Inflation

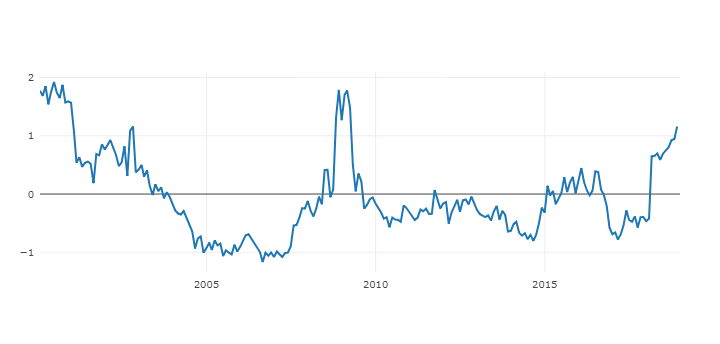

The case for inflationary pressure continues to build in the US. The Consumer Price Index (CPI) jumped 0.6% in January, which is the largest increase in almost 4 years, according to JP Morgan. We are careful not to read too much into the recent strength in inflation numbers, however. Inflation is still low, relative to history, and markets seem to welcome the prospect of rising inflation. Worries about global deflation are receding, in our view. Beyond the near-term we see a stronger case for inflation upside, and believe that core inflation will reach and eventually exceed the Federal Reserve’s 2% target.

Fed

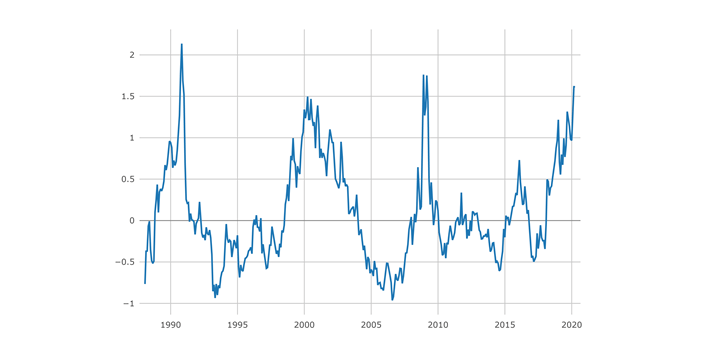

The market may not expect a rate in hike in March. If three rate hikes in 2017 are still on the Fed’s agenda, then the next Fed meeting in May seems a likely time to see action from our central bank. The final rate decision will be mostly formed by Friday March 10. The labor market report comes out just before, and the inflation reports that come out during the 2-day FOMC meeting. Should the US Federal Reserve (Fed) continue to raise interest rates, we believe it is important to focus on the pace at which rates rise, how much the central bank will raise each time, and when it will stop. We expect any rate hikes from here to be gradual. Furthermore, our research suggests the yield curve is likely to flatten over the course of the rate hike cycle, with shorter-maturity bonds rising more than yields on longer bonds.

