US economics, inflation, and the Fed

Inflation slowed in April with the Consumer Price Index reading and producer (wholesale) price growth both easing last month. Specifically, the Producer Price Index (PPI) rose 0.2% in April and was up just 2.3% over the last 12 months. The latter figure was only modestly above the Federal Reserve’s target rate of 2.0%, amounting to an encouraging sign for the central bank in its battle to tame inflation.

Softer price data may give the central bank the opportunity to pause interest rate hikes. Further increases, after raising the federal funds rate by five full percentage points in a little over a year, would pressure the housing industry, the banking system, and the commercial real estate business.

The consumer sector has proven resilient, but with pandemic-era savings eroding, more consumers are paying credit cards late according to the New York Fed, while balances grow. Consumption (68% of the US GDP) will become more restrained going forward.

The economy is slowing, with both manufacturing and residential construction activity weakening. It also is worth noting that initial weekly jobless claims have spiked this month, which suggests that the Fed’s efforts to slow job growth are starting to gain traction according to Value Line. This would not be good for consumer spending and would add to the growing worries about the US economy. On point, April retail sales rose 0.4%, which was half the consensus forecast.

Global economy

The global economy remains on track to generate a healthy 3% annual growth rate in the first half of 2023 according to J.P. Morgan. Consistent with this outcome, employment gains remain strong and unemployment rates have fallen to half a percent below pre-pandemic lows. Core inflation remains elevated, posting global increases at nearly 5% per annum over the first four months of the year.

Despite growth and inflation surprising to the upside this year, central banks look close to a pause. Rates are already on hold for most central banks outside the US and Western Europe. While the debate on the Fed’s upcoming decision continues, it looks likely to hold its fire in June.

J.P. Morgan points to three considerations about the path ahead that are pushing central bankers to pause.

- The first is the lags incorporated in models, which suggest that the drag from roughly 400 basic points tightening in global policy rates (ex. China) will continue to build. A sense of a large and still building drag drives US economist recession forecasts as well as market pricing of Fed easing later this year.

- The second related consideration is the perception of elevated financial stability risks associated with moving at an unprecedented pace. Concerns on this front have heightened significantly with the emergence of US banking sector stress and a broader tightening in developed markets’ bank lending standards.

- Third, there is the judgment that policy stances are now sufficiently restrictive to maintain central bank credibility and ensure that inflation gradually returns to acceptable levels. A pause would be a reasonable decision at this stage.

Despite the slowing US economy, the data continue to challenge views that the global economy is about to weaken sharply in the face of monetary tightening or that inflation is close to being contained. The latest activity readings point to solid underlying growth momentum in Western Europe and Japan.

Earning season and stock market

First-quarter earnings season proved better than expected. With more than 90% of S&P 500 companies reporting, nearly 80% posted positive earnings surprises, according to Value Line. Still, S&P 500 earnings are estimated to have fallen 2.5%, which would mark the second consecutive quarterly decline. The next few quarters may be weak too, as the consumer feels the full effects of higher borrowing costs.

