The stock market is a powerful tool for wealth creation. Legendary investor, Shelby Davis said, “History has shown that equities are the best way to build long-term wealth.” We agree and believe that investing in stocks can help you achieve your goals.

We also know that returns from investing in stocks can be volatile in the short run. The ups and downs of the market can be nerve-wracking, and it’s easy to get discouraged when you see your portfolio value dropping.

Here are some guidelines for navigating volatility.

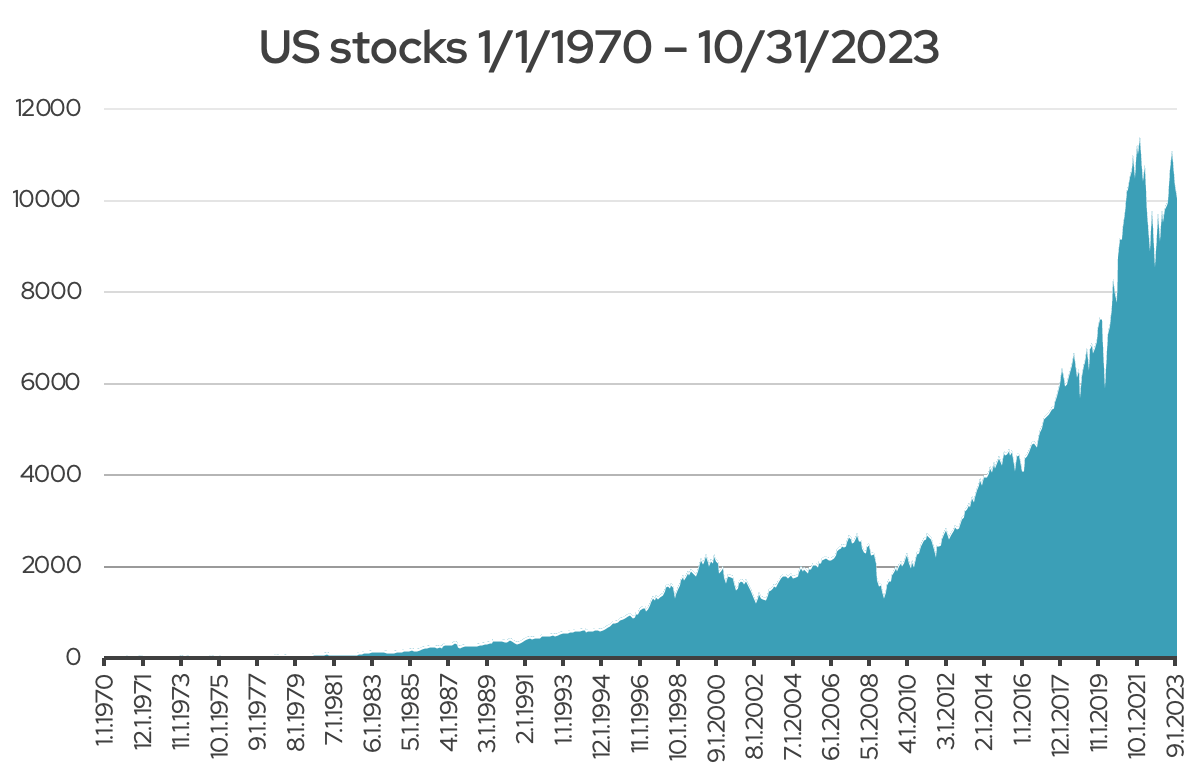

Stocks have historically gone up in the long run.

