US Economics

The overall picture in the US is bright. We see better unemployment trends, strength in manufacturing and non-manufacturing, and notable improvement on the trade front, as exports are rising. With modest increases in consumer prices we expect the Fed to keep raising interest rates but staying less hawkish, since there is a probability of derailing the economy from its path higher if monetary tightening is too strong. The Fed indicated we could see two additional increases this year—most likely in September and December. The Fed also implies that it may raise rates as many as three times in 2019, as it strives for a more normalized rate structure after a decade of unprecedented monetary easing. Overall, we expect the economy to keep up with the recent pace of growth in the second half of the year.

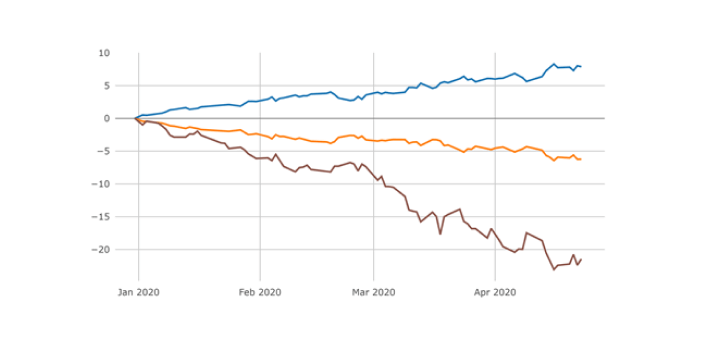

Global Economy

Incoming reports reinforce the message that global growth is accelerating this quarter amid widening regional divergences. The global economy is indeed lifting, but almost entirely due to the US. Europe has yet to rebound, China’s recent PMI and investment data are conflicting (perhaps due to slowing credit) and several EMs like Brazil, Argentina and Turkey are slowing down.

While US GDP is poised to advance at a 4% annual rate this quarter, disappointing Euro area and China releases point to downside risks in their economies with no help from Emerging economies. Per JP Morgan, the balance of data is still positive for 2Q18. Their economists don’t judge these regional divergences to be intrinsic or material enough to create a feedback loop that threatens the global expansion. JP Morgan’s global GDP growth forecast moved up to 3.6% this month.

