Investing during an election year can be tough on the nerves. With the candidates and issues as polarizing as they are, it is natural to feel anxiety about the future and your investments.

No matter which side you’re on, you probably feel strongly that the person or party you vote for will have a positive impact on the country, the economy, the stock market, your personal finances, etc. You also probably feel strongly if your candidates lose, the opposite will occur.

Yet, you should avoid the temptation to make significant changes to a long-term investment plan based on which party controls Congress.

Focus on fundamentals, not politics

A look at the history of stock market returns suggests that there is not much of a relationship between election results and investment returns. Instead, we believe fundamental factors, such as the pace of economic growth, interest rates, corporate profits, and valuations, are much stronger drivers of stocks over the long term.

What history teaches us about stocks and control of Congress

The fact is that the stock market does not know and/or care which party controls Congress, or if control is mixed. Well at least from an investment standpoint.

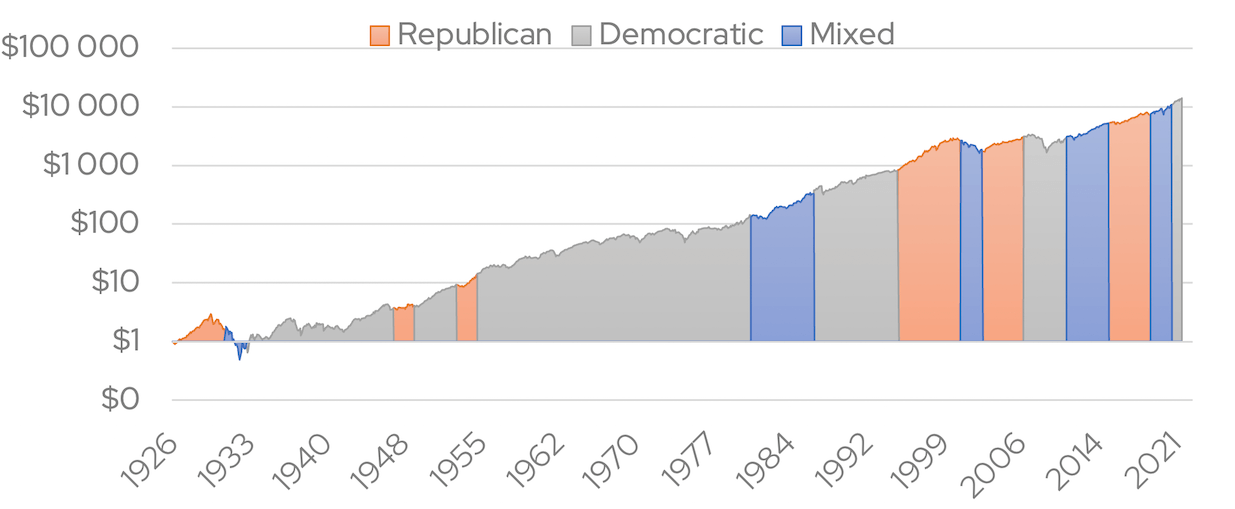

The chart below shows the hypothetical growth of $1 invested in the S&P 500 and party control of Congress. It shows that from 1926 to 2022, stocks trended higher regardless of whether Democrats or Republicans controlled the House and the Senate, or whether control was mixed.

Hypothetical growth of $1 invested in the S&P 500 and party control of Congress

Sources: S&P data, Dimensional Fund Advisors.

To learn more about how the midterm elections might impact your investment strategy, contact your Signet financial advisor, or Steve Tuttle directly at +1 800-390-2755 or stuttle@signetfm.com.