Volatility in the short term: Riding the rollercoaster

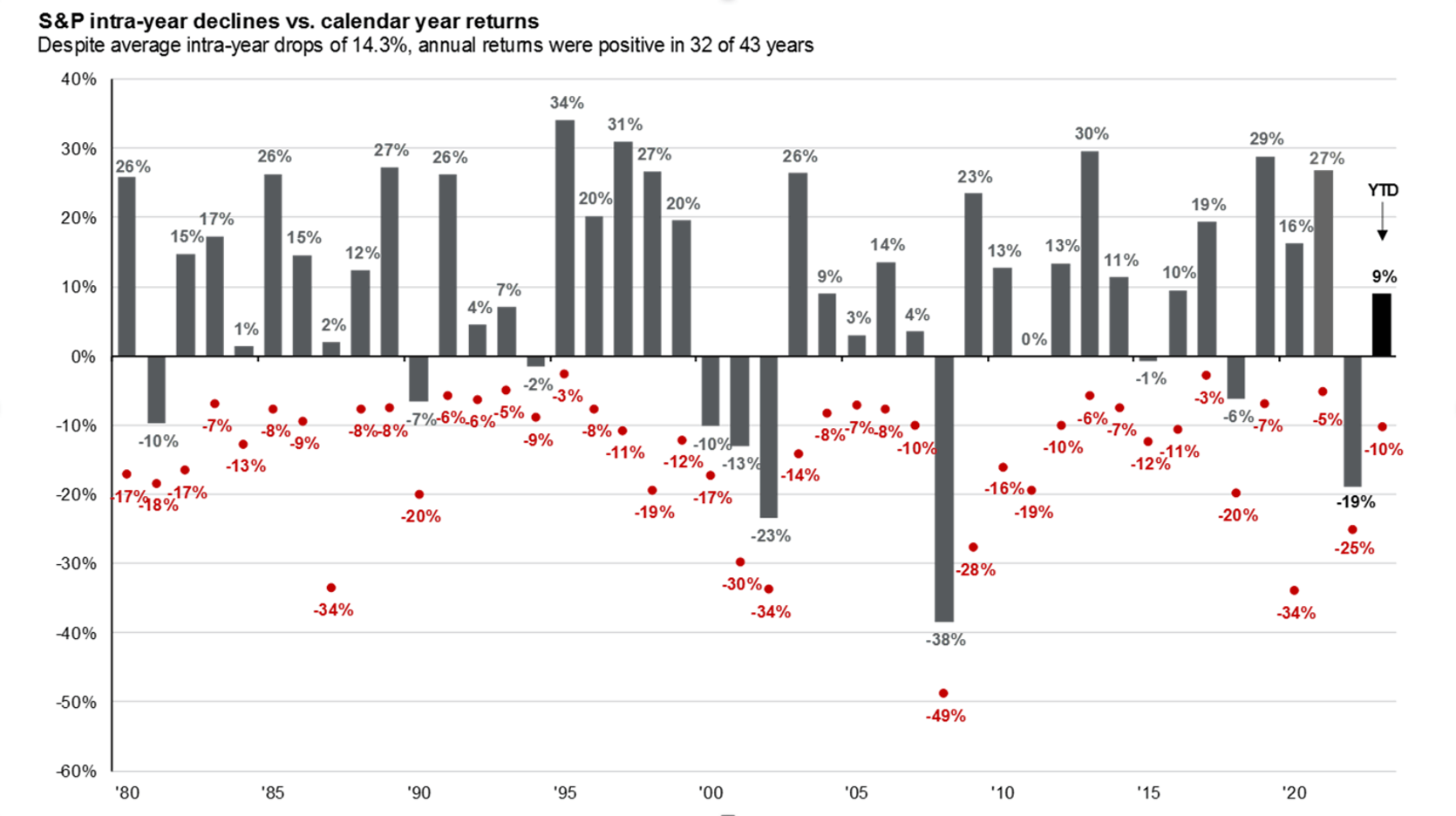

Despite their long-term upward trajectory, stocks are volatile in the short term. This means that their prices can fluctuate wildly over short periods of time. These fluctuations can be caused by a variety of factors, such as changes in the economy, interest rates, and investor sentiment.