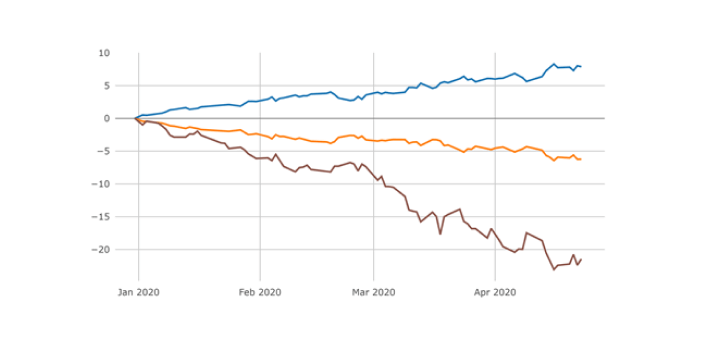

Equities

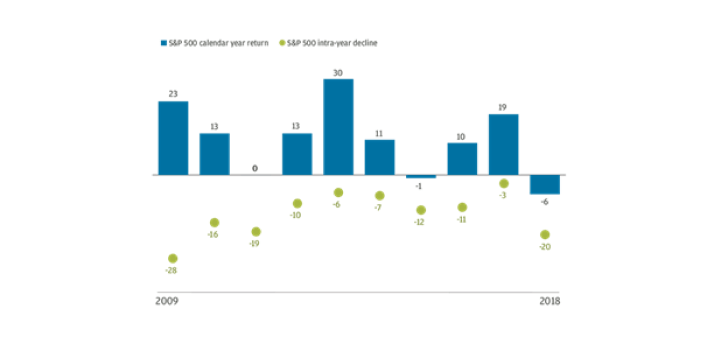

Strong Q4 2016 Earnings: According to JP Morgan, 87% of companies have already reported in the US. 74% of S&P500 companies beat earnings (EPS) estimates and are surprising positively by 2%. EPS growth prints at +5% year-over-year for the overall market, and is positive for 9 of the 11 sectors. Revenue growth rose +5% year-over-year, with 54% of the companies beating estimates. Foreign developed markets regions have also delivered positive EPS growth in Q4, which hasn’t occurred since Q2-2015. The earnings recovery looks particularly strong in Europe and Japan, with double digit growth. Sales growth is positive in Europe and the US, but negative in Japan.

