US economics and COVID

The US economy went through a roaring growth spell in the first half of 2021 and finds itself somewhere in between recovery and expansion. We expect a further advance to be just a bit slower with unavoidable, temporary hiccups. On one hand, employment, industrial production, and factory usage are all strengthening. On the other hand, the impact of the Delta variant on growth and inflation could be somewhat larger than initially expected. Goldman Sachs has lowered their Q3 GDP forecast to +5.5%, reflecting hits to both consumer spending and production. Spending on dining, travel and some other services is likely to decline in August, though they expect the drop to be modest and brief. Production is still restrained due to supply chain disruptions, especially in the auto industry, which could cause more inventory shortages and elevated inflation in Q3.

On the inflation front, the good news is that the Consumer Price Index grew at a slower pace from June to July. Nevertheless, it still increased by 5.4% on an annual basis, reaching a 13-year high. Most of the latest gains come from energy, commodities, and new cars. The Producer Price Index also showed the largest annual advance in prices in more than a decade. The Delta variant and other disruptions could cause further shortages and price increases through year-end. However, the consensus in the market is that the prices of new and used cars, consumer electronics, and other durable goods may fall next year and the PCE price index (a broader measure of inflation than CPI) may grow by a much more subdued rate of 2% in 2022.

Federal Reserve officials indicated that higher inflation is helping to achieve its 2% average target and to anchor inflation expectations near that level. This underscores a common theme throughout the world that central banks will react much more cautiously to higher inflation than they did in the past.

Global economics

Global economic growth slowed in July despite a very strong US employment report according to JP Morgan. Reported declines in the global PMI, consumer confidence, and auto sales have been followed by retail sales contractions in three large economies – the US, China, and the UK. JP Morgan’s downward revisions are concentrated in China where they now look for growth to stall this quarter.

Despite this slowdown, a global growth boom is expected in the second half of 2021. JP Morgan forecast global GDP to increase at a 6% annual rate this quarter. Moreover, they have modestly raised forecasts for the coming two quarters, looking for global GDP to expand at a roughly 5% annual rate. Services should drive global growth as consumers shift their spending preferences away from goods. This expectation is supported by the details of the US July employment and retail sales reports.

Growth-oriented macro-policy stances should elevate global growth well into 2022, assuming the Delta wave, China’s restraining economic policy, and global supply constraints prove transitory and fade after this quarter.

Stock market and portfolio management

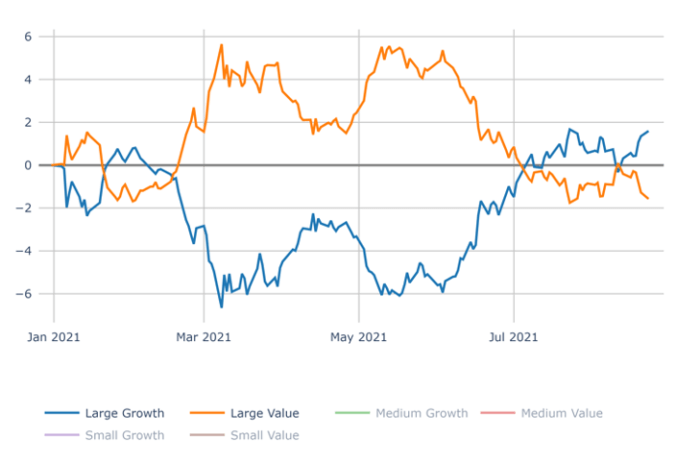

With 85% of companies beating the earnings projections in the S&P 500 and strong earnings guidance during the second-quarter earnings season, we saw the year-end stock index target revised up by many investment analysts. During the summer, Large Cap Growers (especially IT and Communications mega-caps) clawed back some of their underperformance earlier in the year (see Large Growth vs. Value chart below). Fears of the Fed potentially tapering too soon and the Delta variant spooked markets somewhat. However, with real interest rates in negative territory, higher inflation, a strong economy, and still elevated Valuation spreads, the chances of Value, cyclicals, and smaller caps outperforming over the next 12 months are substantial, in our opinion.

Large Growth vs. Value 2021 YTD (as of 08/25/2021)

Source — Signet FM

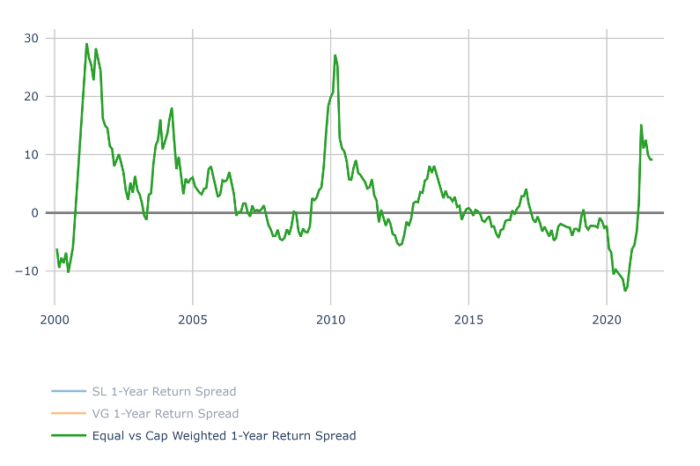

Equal vs. Market Weighted 1 Yr. Return Spread

Source — Signet FM

It makes sense to maintain exposure to Large Growers of GARP nature (from IT, Communications, some Discretionary). This part of the Large Growers cohort usually outperforms expensive peers in a rising long-term interest rate environment, and we still anticipate rates higher by the year-end. The market treats this group as a safe haven against a potential economic slowdown.

