US economics, inflation, and the Fed

It is hard to tell whether inflation has peaked or not. Stubborn price increases have continued despite this year’s attempts by the Federal Reserve to stabilize prices, which, along with fostering full employment, is part of the central bank’s dual mandate. Both consumer and producer prices keep marching up, with respective 12-month advances of 8.3% and 8.7% in August. The most troubling sign was the 0.6% month-to-month jump in “core” consumer prices (excludes food and energy), double the consensus forecast.

The restrictive monetary policies — the Fed is both increasing rates and buying fewer Treasury bonds — are starting to take a toll on the economy according to Value Line. The Fed hopes that reducing the availability of money to borrow will make credit more expensive for consumers. In time, this should lower demand for goods and services and ultimately put downward pressure on prices. The higher borrowing costs are hurting housing demand and starting to drive down average home sale prices, which fell for the first time this year in August.

Meantime, pessimism on profits from corporate America ahead of the third-quarter earnings season suggests the U.S. economy is slowing. On point, FedEx, the freight shipping giant, whose performance is seen as a barometer of the overall health of the economy, issued a dour outlook for global shipping services, citing weakness in China and Europe, and growing concerns about the state of the U.S. consumer. This, along with the continued inversion of the Treasury market yield curve, is signifying that the economy may be headed toward a recession.

Global economy

Per J.P. Morgan, the ongoing hawkish tilt by developed markets’ (DM) central banks (outside Japan) reached a crescendo this month as outsized rate hikes were accompanied by guidance for further tightening ahead. Cumulatively, J.P. Morgan have moved up their sights for year-end DM policy rates dramatically — by more than 100bp since midyear — for the Fed (4.25%), Bank of England (3.5%), and ECB (2%).

This hawkish tilt is a response to two closely related developments. First, central banks are shifting their views on slack and salience in a manner that requires both larger and more front-loaded action. Second, their actions have yielded few results thus far. Despite sub-par GDP growth this year, DM labor markets continue to tighten with employment gains running well above pre-pandemic norms. And despite their success in anchoring medium-term expectations through the inflation surge, inflationary pressures continue to broaden with DM core inflation remaining above 5% per annum this quarter.

While J.P. Morgan remains confident that a softening in labor markets and core inflation is in the pipeline, they are becoming less confident that central banks will pause. As a result, the perception that near-term recession risks associated with supply shocks have waned is accompanied by rising concern that central banks will, by intent or by accident, engineer a recession.

As one considers the rising risk that the Fed and other central banks will engineer a recession it is important to recognize that DM central banks have not yet faced a difficult choice. This test will come when labor markets show signs of cooling well in advance of inflation returning to target. Only at this point will it be possible to gauge central banker patience — and their tolerance for pain — in the battle to return inflation to target.

Stock market dynamics by Empirical Research Partners

Empirical Research Partners is a smaller but very influential think tank. They seem more optimistic about their macro assessment than many investment banks, which might not be impartial in their assessment and could easily have trades on both sides of economic scenarios. In their recent Portfolio Strategy Update, Empirical Research Partners cover a lot of points of interest:

1. Baby boomers are retiring — that contributes to the tight job market. With depressed immigration on top of retiring crowds, the labor market could remain hot for an extended period of time, hence it is going to be tougher for the Fed to fight inflation back to what used to be a norm (2% target) for the last 20-30 years.

2. Wage growth is still sufficient to offset higher prices. Moreover, personal savings still remain elevated and represent a cushion for consumption and economy.

3. Supply-side inflation is giving way to demand-side inflation driven by higher salaries. Since the labor market may stay tight for a while, the Fed might reconsider their 2% inflation target and lift it up.

4. Mortgages: housing affordability is at historic lows — rents are up. At the same time, the US economy seems very resilient to higher interest rates and people still buy real estate. We are not at a full halt yet.

5. Big Growers have missed earnings more than the broader market, suggesting that Value is outperforming Growth for a reason.

6. Favoring GARP (Growth At Reasonable Price) stocks are the way to go! If we hit a recession, growth is going to be scarce, and investors will appreciate growth stories more. At the same time, Value will still be important due to higher interest rates. So, GARP stocks are a nice compromise in times of high uncertainty regarding “the landing” of the economy.

