US economics, inflation, and the Fed

The Wall Street Journal shared great news in January 2024: the U.S. economy grew 3.1% over the last year, defying projections of a recession as a resilient labor market supported strong consumer spending. The year was capped by a fourth quarter in which the economy grew at a 3.3% seasonally and inflation-adjusted annualized pace, as household outlays and government spending rose, the Commerce Department said Thursday. The quarterly reading showed a slowdown from the summer’s torrid 4.9% pace but in line with prepandemic trends. The 2023 figures stand in contrast to what economists expected a year ago, when they saw a recession as likely and expected anemic 0.2% growth for the year, measured fourth quarter to fourth quarter. Last year’s gain was a sharp pickup from a comparable 0.7% advance in 2022.

Despite great economic news on the GDP front, stubbornly high inflation persisted at the consumer level. The December Consumer Price Index (CPI) rose 0.3% on a month-to-month basis and was up 3.4% over the last 12 months, both higher than expected according to Value Line. Conversely, the Producer Price Index (PPI) fell 0.1% and was up just 1.0% over the last year. Given this varied data, the Personal Consumption Expenditures (PCE) Price Index, the assessment of inflation most closely tracked by the central bank, will be a key data point ahead of the next Federal Open Market Committee (FOMC) meeting. The Federal Reserve may not be in a rush to reverse monetary policy course. Indeed, despite forecasts on Wall Street for an interest-rate cut as early as this March, senior Fed officials have stated that the federal funds rate may need to stay high for longer to effectively fight inflation. Value Line’s stance is that a reduction to the benchmark interest rate will not come before the second half of this year.

Professor Siegel of Wharton Business School doesn’t think we need five to six cuts from the Fed to have continued equity market gains this year. The Dot Plot penciled in three rate cuts — but the key insight he took from Powell’s December discussion was the willingness of the Fed to cut rates if the economy weakens. Professor Siegel previously was concerned the Fed might be stubborn in its inflation fight even in a softer economic scenario. Now we see the Fed weighing the employment side of its mandate as much as the inflationary side. And that’s the key flexibility we need to lower downside risks. If the economy is strong and the Fed does not cut rates as much as some expect — earnings growth may end up being supportive for the market.

Global economy

JP Morgan continues to emphasize limited visibility in key elements of the 2024 outlook — most notably whether we are moving to a path of sustainable expansion — it is notable that markets and economic forecasters are increasingly embracing a soft-landing scenario. On growth, JP Morgan sees low recession risks in the first half of 2024. With financial conditions having eased materially and moderating inflation boosting household purchasing power, pressures that could spark a near-term break have abated. The year-end signal from the global composite PMI and labor markets aligns with JP Morgan’s forecast that growth is proceeding at a trend-like pace as we turn into the new year.

After two years of 5% gains, global core inflation tumbled to 3.3% in the second half of 2023. Despite that fact, the nearly unanimous message from developed markets central banks in recent weeks, including the Fed and ECB, is that rate cuts are unlikely to start this quarter.

Despite some weaknesses in manufacturing in the second half of 2023, JP Morgan expects the world economy to grow by 2.2% this year and Goldman Sachs (GS) is optimistic in its forecasts as well.

