US economics and global economy

The Omicron wave is reverberating around the world and hitting the US hard. However, this variant is less virulent and spreads quickly, which makes us believe that it will last for a shorter period and its economic impact will be limited to the early months of the year. The US and Global economies keep expanding despite the virus’ impact on the purchasing appetite of the US Consumer with retail sales declining by 1.9% in December. Nevertheless, JP Morgan expects, that when the statistics are finalized, the US economy will have grown by 6.9% in the 4th quarter of 2021 and the growth for the year was 5.5%, the best in nearly four decades. According to JP Morgan, the global economy is to generate a 5% increase in the 4th quarter of 2021 and 5.9% for the year. For the whole year of2022, the bank expects the US economy to have risen by 3.7% and the world by 4.2%.

Interest rates and markets

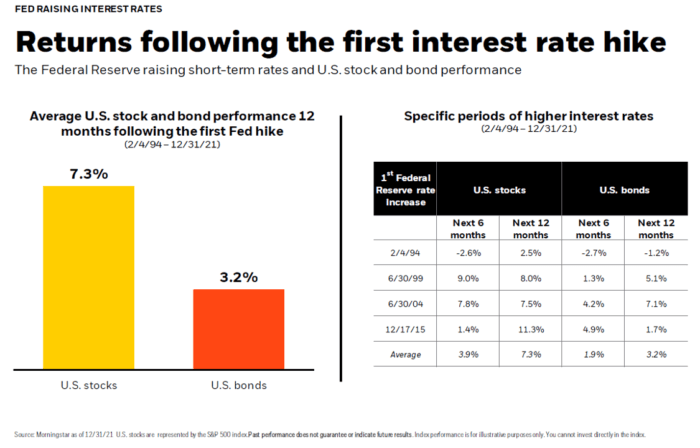

In January, the markets were dominated by expectations that the Fed will start tightening its monetary policy in response to the current high rate of inflation that has not been seen for multiple decades and the tight job market. While the markets reacted strongly to the news that the Fed could have several more interest rate hikes this year than initially anticipated; we must keep in mind that the Fed’s policy is to implement such tightening only if they believe the economy is expanding quickly enough and that such tightening of financial conditions will not derail the economy. If history is any indicator, the Fed’s initial rate hikes do not typically result in adverse market returns over the following 12 months. Please, see the illustration from BlackRock below:

