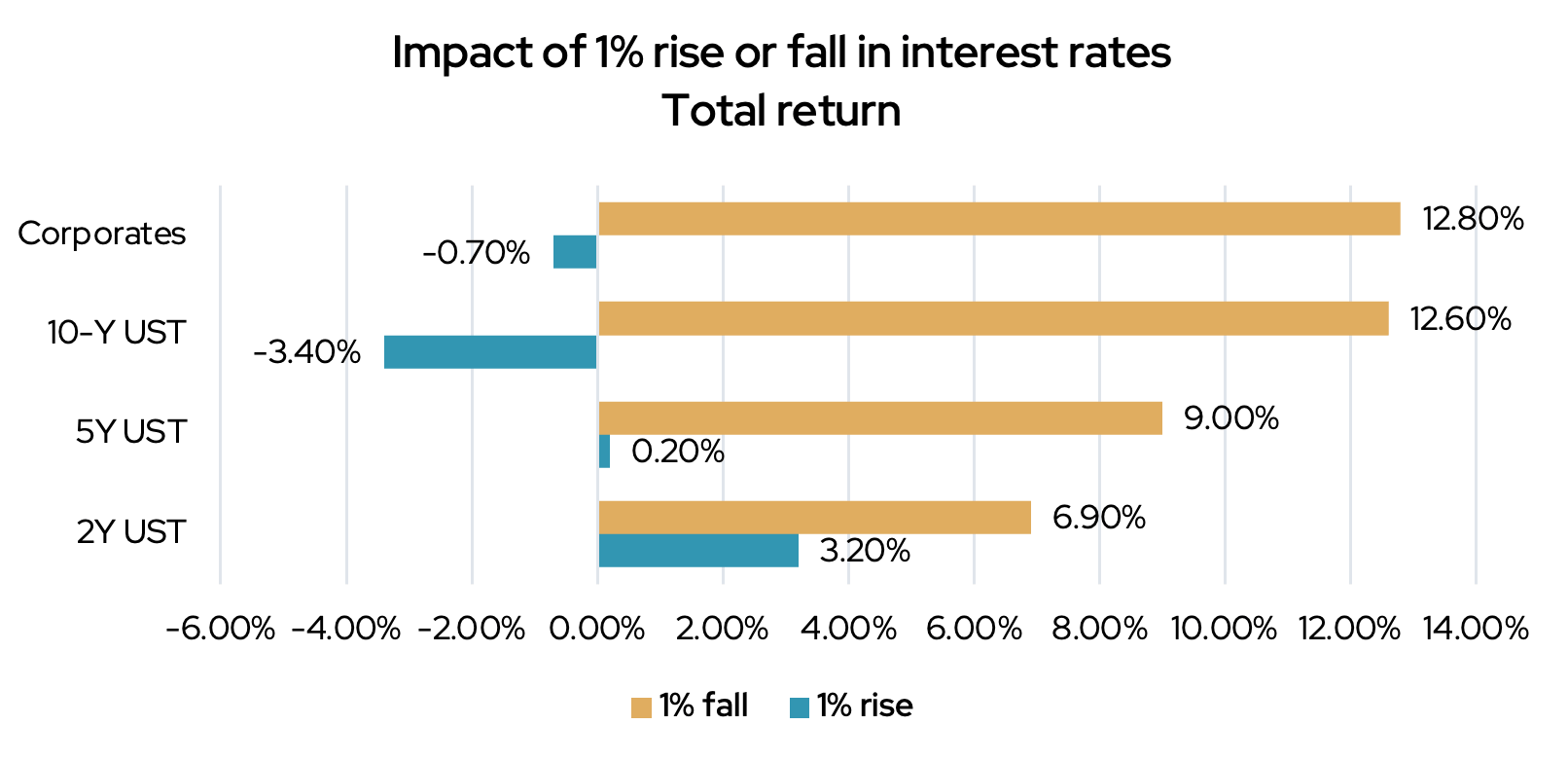

As interest rates stabilize, bond prices may increase, potentially leading to capital appreciation for investors. The chart below shows how various bond maturities should react to a 1% decrease in rates, compared to a 1% increase. We believe the upside potential is attractive, and the downside is limited from here.

Source: Bloomberg, JP Morgan data as of September 30, 2023

Stability

In an environment where stocks are volatile, core bonds can provide a more stable investment option with lower volatility.

Diversification

Investing in bonds can also help to diversify a portfolio and provide downside protection. When combined with stocks and other asset classes, bonds can help to balance risk and may provide a more consistent return.

Now may be a good time to consider locking in current interest rates through intermediate-term bonds. While interest rates have been rising, they have recently stabilized and may even decrease soon. By adding bonds maturing between three to seven years, investors can potentially earn higher yields and generate more income, while also benefiting from diversification.

There has been a lot of volatility in bond markets, and there is still uncertainty as we look ahead. Yet, the outlook for fixed income has shifted. Today’s starting yields offer much better prospects for total returns and can also absorb a potential continued increase of yields. Especially after the rise in rates, we believe a fixed income allocation makes sense for a lot of investors.

If you have any questions or want to explore how you might benefit from bonds, please contact your Signet advisor.