7. Cash flow margins are king! Going forward, the companies making $$$ will be rewarded more than promise stories with no current cash flow. This is a huge implication for investment regime and Growth vs. Value Dynamics.

8. Companies start finding it more difficult to pass through higher input costs, but profit margins still look ok. More careful analysis of the sustainability of profits should be very useful for portfolio managers.

9. Globalization is not over (although more and more US firms are bringing jobs back home). The salary discrepancy between DM and EM is growing, which makes EM still appealing for production.

10. If a full-scale recession (without a soft landing) hits the US, S&P 500 earnings could go down to $190 from $230 — an 18% decline. Since the market should price only a fraction of such a drop into the stock prices (based on long-term cash flows, not one-year results), the current market drop is an overreaction (which we want you to exploit).

Overall, Empirical highlights the fact that personal savings are still very healthy and the labor market is strong as ever. As such, the probability of a soft landing is still fairly high.

Stock market — a huge opportunity

If you have concerns about the current stock market volatility, please, reach out to your Signet advisor! From our standpoint, this market represents a huge opportunity for investors to enter or increase their exposure to the stock market at discounted prices. It seems almost nobody in the stock market is feeling good right now. That is usually a sign that things could turn around soon.

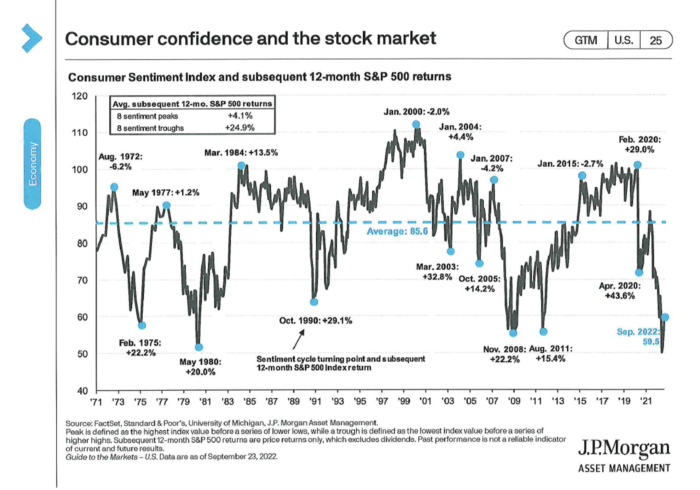

The depicted below chart looks at the S&P 500 performance after peaks and troughs in consumer sentiment. Interestingly, troughs in sentiment tend to precede stellar equity returns while peaks in sentiment don’t see as much upside. This underscores that getting out of the market when people feel crummy can be a tough investment strategy.

The information and opinions included in this document are for background purposes only, are not intended to be full or complete, and should not be viewed as an indication of future results. The information sources used in this letter are: WSJ.com, Jeremy Siegel, Ph.D. (Jeremysiegel.com), Goldman Sachs, J.P. Morgan, Empirical Research Partners, Value Line, BlackRock, Ned Davis Research, First Trust, Citi research, HSBC, and Nuveen.

IMPORTANT DISCLOSURE

Past performance may not be indicative of future results.

Different types of investments and investment strategies involve varying degrees of risk, and there can be no assurance that their future performance will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

The statements made in this newsletter are, to the best of our ability and knowledge, accurate as of the date they were originally made. But due to various factors, including changing market conditions and/or applicable laws, the content may in the future no longer be reflective of current opinions or positions.

Any forward-looking statements, information, and opinions including descriptions of anticipated market changes and expectations of future activity contained in this newsletter are based upon reasonable estimates and assumptions. However, they are inherently uncertain, and actual events or results may differ materially from those reflected in the newsletter.

Nothing in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice. Please remember to contact Signet Financial Management, LLC, if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and/or services. No portion of the newsletter content should be construed as legal, tax, or accounting advice.

A copy of Signet Financial Management, LLC’s current written disclosure statements discussing our advisory services, fees, investment advisory personnel, and operations are available upon request.