US economics and geopolitics

Strong economic growth accompanied by very hot inflation readings, made the Fed’s monetary tightening certain; these readings included the January Consumer and Producer Price Indexes. The magnitude of any interest rate hikes matters to the market a lot, the uncertainty has largely contributed to recent volatility. The geopolitical situation with Russia and Ukraine is pushing oil prices up, which could impact inflation and spur the Fed to act more swiftly. However, historically, these geopolitical events do not matter much for equities.

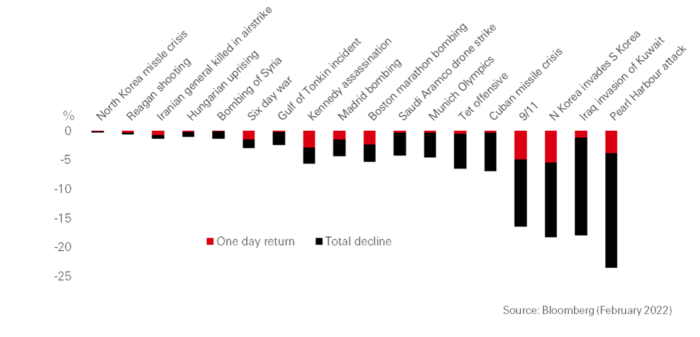

Consider the S&P 500, as it tends to lead the way. According to HSBC, there have been 18 events over the past 80 years that have resulted in the index selling-off, from full-scale wars and invasions to shootings and one-off terrorist bombings. On average, US shares dropped 1.5 percent on the day of the event itself, then took 15 more sessions to decline 5.4 percent in total, before returning to the black after 35 days. Included in these events are Pearl Harbor and Iraq’s invasion of Kuwait, stocks declined substantially.

Geopolitical events and S&P500 returns

Global economics and Omicron

While the Omicron wave has peaked and is now fading in the US and Europe, it is still surging across Asia. So far, the damage to regional supply chains from the variant is limited. Building drags from Omicron and the purchasing power squeeze from high inflation have pushed JP Morgan’s current-quarter global growth forecasts sharply lower, to a trend of a 2.5% increase from a year ago. However, they expect that current-quarter drags will prove to be short-lived and forecast that global GDP re-accelerates to 4.2% and the US GDP to a 3.6% growth rate for 2022.

Stock market and portfolio management

Earnings

With 82% of the S&P 500 market cap reported, 4Q 2021 EPS appears to have grown by 26% vs. 4Q 2020 according to Goldman Sachs (GS). Consensus expectations were for 20% growth at the start of the reporting season. Consensus estimates show year/year EPS growth slowing to a single-digit pace in early 2022. For full-year 2022, consensus expects S&P 500 EPS of $226, representing 8% annual growth. One concern investors had over higher inflation is about the resilience of corporate profit margins. So far, according to Empirical Research, 60-70% of companies noted in their quarterly reports that they could pass the higher input prices on to the consumer. GS revised the year-end S&P 500 target from 5100 to 4900 but did so by lowering the earnings multiple, leaving the earnings projection intact.

Interest rate hikes and investment regime

With inflation intensifying and reaching 7.5% in January 2022 over the last 12 months, the Fed is expected to start raising interest rates as soon as March. Many participants project up to 7 raises this year and should that happen a much flatter yield curve will result at the end of 2022 and into 2023. The long-term rates usually don’t go up as much as short-term ones when the Fed raises rates, additionally, the economy keeps growing but at a slower pace.

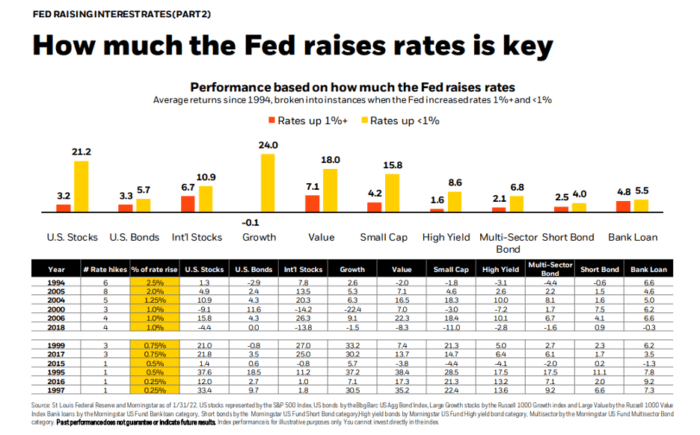

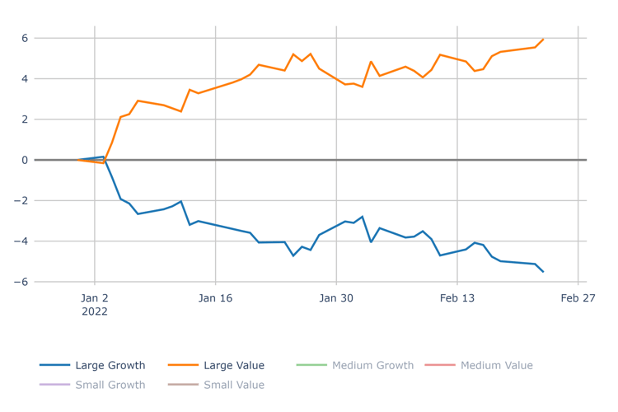

The magnitude of the Fed’s raising of interest rates hikes matters the most. According to BlackRock’s historical analysis, if the Fed raises rates above 1% that also benefits Value and Small Cap over their Large Cap Growth counterparts (see Fed Raising Rate Illustration below). Our proprietary Valuation Spread calculation still suggests that Value can outperform (see Valuation Spreads and Large Growth vs. Value Graphs in Appendix 1). More importantly, looking at our Macro Score 1Yr composition, we see that Profitability takes the center stage in our multi-factor framework.