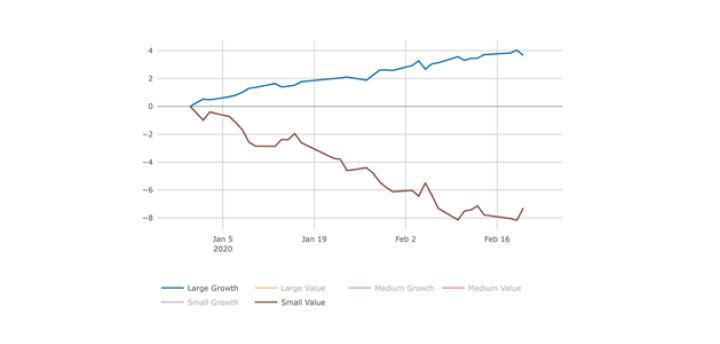

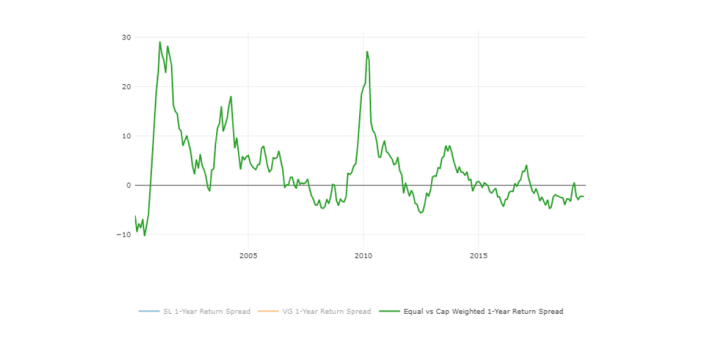

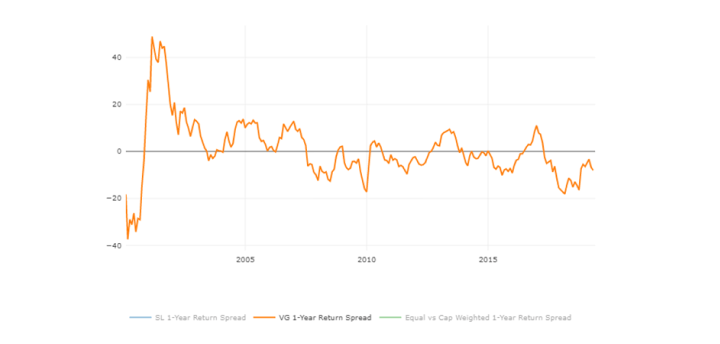

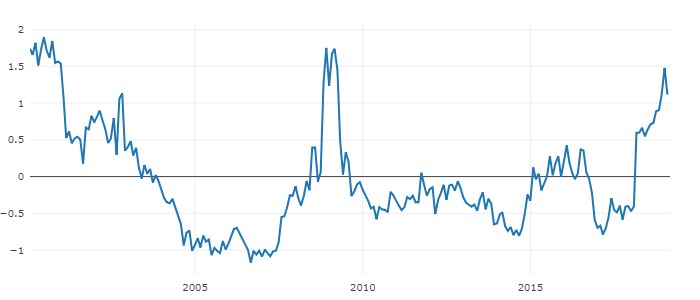

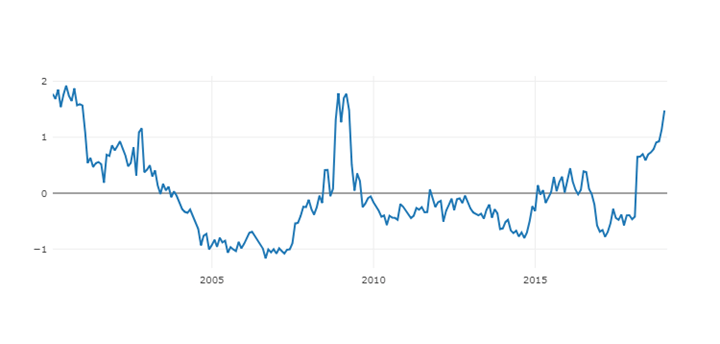

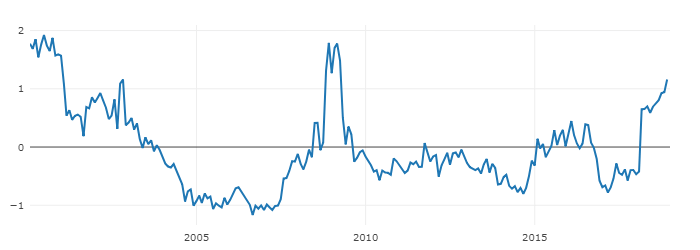

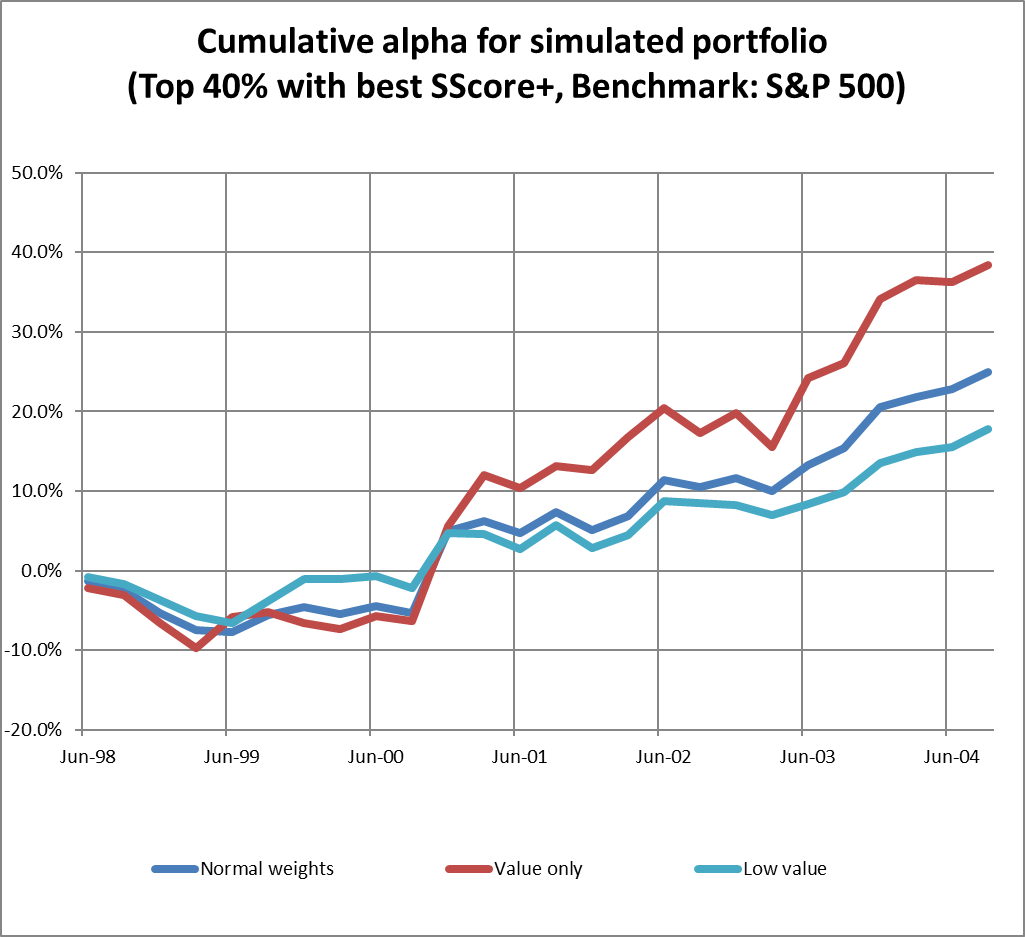

GARP looks attractive: The outlook for value investing is now less appealing than a year ago. That’s reflected in equity valuation spreads that have come down by two standard deviations and now sit somewhere between 1/3 to 1/2 deviation below their long-term average, according to Empirical Research Partners. With the opportunity set for value investing looking less potent than it did a year ago, we’re finding opportunity in our default strategy: growth-at-a-reasonable-price. We remain optimistic that stocks scoring well in our quantitative framework and analysis have potential to reward patient investors.

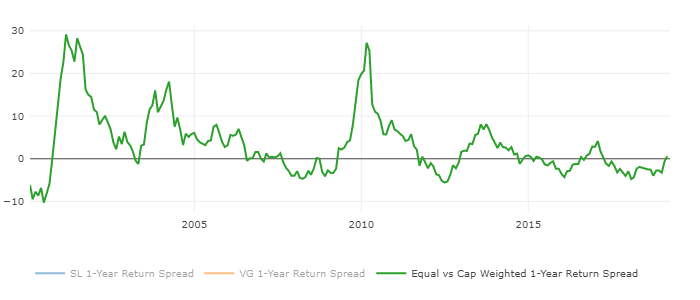

Stock picking is important: We expect S&P 500 stock return dispersion will rise in 2017. Return dispersion has risen post-election while index-level volatility has collapsed and average stock correlation has plunged to near historical lows. We expect elevated economic policy uncertainty under the Trump Administration will create “winners” and “losers” and stock performance increasingly will be driven by idiosyncratic factors, such as sensitivity to wage inflation, margin