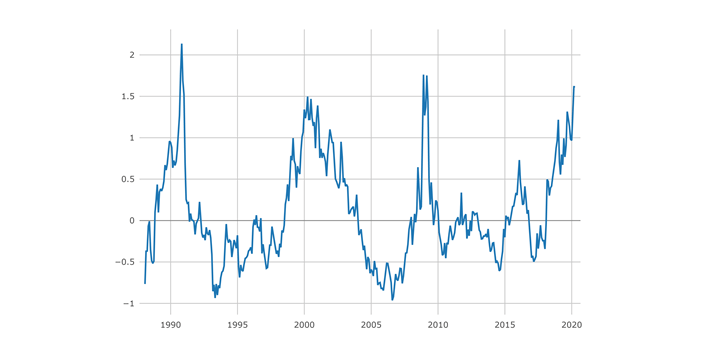

Earnings and Multiples

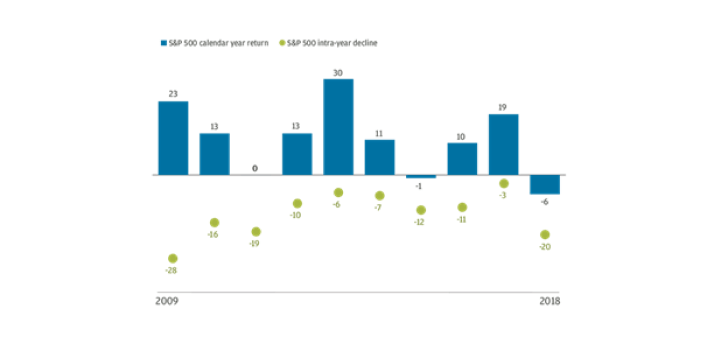

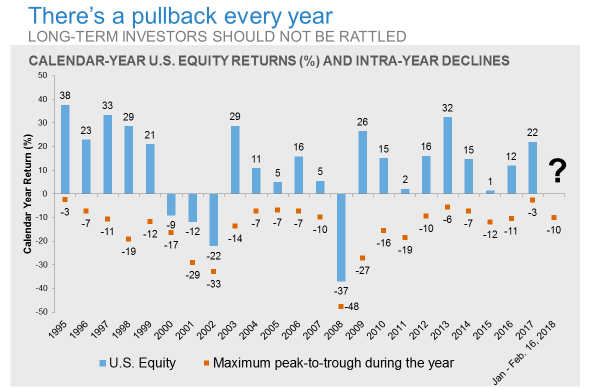

The US economy is growing and corporate profits are rising, which should support higher stock prices through 2019. However, the appreciation potential will be constrained by tightening monetary policy, a flattening yield curve, rising trade tensions, and the upcoming mid-term Congressional elections. Economic growth, oil prices, and tax rates have been better than expected in 2018. Per Goldman Sachs, EPS consensus growth rate is 21% in 2018, 10% in 2019, and 9% in 2020. Valuation compression generally occurs when earnings growth exceeds share price gains. An environment of decelerating economic growth, a tightening Fed, a flattening yield curve, and political uncertainty is consistent with a P/E multiple that will end 2018 at 16.8x, unchanged versus today but 10% below its January peak.

JP Morgan’s global strategists believe that earnings remain a tailwind for stocks. They highlight that, after stalling in Q1, global growth is delivering above potential and operating leverage remains positive. They think the consensus EPS growth expectations for this year of 10-12%, ex US tax cut impact, is likely to be met or surpassed. Wage growth could eat into margins but strong sales growth should offset any negative impact on the bottom-line. There is more potential for US earnings upside, as US earnings typically tend to significantly overshoot the trend line – they are currently exactly at trendline now.