Every year has its rough patches and while pullbacks cannot be predicted, they can be expected. Markets suffered double-digit returns in 24 of the last 43 years but ended the year with positive returns 75% of the time, per JP Morgan.

While volatility can be unsettling, it’s important to remember that it’s a normal part of the stock market. Trying to time the market is a recipe for disaster, as it’s impossible to predict when prices will go up or down. Instead, it’s better to focus on the long term and stay invested through the ups and downs.

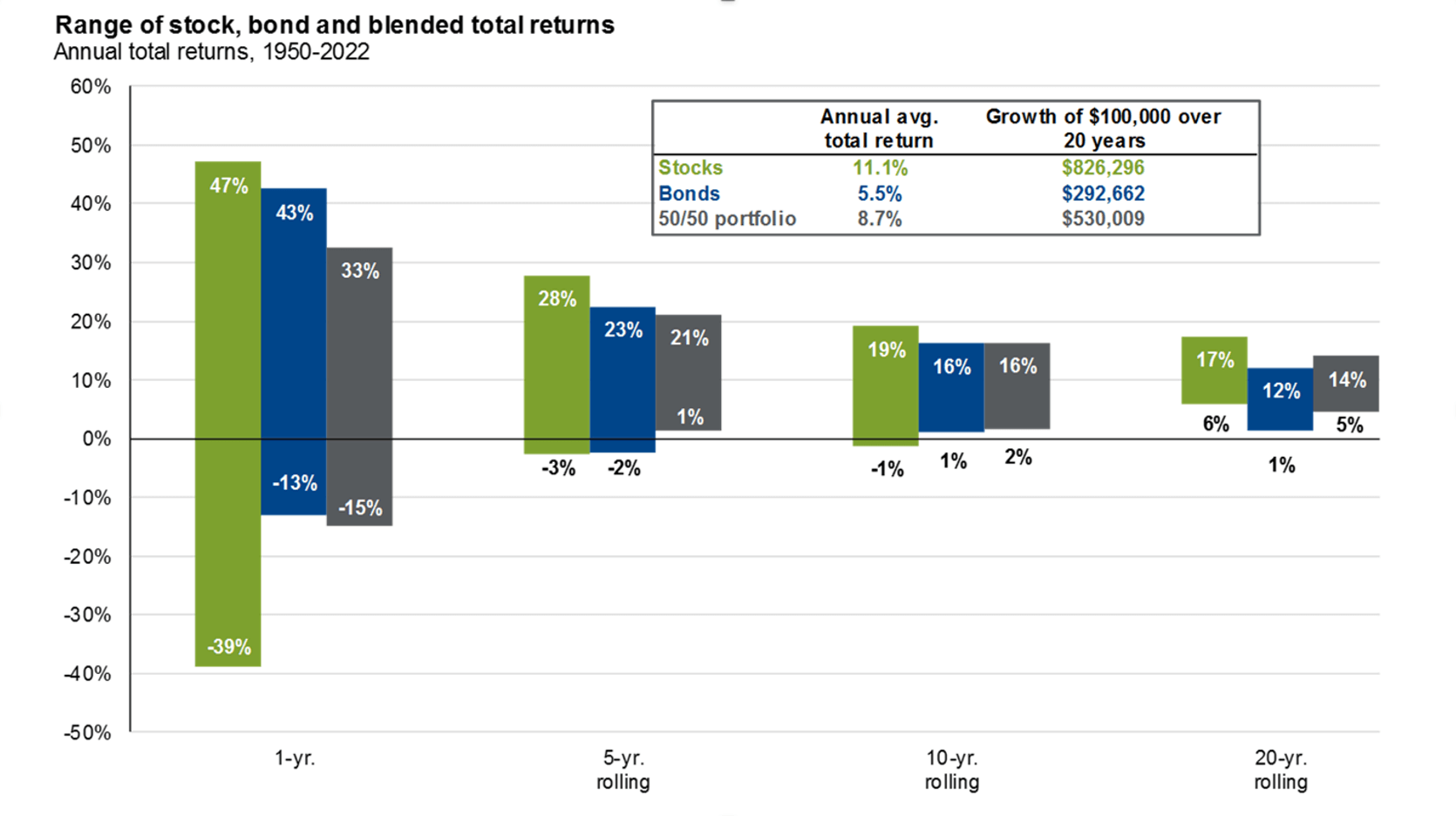

Staying invested for the long haul: The power of time

The longer you stay invested in the stock market, the greater your chances of success. This is because time allows you to ride out the short-term volatility and benefit from the long-term growth of the market.