pressures, and uses of cash. Higher return dispersion will provide a wider stock-picking opportunity set for fund managers. After years of flows into passively managed funds, a high return dispersion environment will benefit skillful stock-pickers, in our opinion.

Fixed Income

Floating rate securities provide yield with less duration: While bond yields have risen over the last 9 months, we remain in a low yield environment, with the 10-year Treasury bond yielding less than 2.5% currently. Floating rate bank loans offer higher yields, but with much less interest-rate sensitivity than traditional bonds. Of course, there are credit risks to investing in bank loans. Since loans provide exposure to below investment grade credit, a sharp economic downturn could trigger negative performance for bank loans. In such an environment, high quality investment grade bonds would tend to do better. This negative correlation is why these asset classes work well together in a portfolio. We believe a long-term allocation to bank loans is prudent for income investors.

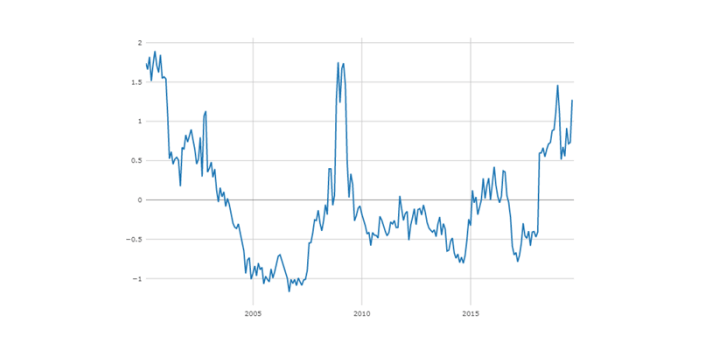

TIPS provide inflation hedge: Given current valuations and the increased possibility of higher inflation, we believe including Treasury Inflation Protected Securities (TIPS) in a portfolio makes sense. We feel inflation-hedging assets, like TIPS, are attractive tools to improve portfolio construction in this environment.