Stock market

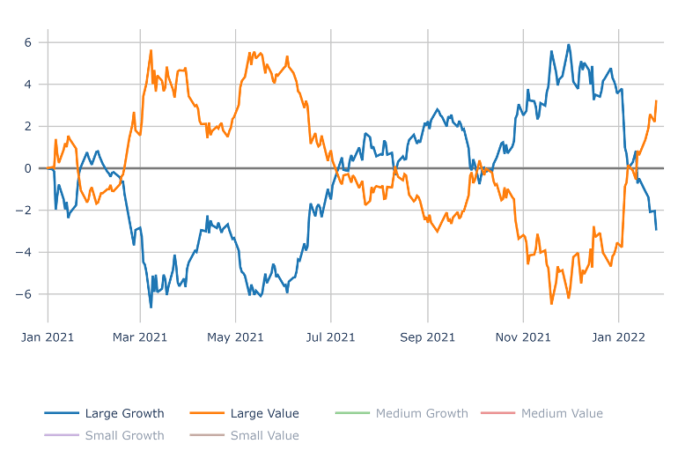

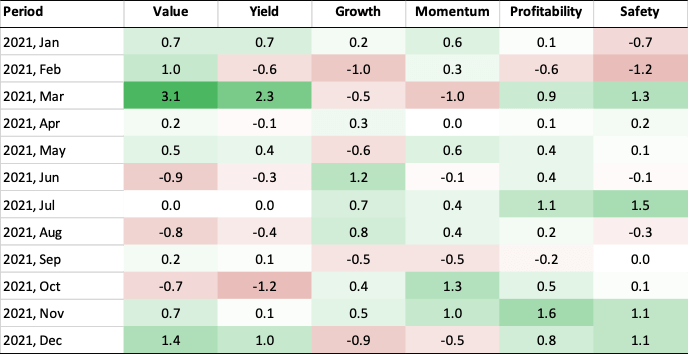

Since March 2020 Value and GARP (Growth at Reasonable Price) Growth companies have had a pretty good run, finishing last year on a high note. The leadership in the stock market changed in late November 2021, transitioning back to Value outperforming Growth (See Large Growth and Value Alpha Chart and Factor Alpha Heatmap below). The less profitable stocks in the Growth cohort — are the ones most susceptible to interest rate hikes, which brought Growth’s relative performance down. This year, Value has continued to outperform for the same reason. As the markets got choppier, the riskier stocks in the Large Cap group and Small Caps fell behind.

On a recent Zoom call, Professor Siegel of Wharton Business School stated that when the markets go through corrections, all the stocks (good and bad) go down, but the good ones recover much quicker. That creates a buying opportunity for patient investors. Going forward, in a slower-growing economy, we think investors will need to pay more attention to Profitability, Safety, alongside Valuation and Growth. This multifactor approach is at the heart of Signet’s investment management. We employ this philosophy in our Large, Mid and Small Cap actively managed equity strategies and across our asset allocations as well.

Large Growth and Value SP Indexes Alpha 2021 and 2022 YTD (as of 1/25/2022)

Source — Signet FM

Factor Performance (Top 50% in each Factor Group vs Benchmark)

Source — Signet FM

Lessons from history

The stock market is down so far in 2022. While selloffs are nerve-wracking for investors, history provides a useful ballast to our emotions.

Using data from the S&P 500 over the last century, Russell Investments finds:

- Market corrections tend to occur once every two years;

- They are usually short-lived — with the S&P 500 index recapturing losses in just four months on average.

LPL Research reminds us that stocks tend to rebound quickly from losses. A year after a correction, stocks are typically much higher: up 25% on average, per LPL. This data indicates that panic selling in the face of a selloff probably isn’t the best way to reach your long-term goals.

Of course, these are averages. Will the volatility we are experiencing be a typical correction, or progress to a full-blown bear market? That’s the big question. Again, looking at history, Ben Carlson provides evidence in his blog, A Wealth of Common Sense, that corrections that do not occur with an economic recession are much milder and shorter than corrections that occur because of an economic slowdown. This makes sense when you consider how much financial pain is inflicted on households during a recession.

We believe the economic recovery has room to run and a recession in the near term is unlikely. Therefore, we don’t expect the end of the bull market, and we view the current market decline as an opportunity to buy good companies at better prices.

The information and opinions included in this document are for background purposes only, are not intended to be full or complete, and should not be viewed as an indication of future results. The information sources used in this letter are WSJ.com, Jeremy Siegel, Ph.D. (Jeremysiegel.com), Goldman Sachs, JP Morgan, Empirical Research Partners, Value Line, BlackRock, Ned Davis Research, First Trust, Citi research, and Nuveen.

IMPORTANT DISCLOSURE

Past performance may not be indicative of future results.

Different types of investments and investment strategies involve varying degrees of risk, and there can be no assurance that their future performance will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

The statements made in this newsletter are, to the best of our ability and knowledge, accurate as of the date they were originally made. But due to various factors, including changing market conditions and/or applicable laws, the content may in the future no longer be reflective of current opinions or positions.

Any forward-looking statements, information, and opinions including descriptions of anticipated market changes and expectations of future activity contained in this newsletter are based upon reasonable estimates and assumptions. However, they are inherently uncertain, and actual events or results may differ materially from those reflected in the newsletter.

Nothing in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice. Please remember to contact Signet Financial Management, LLC, if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and/or services. No portion of the newsletter content should be construed as legal, tax, or accounting advice.

A copy of Signet Financial Management, LLC’s current written disclosure statements discussing our advisory services, fees, investment advisory personnel, and operations are available upon request.