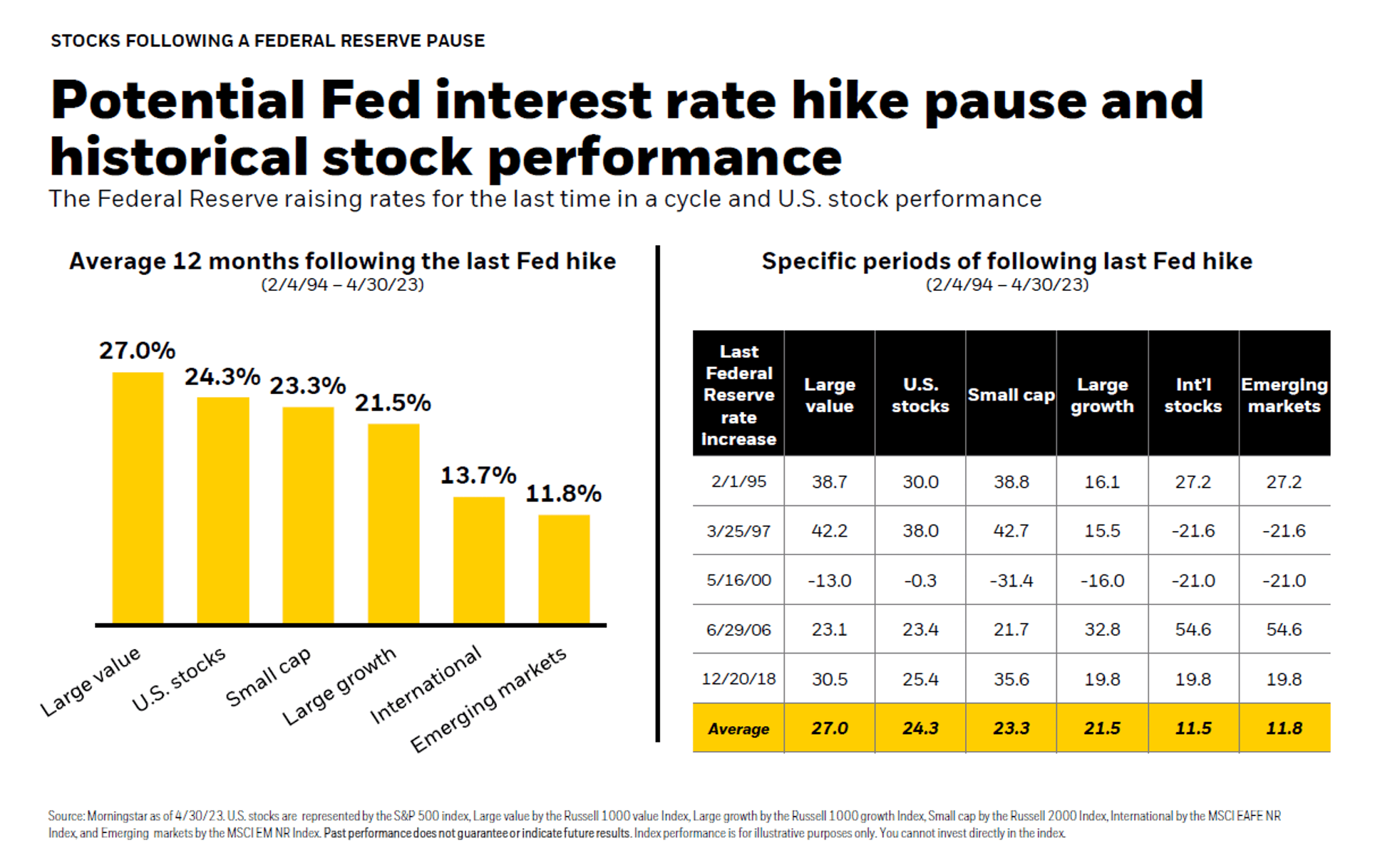

As we discussed above, there is a high possibility that the Federal Reserve will pause its rate hikes. According to BlackRock research, the potential pause in the Fed hiking interest rates should be good for risky assets (see the illustration below).

Sector forecast and stock portfolio rebalancing

Recently we rebalanced our actively managed equity portfolios. We maintained our barbell approach (although we narrow it down a bit, over-emphasizing more profitable companies).

It makes sense to keep exposure to Large Growers of a GARP nature (Technology, Communications, some Discretionary). However, we like cyclicals at attractive valuation levels, and we find it appropriate to maintain a healthy exposure to cyclicals (Consumer Discretionary, Financials, Industrials, and Tech); especially considering that many (such as Energy, and Materials) provide a natural hedge against inflation and rising interest rates. We stay underweight Utilities. We maintain adequate exposure to Healthcare, which worked really well in 2022 as a hedge.

At Signet we look at a lot of macro and micro indicators to forecast each economic sector’s attractiveness over the next 12 months.

