US Economics

This Fall saw Americans buying more cars, clothing and furniture at stores and online. The result was a welcome recovery, as retail spending surged 1.6%, despite hurricanes impacting many communities. This was the best retail showing of the year. Such healthy spending should bode well for the current quarter. Should we see a modest pickup in industrial production and factory usage, projected strength in homebuilding, and likely hurricane-related rebuilding efforts, the U.S. gross domestic product could well advance over 3% in the fourth quarter.

Global Economy

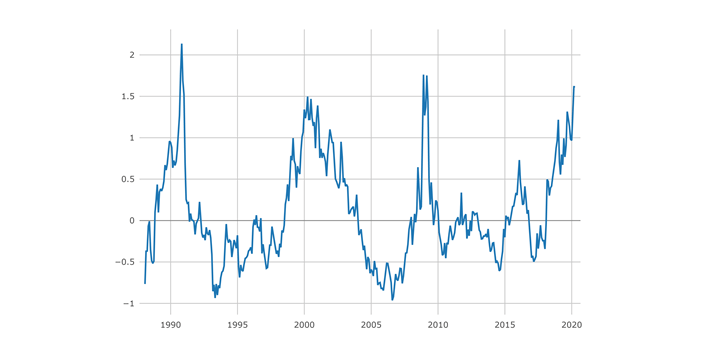

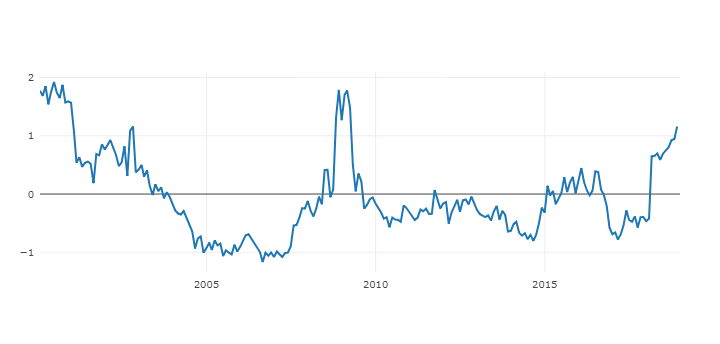

We see a major shift in G4 central bank balance sheet policy. On the heels of the Fed’s September announcement to reduce its reinvestments, the European Central Bank is expected to announce a major slowdown in its asset purchase plan next week. The pace of Bank of Japan purchases has drifted down to ¥47tn ($415bn) over the past three months. As a result, the flow of G4 asset purchases—which ran close to a $2 trillion annualized pace over the past year—is slowing and is expected to come to a halt on net by mid-2018. The fact that G4 central banks will halt bond purchases is expected to nudge global bond yields higher, we don’t think this will affect the financial stability of the world financial system. The tapering is winding down for good reason: the global economy seems healthy and doesn’t need medicine anymore.

Global Economy

Since the mid 2016 the global GDP has delivered consistent above-trend outcomes and upside surprises. Inflation also has risen though still at a subdued pace. The global economy seems to be entering a traditional business cycle upturn as broader growth lifts private sector confidence and asset prices. As recently has been the case, China could be a headwind to a continuous above trend growth, but the major central banks’ commitment towards supporting the recent expansion should be enough to overcome occasional hiccups.

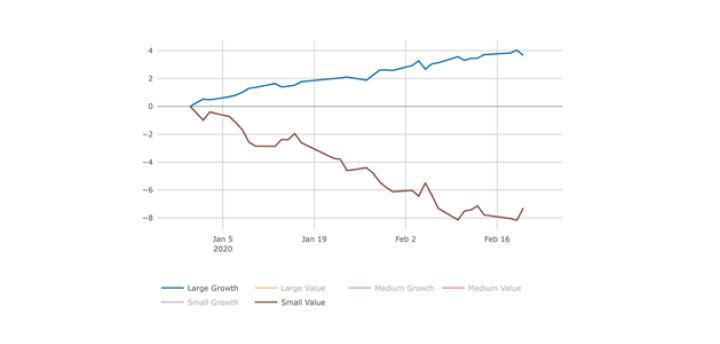

Equities and Taxes

Progress in Washington, D.C. toward tax reform has increased the chances of a new tax bill in 2018. Tax reform could boost corporate earnings significantly, but the effect on the aggregate US equity market, and the distinction between winners and losers, will depend on details that remain to be negotiated. Recent stock market performance suggests investors are already pricing some optimism regarding tax reform. According to Goldman Sachs, the White House’s tax reform plan would bring the US federal statutory corporate tax rate to 20%, close to the OECD (Organization for Economic Co-operation and Development) average and significantly below the median S&P 500’s company’s current 27% effective rate.

In addition to the direct earnings benefit, the combination of corporate and personal tax reform could spur faster economic growth. However, by accelerating economic growth late in the cycle, fiscal stimulus could also boost inflation and therefore the path of Fed tightening. The probability of the Fed rushing with interest rate increases is pretty low though, since inflation is much softer than what it ought to be at the current unemployment rate. Even if detailed legislation is passed, many other uncertainties would remain given the potential consequences of tax reform on economic growth and the reactions of corporate managers and their accountants to the new tax code.

Earnings Season

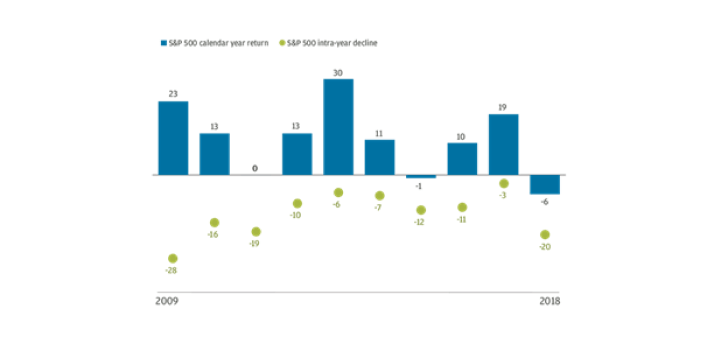

The third quarter earnings season is at an early stage. 19% of companies have reported in US and Europe, and 10% in Japan. The bulk of the results will be released over the next two weeks. Preliminary results look encouraging: earnings per share (EPS) and sales growth are running above consensus estimates in all the three regions, but more companies are beating in US and Japan compared to Europe so far accordingto JP Morgan. In the US, 80% of S&P500 companies beat EPS estimates – the best in three years. In Europe, 48% of Stoxx600 companies beat EPS estimates. Finally, in Japan, 59% of Topix companies beat EPS estimates, which is in line with the historical average.

The information and opinions included in this document are for background purposes only, are not intended to be full or complete, and should not be viewed as an indication of future results. The information sources used in this letter are: Jeremy Siegel, PhD (Jeremysiegel.com), Goldman Sachs, JP Morgan, Empirical Research Partners, Value Line, Ned Davis Research, Citi research and Nuveen.