Stock market: earnings and small caps

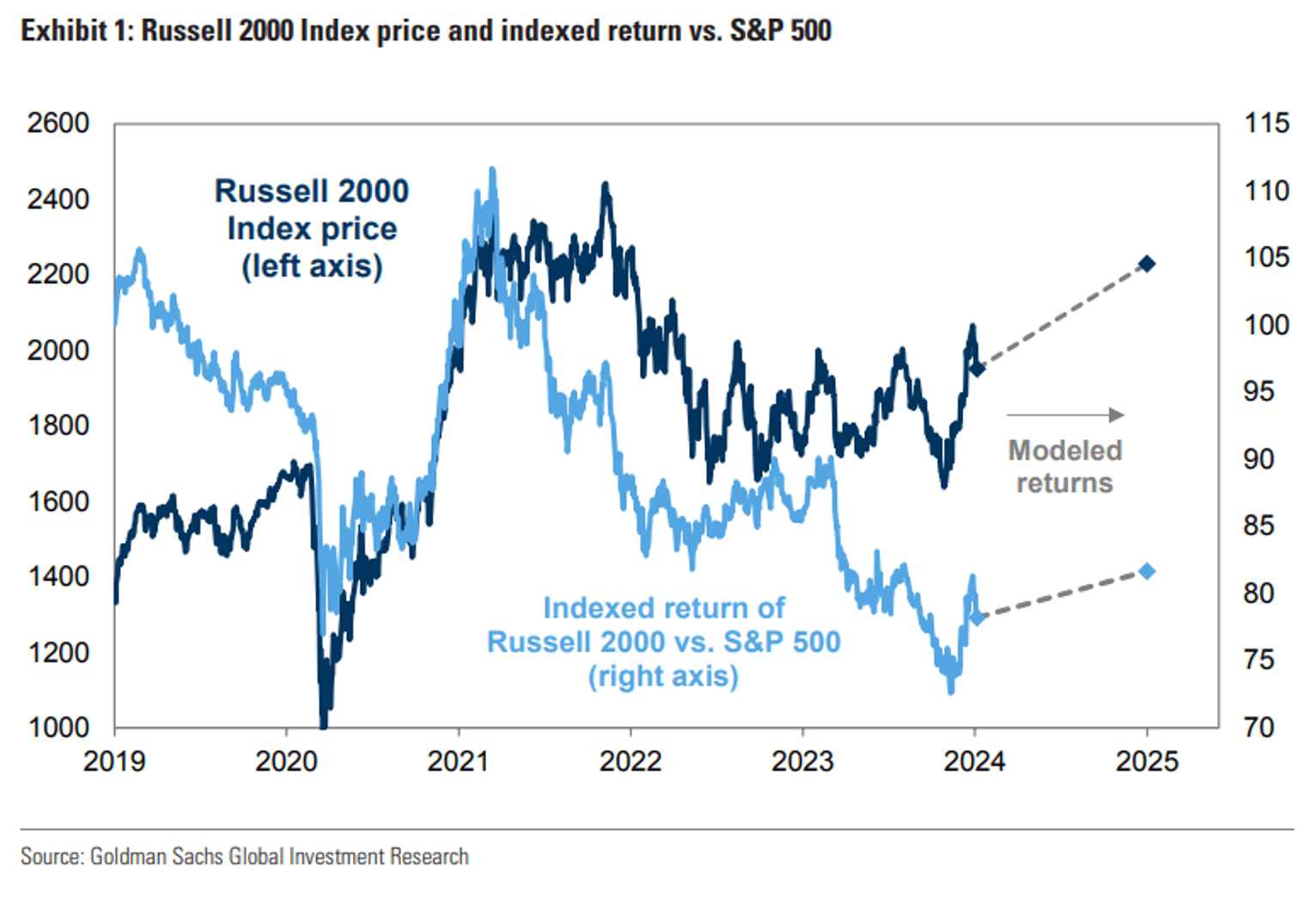

Fourth-quarter earnings season got off to a decent start, with big banks delivering solid profit growth. Solid results from Corporate America may be needed to justify current stock valuations. In its latest research, Goldman Sachs states that the combination of low current valuations and a healthy economic outlook indicates that the Russell 2000 small-cap index should return roughly 9% in the next 6 months and 15% in the next 12 months. This compares with GS’s forecast that the large-cap S&P 500 will rise by 7% to 5100 at the end of 2024 (total return of 9% including dividends). In recent decades, nearly two-thirds of the variation in Russell 2000 12-month returns have been explained by valuations at the start of each period and real US economic growth during the period. If GS economists’ 2024 real US GDP growth forecast of 2% is realized, these historical relationships suggest small caps should generate solid returns in the coming months.

The information and opinions included in this document are for background purposes only, are not intended to be full or complete, and should not be viewed as an indication of future results. The information sources used in this letter are: WSJ.com, Jeremy Siegel, Ph.D. (Jeremysiegel.com), Goldman Sachs, J.P. Morgan, Empirical Research Partners, Value Line, BlackRock, Ned Davis Research, First Trust, Citi research, HSBC, and Nuveen.

IMPORTANT DISCLOSURE

Past performance may not be indicative of future results.

Different types of investments and investment strategies involve varying degrees of risk, and there can be no assurance that their future performance will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

The statements made in this newsletter are, to the best of our ability and knowledge, accurate as of the date they were originally made. But due to various factors, including changing market conditions and/or applicable laws, the content may in the future no longer be reflective of current opinions or positions.

Any forward-looking statements, information, and opinions including descriptions of anticipated market changes and expectations of future activity contained in this newsletter are based upon reasonable estimates and assumptions. However, they are inherently uncertain, and actual events or results may differ materially from those reflected in the newsletter.

Nothing in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice. Please remember to contact Signet Financial Management, LLC, if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and/or services. No portion of the newsletter content should be construed as legal, tax, or accounting advice.

A copy of Signet Financial Management, LLC’s current written disclosure statements discussing our advisory services, fees, investment advisory personnel, and operations are available upon request.