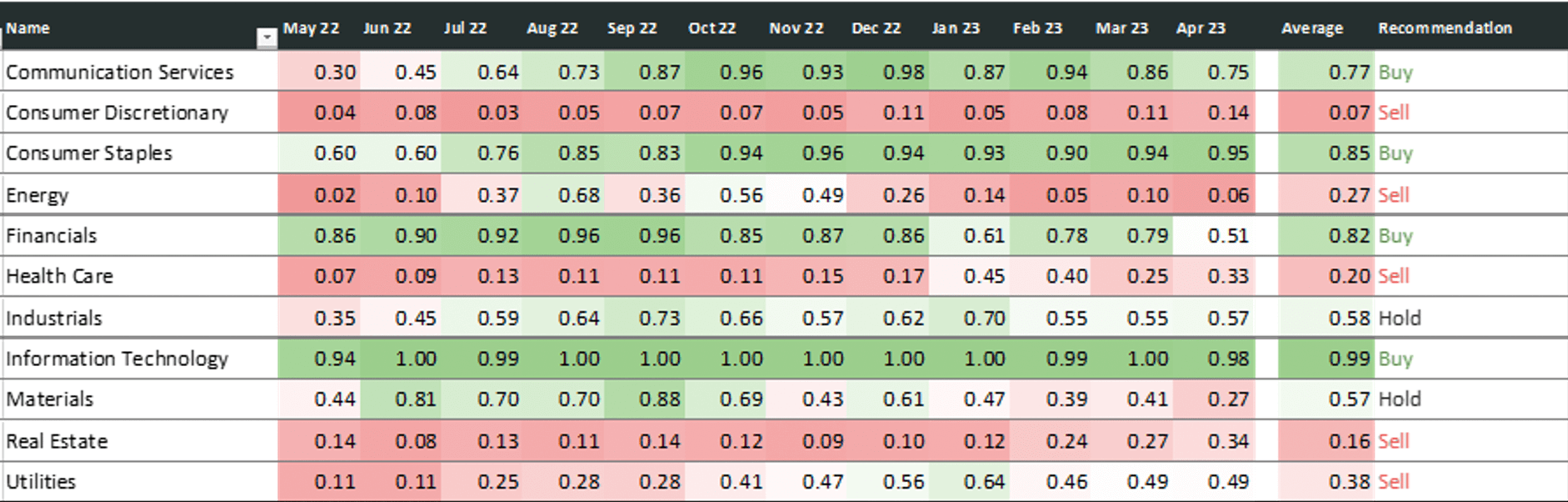

Our current reading (see the heat map below) points to a combination of caution and optimism. The bottom-up forecast favors Communications and Consumer Staples on the safe side and cyclical Technology and Financials on the more adventurous side.

Finding the right balance between opportunities in value and safety in quality is at the core design of all our portfolios!

The information and opinions included in this document are for background purposes only, are not intended to be full or complete, and should not be viewed as an indication of future results. The information sources used in this letter are: WSJ.com, Jeremy Siegel, Ph.D. (Jeremysiegel.com), Goldman Sachs, J.P. Morgan, Empirical Research Partners, Value Line, BlackRock, Ned Davis Research, First Trust, Citi research, HSBC, and Nuveen.

IMPORTANT DISCLOSURE

Past performance may not be indicative of future results.

Different types of investments and investment strategies involve varying degrees of risk, and there can be no assurance that their future performance will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

The statements made in this newsletter are, to the best of our ability and knowledge, accurate as of the date they were originally made. But due to various factors, including changing market conditions and/or applicable laws, the content may in the future no longer be reflective of current opinions or positions.

Any forward-looking statements, information, and opinions including descriptions of anticipated market changes and expectations of future activity contained in this newsletter are based upon reasonable estimates and assumptions. However, they are inherently uncertain, and actual events or results may differ materially from those reflected in the newsletter.

Nothing in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice. Please remember to contact Signet Financial Management, LLC, if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and/or services. No portion of the newsletter content should be construed as legal, tax, or accounting advice.

A copy of Signet Financial Management, LLC’s current written disclosure statements discussing our advisory services, fees, investment advisory personnel, and operations are available upon request.