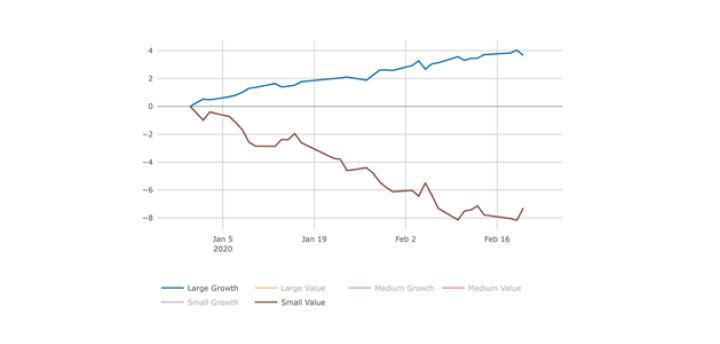

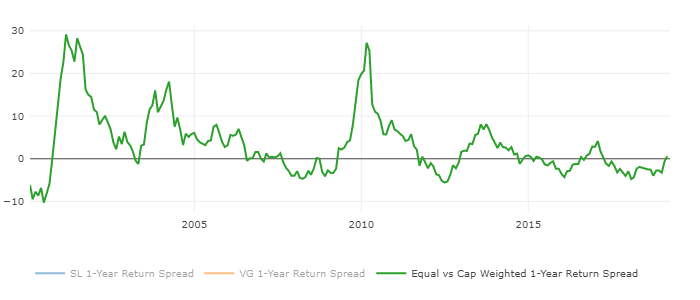

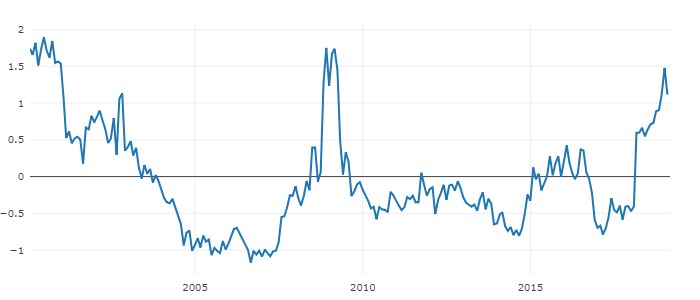

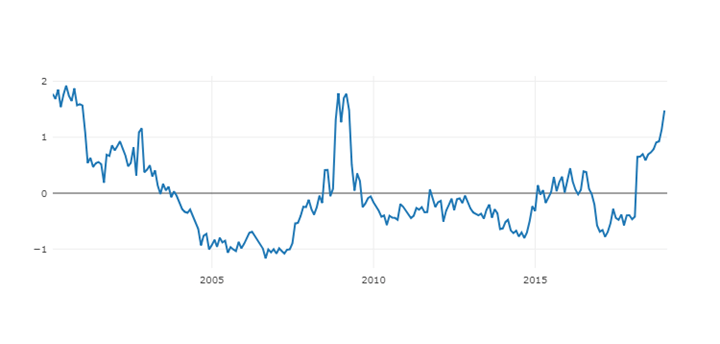

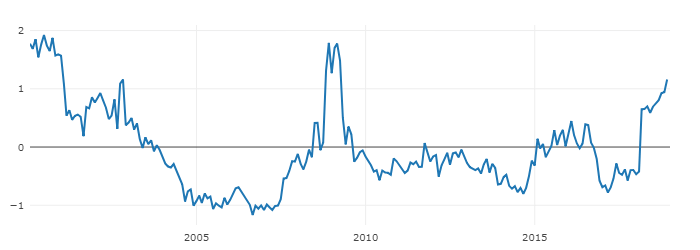

Fundamentals and 2Q Performance

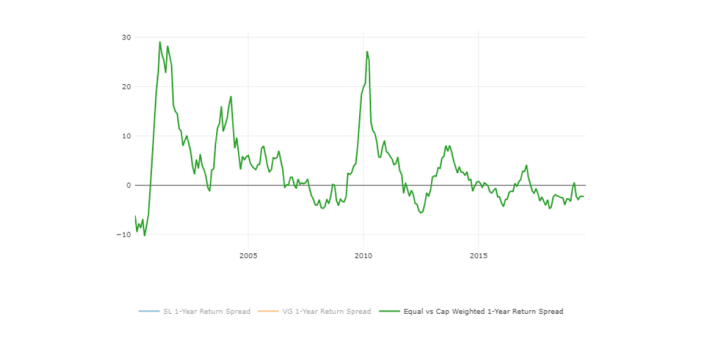

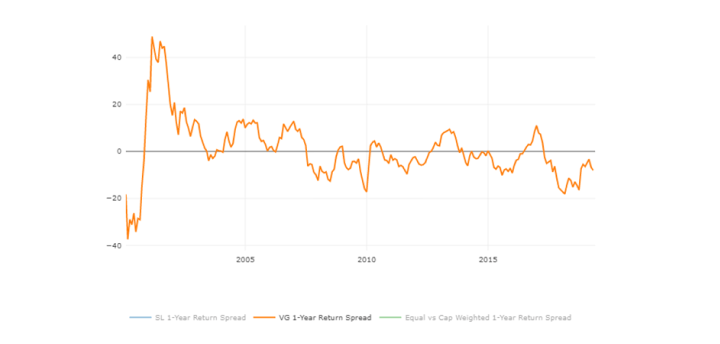

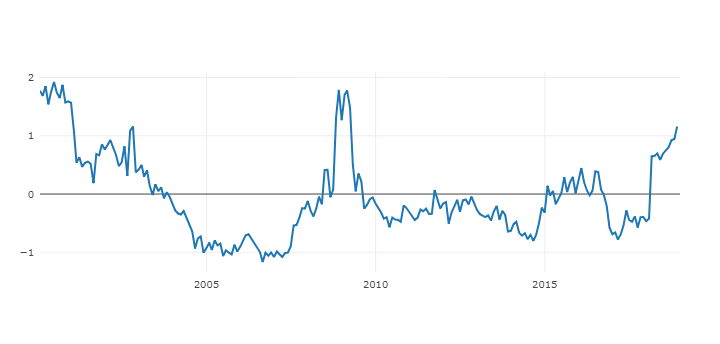

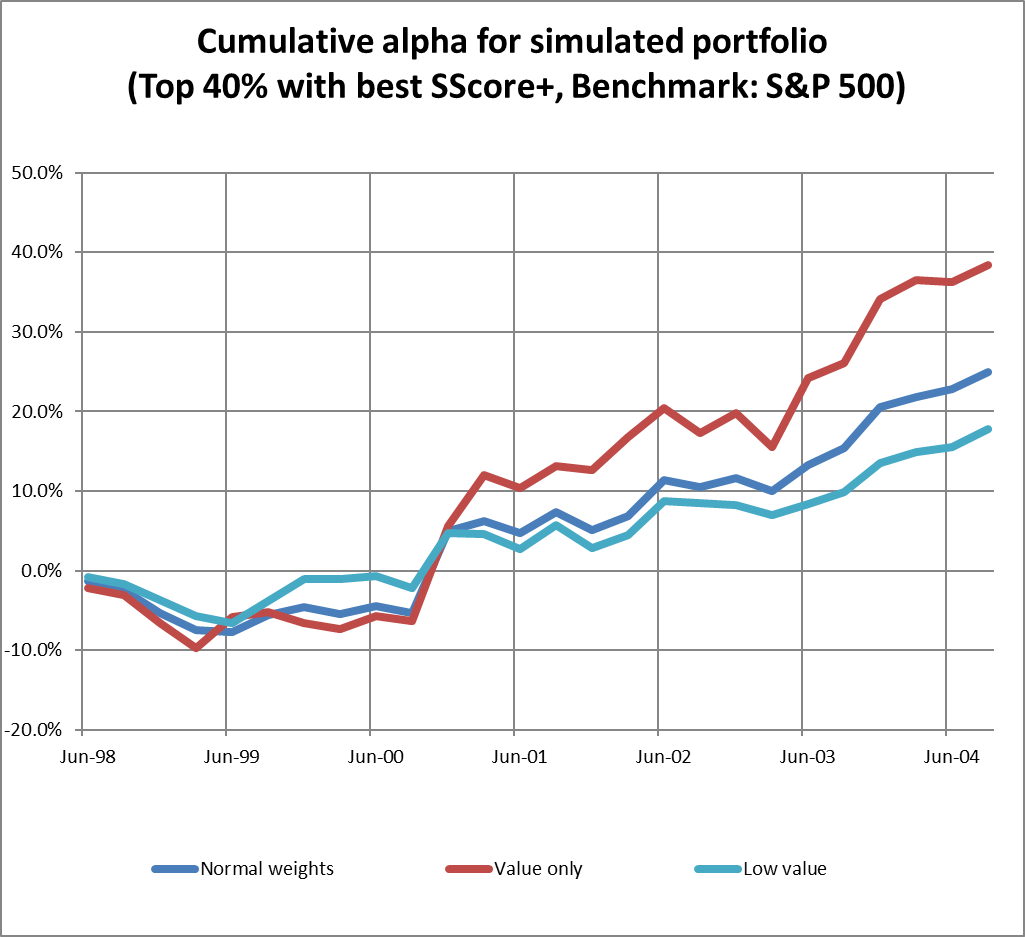

Factor performance in 2Q18 was dominated by stocks with Safety and Momentum characteristics. Valuation, Growth and Profitability lagged. In such an environment, our fundamental scores can get inverted, with weaker fundamental characteristics outperforming. We saw this trend slow in May and June. Such flip flops are usually short-lived. We expect the market to favor companies with good valuation and descent growth characteristics, or Growth-at-a-Reasonable-Price (GARP), over the longer-term

Our Macro forecast shows reviving Consumer Discretionary on the horizon and stabilizing Technology – both are encouraging signs for this long economic cycle.