You’ve worked hard and saved for retirement the majority of your life. Don’t you think it’s time that your savings worked for you? The trouble is that traditional sources of investment income, such as US government bonds and savings accounts, are inadequate in today’s low-yield environment. The good news is, despite low rates, opportunities exist for those who know where to look and how to manage the risks of doing so.

A portfolio of dividend-paying stocks is one way to supplement or fully fund your retirement income. The strategy can help preserve your capital over long periods and generate a growing income stream regardless of market conditions.

4 reasons to consider dividend-paying stocks now

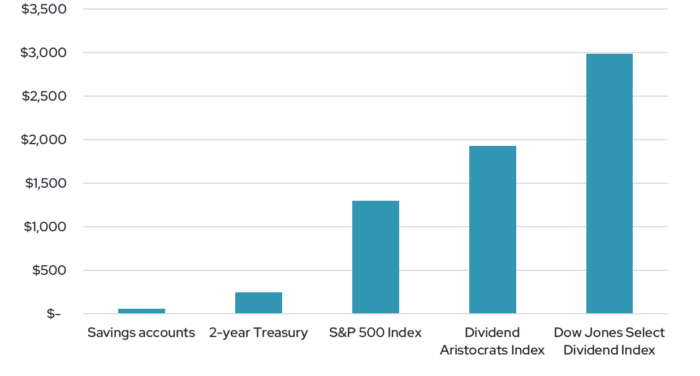

1. Attractive yields compared to savings accounts and other fixed-income investments

With the 10-year US Treasuries yielding < 1.5% and the national average interest rate for savings accounts at 0.06% (source: Bankrate,6/30/21), stock dividend strategies can offer significantly more income potential in the coming years.

Income earned on $100,000

The income estimate is a projected income amount over 1 year, based on current yields as of June 30, 2021. Actual income over the next 12 months could be higher or lower.

2. Potentially lower risk than broad stock markets

Dividend payers tend to be big, well-established companies. Dividend-paying stocks, on average, tend to be less volatile than non-dividend-paying stocks. Dividends provide a way to get paid even during rocky market periods when capital gains are hard to achieve.

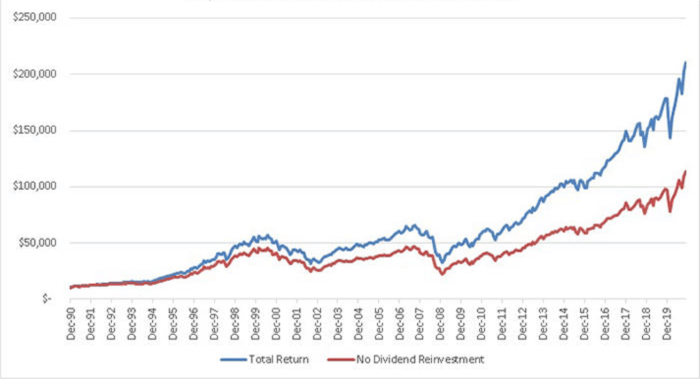

3. Reinvesting dividends could boost total returns over time

While you are saving for retirement, you can reinvest your dividends. This means that you systematically use dividends received to buy more shares in the companies that are paying the dividend. The chart below shows how reinvesting dividends can enhance stock performance.

Impact of dividend reinvestment on return

Calculations assume a starting portfolio value of $1,000. Indexes are unmanaged, do not incur management fees, costs, and expenses, and cannot be invested in directly. Past performance is no guarantee of future results.

4. Dividends may benefit from favorable tax treatment

Most taxpayers are subject to a top federal tax rate of only 15% on qualified dividends, although certain high-income taxpayers may pay up to 23.8%. However, this is still much lower than the top rate on ordinary income.

A word of caution

No investment vehicle is perfect. Dividend stocks are subject to the risks as all other equities. And unlike bonds—whose coupon payments are nearly guaranteed, barring default—their payouts could be trimmed or eliminated without warning.

All of which is to say that dividend stocks should not be viewed as a replacement for traditional fixed-income investments but rather as a complement to a diversified portfolio.

Dividends can be a significant source of income for your retirement.

One way to enhance your retirement income is to invest in dividend-paying stocks. Against a backdrop of low yields and stretched valuation for stock markets, we see the potential for dividend strategies to help retirees generate sustainable income.

A properly constructed mix of dividend-paying stocks for your portfolio can provide current income, income growth, and long-term capital appreciation.

Signet can help

Signet can help retirees build and maintain a portfolio of dividend stocks.To learn whether you can benefit from our expertise in generating income, please contact your Signet advisor, or Steve Tuttle directly at 800-390-2755 or stuttle@signetfm.com.