In summary, going forward we see that Profitability and Valuation characteristics should matter much more than in recent memory; that being said, in an economy that grows slower, Growth will become more and more scarce, so we shouldn’t give up on Growth altogether. All things considered, our multi-factor framework (which considers all fundamental characteristics simultaneously) should become even more effective as we progress into 2022.

Sectors, size, and style posture

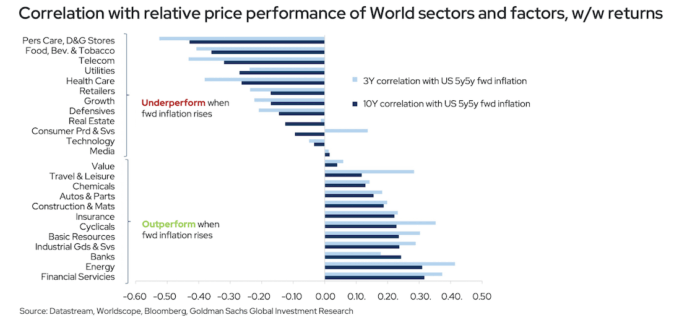

In this environment of high inflation, increasing rates, tight job market, and still growing economy, Value and cyclical usually do better according to history analyzed by GS:

Rises in inflation expectations tend to be more supportive of cyclical assets relative to deep value

Stock market

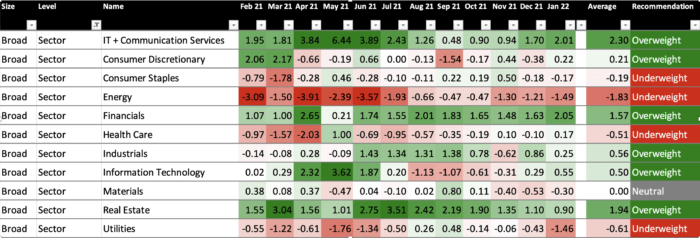

In our actively managed portfolios, we keep our barbell approach (a balanced Value-Growth posture, although we narrow it down a bit by over-emphasizing more profitable companies). On one hand, it makes sense to keep exposure to Large Growers of GARP nature (IT, Communications, some Discretionary), the part of Large Growers cohort outperforming their expensive peers in the rising interest rate environment. On the other hand, since we are still in the expansion of the economic business cycle, we find cyclicals like Consumer Discretionary, Financials, Industrials, and REITs attractive, especially with a lot of them (Financials, Energy, and Materials) providing a natural hedge against inflation and rising interest rates. REITs should benefit from the pent-up demand for housing despite rising mortgage rates, which are still historically low. We stay less attracted to Consumer Staples and Utilities.

We keep adequate Large/Mid/Small cap exposure in the portfolios with emphasizing Mid-Caps in this economic expansion.

Signet Sector Macro and Micro Blended Forecast

Appendix 1

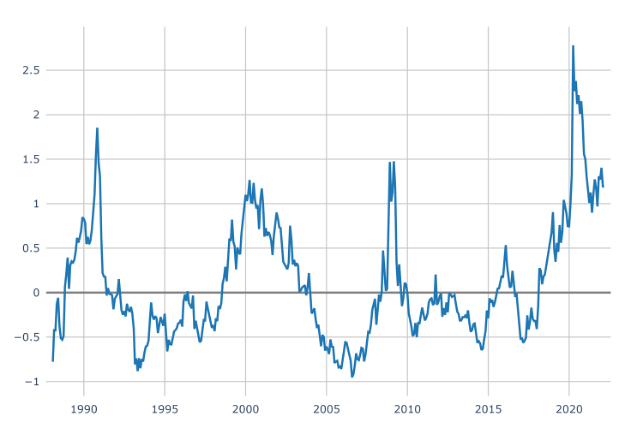

Valuation Spread through January 2022

Source — Signet FM

Large Growth and Value SP Indexes Alpha 2022 YTD (as of 02/23/2022)

Source — Signet FM

The information and opinions included in this document are for background purposes only, are not intended to be full or complete, and should not be viewed as an indication of future results. The information sources used in this letter are WSJ.com, Jeremy Siegel, Ph.D. (Jeremysiegel.com), Goldman Sachs, JP Morgan, Empirical Research Partners, Value Line, BlackRock, Ned Davis Research, First Trust, Citi research, and Nuveen.

IMPORTANT DISCLOSURE

Past performance may not be indicative of future results.

Different types of investments and investment strategies involve varying degrees of risk, and there can be no assurance that their future performance will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

The statements made in this newsletter are, to the best of our ability and knowledge, accurate as of the date they were originally made. But due to various factors, including changing market conditions and/or applicable laws, the content may in the future no longer be reflective of current opinions or positions.

Any forward-looking statements, information, and opinions including descriptions of anticipated market changes and expectations of future activity contained in this newsletter are based upon reasonable estimates and assumptions. However, they are inherently uncertain, and actual events or results may differ materially from those reflected in the newsletter.

Nothing in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice. Please remember to contact Signet Financial Management, LLC, if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and/or services. No portion of the newsletter content should be construed as legal, tax, or accounting advice.

A copy of Signet Financial Management, LLC’s current written disclosure statements discussing our advisory services, fees, investment advisory personnel, and operations are available upon request.