The bond market presents better opportunities to generate income than we’ve seen in years. This year’s bond market volatility has led to higher yields and a flatter yield curve, which creates a compelling case for shorter-maturity bonds in your portfolio.

This year is well on its way to being the worst in modern history for bond investors. But there is a significant silver lining:

There is finally some income to be earned in the fixed-income market

Bond prices and yields move in opposite directions. And in 2022, there has been a decline in prices across the entire market. That led to a huge rise in bond yields.

A rapid move higher in 2-year Treasury yield

After more than a decade of low yields, the Federal Reserve is hiking interest rates in response to multi-decade-high inflation.

Bond yields have abruptly shifted higher since last fall. Just a year ago, a U.S. Treasury 2-year note was yielding a measly 0.2%, while 10-year Treasury notes were around 1.3%. Today, U.S. Treasury 2-year notes earn 4.28%

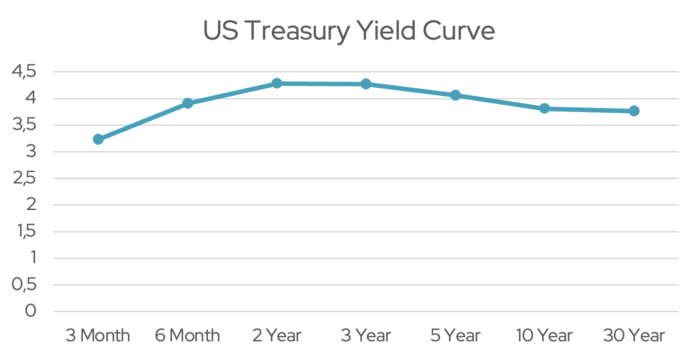

A flatter yield curve should benefit short-term bonds

The repricing of yields has led to a significantly flatter yield curve. A yield curve is a collection of yields for bonds of different maturity dates. Today, investors can receive nearly the same or higher yield in short-term bonds as they would from longer-maturity credits. The chart below shows that 2-year and 3-year Treasuries currently yield more than 10-year and 30-year maturities, and 6-month notes yield roughly the same as maturities over 10 years.

Higher yields and a flatter yield curve mean an investor doesn’t need to take a substantial risk or sacrifice liquidity to receive attractive income over the next few years.

Expect a bumpy ride

The caveat for investors is that if inflation remains stubbornly high, the Fed may continue to raise interest rates even higher than is currently expected. That in turn could cause further price declines for bond investors in the near term. However, if the objective is income and you hold a bond to maturity, temporary price fluctuations should not matter much.

What about cash?

It can be tempting to move to the sidelines by sitting in cash, but bond yields are higher now. While we believe it is prudent to be cautious today, investors have opportunities to earn better yields on their cash reserves.

Are bonds a good buy now?

With yields near 15-year highs, we believe short-term bonds offer attractive income solutions. The combination of increased yields and lower interest rate risk in short-term bonds may provide a buffer against further bond market volatility.

If you’re looking to put money to work, but are leery about market volatility, consider diversified fixed-income solutions with less than two years of duration. We believe short-term, high-quality bonds can provide flexibility, stability, and liquidity to your investment portfolio.

Let Signet help you construct a fixed-income solution to meet your financial needs. To learn more about opportunities in short-term bonds, contact your Signet financial advisor, or Steve Tuttle directly at +1 800-390-2755 or stuttle@signetfm.com.