Should you be worried about rising prices? Maybe concerns about inflation are overblown. How can you position your portfolio for financial success regardless of how much prices rise?

Overview

- Surging US consumer prices have led to concerns about inflation.

- We believe that inflation reflects a rebounding economy and will cool off over the long term.

- Yet there is a risk that inflation could surprise markets to the upside in the near term.

- Inflation-hedging assets such as stocks, inflation-linked bonds, and commodities tend to benefit from inflation.

- For investors that wish to hedge against inflation risk, we encourage a portfolio approach that combines multiple asset classes and strategies.

Inflation worries grow as the economy reopens

As the economy reopens and folks return to their traditional spending habits, price increases should not be a surprise. Nonetheless, surging energy, housing, and food costs have propelled inflation to an annual rate above 5%, per the Bureau of Labor Statistics. This is more than most expected and does have some investors worried that the rise will persist or continue higher.

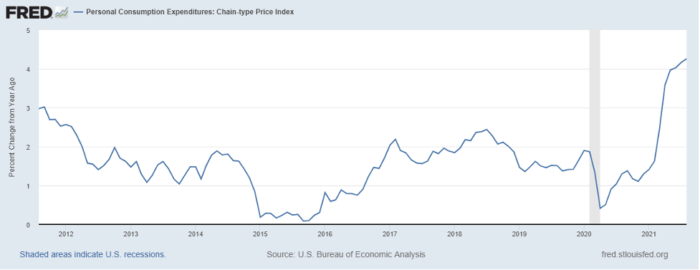

The chart below shows that a key measure of inflation has spiked higher since last year.

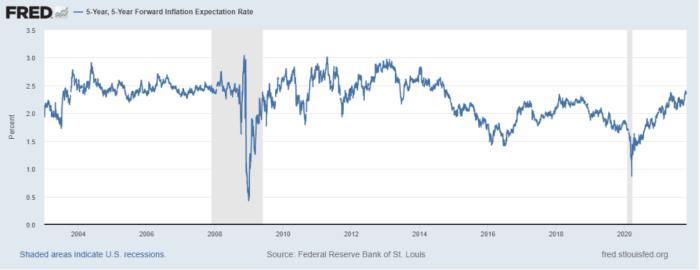

Yet, relative to history (see the chart below), the expectations are moderate, and certainly do not indicate hyperinflation is imminent.

What is inflation?

Inflation is a sustained rise in the overall prices of goods and services. Moderate inflation is associated with economic growth, while high inflation can signal an overheated economy.

How will inflation impact investors?

Inflation poses a “stealth” threat to investors, particularly retirees because it chips away at real savings and investment returns.

Most economists believe that recent inflation readings will cool as supply issues are resolved and year-earlier comparisons to the pandemic fade out. The Federal Reserve Board has said rising prices are “transitory” as a result of the pandemic. Yet, Fed Chairman Powell recently acknowledged they may last longer than originally thought.

While we do not believe that rampant inflation is imminent or likely, it is possible. Here are our expectations for major assets classes during periods of higher inflation.

- Stocks

Inflation is associated with economic growth, and stocks tend to fare well during periods of growth. The risk of a protracted negative impact of inflation on the stock market is not large, in our opinion. But stocks, in general, may not welcome high inflation. Not all stocks are the same. Certain sectors and stock factors should benefit from inflation. We believe cyclicals, financials, materials, energy, and value stocks are poised to benefit from rising inflation. - Fixed income

Inflation can hurt fixed income returns. Many investors own bonds for stable income. Because the rate of interest on most fixed income remains the same until maturity, the purchasing power of the interest payments declines as inflation rises. - Real assets

Three commonly used inflation-hedging assets are Treasury inflation-protected securities, commodities, and real estate. They can each benefit from inflation. We believe combining the assets in a portfolio has the potential to deliver attractive returns relative to traditional stocks and bonds.

Key takeaways

- We don’t believe inflation poses a major threat for investors now.

- No one knows for sure whether the recent price spikes will produce sustained inflation.

- Increased uncertainty about inflation highlights the importance of building a well-diversified portfolio with multiple sources of return.

- Certain investments, like commodities, inflation-protected bonds, real estate, and value stocks, historically perform well in moderate-to-high inflation regimes.

- This isn’t the 1970s. While inflation is high now, that doesn’t mean investors are in trouble.

Signet can help you invest to stay ahead of inflation

To learn how to prepare for inflation, please contact your Signet advisor, or Steve Tuttle directly at 800-390-2755 or stuttle@signetfm.com.