For example, if you invested $1,000 in the S&P 500 index in 1970, it would be worth over $28,000 today, even after factoring in inflation. This is a return of over 11% per year.

Of course, there will be years when the market goes down. But over the long term, the market has always gone up. So, if you can stay invested for 10, 20, or even 30 years, you’re very likely to see your portfolio grow significantly.

Adding bonds for smoother sailing

While stocks offer the potential for high returns, they also come with the highest level of risk. If you’re looking for a way to reduce the volatility of your portfolio, you can add bonds.

Bonds are loans that you make to companies or governments. In return for your loan, you’ll receive interest payments. Bonds are generally considered to be less risky than stocks, as they are more likely to pay back your principal.

By adding bonds to your portfolio, you can smooth out the volatility and reduce your overall risk. However, it’s important to note that bonds also have lower potential returns than stocks.

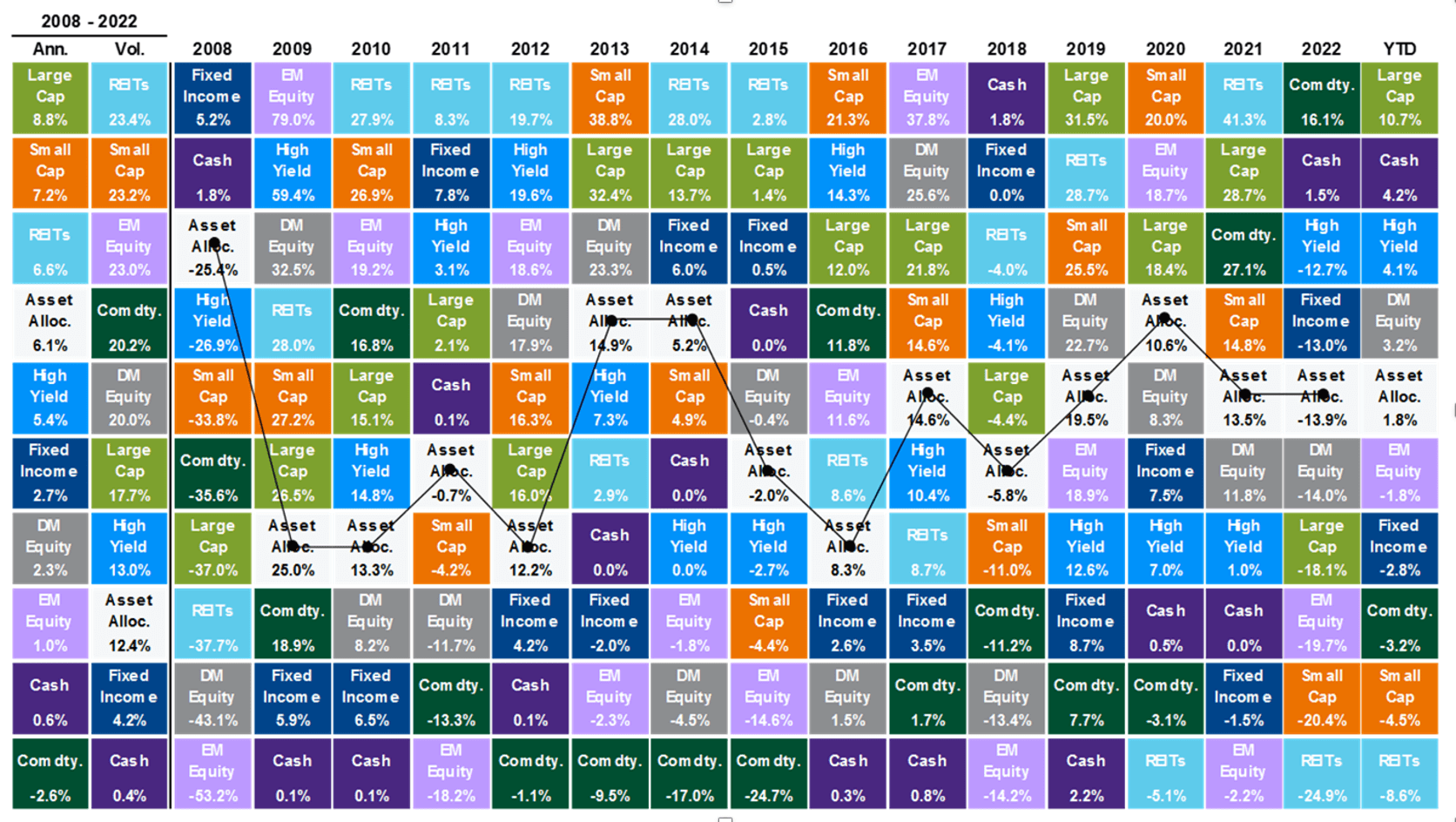

Diversifying your portfolio with other asset classes

The last 15 years have provided a volatile and tumultuous ride for investors, with multiple natural disasters, numerous geopolitical conflicts, a global pandemic and two major market downturns.

Yet, despite these difficulties, cash was among the worst performing asst classes over this time. A well-diversified portfolio of stocks, bonds, and other assets classes returned roughly 6% per year (and over 150% on a cumulative total return basis).

The specific asset allocation that’s right for you will depend on your individual circumstances, such as your age, risk tolerance, and investment goals. It’s always a good idea to talk to a financial advisor to develop an investment plan that’s right for you.

Conclusion: The path to long-term success

Investing in the stock market can be a great way to build wealth over the long term. However, it’s important to remember that stocks are volatile in the short term. By staying invested for longer periods of time, adding bonds and other asset classes to your portfolio, and diversifying your investments, you can reduce your risk and increase your chances of success.