Since we are still in a recovery /expansion phase of the economic business cycle, we also find cyclicals like Consumer Discretionary, Financials, Industrials, and REITs very attractive. Many stocks in these sectors provide a natural hedge against inflation and a potential rise in interest rates.

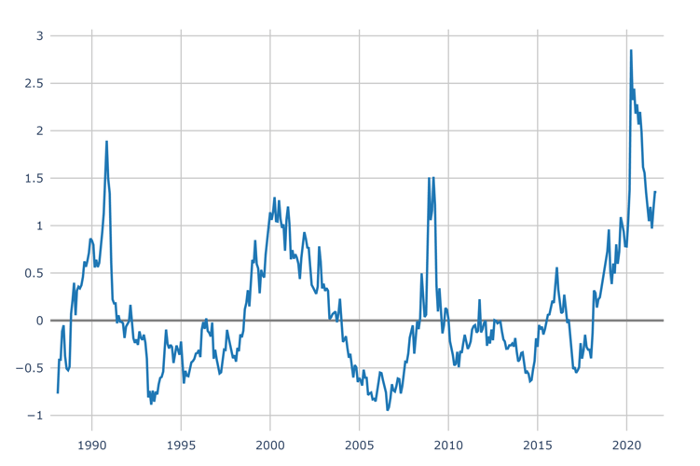

Valuation spreads (showing growth stocks are relatively more expensive than value stocks) have come down but still have room to shrink. Growth stocks, in aggregate, still seem a bit overpriced and Value is still an important consideration going forward (see Valuation Spread chart below).

Valuation spread through July 2021

Source — Signet FM

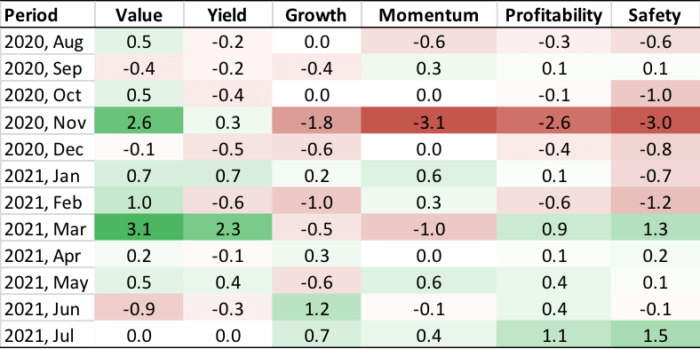

We also see an improvement in the Safety and Profitability factors (see Factor heatmap below) and believe slowly increasing exposure to Healthcare – a traditional defensive sector with good profitability makes sense. We stay less attracted to Consumer Staples and Utilities.

Factor performance (top 2 quintiles of Large Cap Universe vs. SP 500)

Source — Signet FM

We still believe that companies will be able to pass the higher input prices to end consumers. With our macro forecast favoring cyclical sectors, IT and Communications, strong corporate earnings, and an expanding economy, we stay bullish and see more room for fundamentally strong stocks to grow.

The information and opinions included in this document are for background purposes only, are not intended to be full or complete, and should not be viewed as an indication of future results. The information sources used in this letter are WSJ.com, Jeremy Siegel, Ph.D. (Jeremysiegel.com), Goldman Sachs, JP Morgan, Empirical Research Partners, Value Line, BlackRock, Ned Davis Research, First Trust, Citi research, and Nuveen.

IMPORTANT DISCLOSURE

Past performance may not be indicative of future results.

Different types of investments and investment strategies involve varying degrees of risk, and there can be no assurance that their future performance will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

The statements made in this newsletter are, to the best of our ability and knowledge, accurate as of the date they were originally made. But due to various factors, including changing market conditions and/or applicable laws, the content may in the future no longer be reflective of current opinions or positions.

Any forward-looking statements, information, and opinions including descriptions of anticipated market changes and expectations of future activity contained in this newsletter are based upon reasonable estimates and assumptions. However, they are inherently uncertain, and actual events or results may differ materially from those reflected in the newsletter.

Nothing in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice. Please remember to contact Signet Financial Management, LLC, if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and/or services. No portion of the newsletter content should be construed as legal, tax, or accounting advice.

A copy of Signet Financial Management, LLC’s current written disclosure statements discussing our advisory services, fees, investment advisory personnel, and operations are available upon request.