About Signet Financial Management

Signet Financial Management is a wealth management firm that takes a personal approach in helping high-net worth families, individuals, and business owners navigate the complexities of managing money. We believe in your financial well-being, and custom tailor solutions using sophisticated investment management tools to help you keep more of what you earn and to reach your financial goals.

Founded in 1988, we manage approximately $840 million in assets with offices in Parsippany, NJ; Sterling, VA; Miami, FL; and Naples FL.

For more information, please contact Steve Tuttle directly at +1 800-390-2755 or stuttle@signetfm.com.

IMPORTANT DISCLOSURE

This is a publication of Signet Financial Management, LLC.

The information presented is believed to be factual, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or position. Information in this presentation does not involve the rendering of personalized investment advice. It is limited to the dissemination of general information on products and services. A professional adviser should be consulted before implementing any of the options presented.

Information in this presentation is not an offer to buy or sell, or a solicitation of an offer to buy or sell the securities mentioned herein. Information on this presentation is directed toward U.S. residents only. Signet only transacts business in states where it may legally do so.

Signet is registered as an investment adviser with the Securities and Exchange Commission. SEC registration does not constitute an endorsement of the firm by the Commission, nor does it indicate that Signet has attained a particular level of skill or ability. A copy of the Signet current written disclosure statements discussing our advisory services and fees is available upon request.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Signet) or any non-investment related content, made reference to directly or indirectly on this website, will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Moreover, you should not assume that any discussion or information contained in this presentation serves as the receipt of, or as a substitute for, personalized investment advice from Signet.