US economics, inflation, and the Fed

The mighty U.S. consumer has proven resilient amid the high inflation environment. Although the headline July retail sales figure was flat on a month-to-month basis, the core reading, which excludes the automobile component, climbed 0.4%. The consumer sector accounts for roughly two-thirds of the gross domestic product (GDP) and the positive demand figure, when coupled with solid job-creation numbers, may indicate the U.S. economy is somewhat stronger than other recent data have suggested according to Value Line.

Quarterly results from the retailers were a positive surprise. Mass merchandisers Walmart and Target beat expectations, and the club store operators Costco and BJ’s delivered strong results. However, they did say that consumer behavior has changed in recent months, with many trading down to less expensive private-label items as inflation remains high.

The Federal Reserve is not fooling around with inflation. July consumer and producer prices did show some moderation, but most of the relief was due to lower energy costs. The central bank is likely to remain on its current monetary tightening course but has to guard against being too restrictive and pushing the economy into a deep recession. Value Line highlights notable demand weakness in the housing market, and the U.S. consumer taking on more debt at higher rates to deal with inflation. The Federal Reserve Bank of New York said that credit card balances rose 13% in the second quarter, the largest year-over-year increase in more than 20 years.

Global economy

Despite all the negative news of late J.P. Morgan (JPM) expects the global GDP to grow by 2.7% this year, while the US should climb by a 1.7% rate. The bank’s global outlook can be summarized in three easy pieces.

First, the global expansion looks likely to skirt recession despite being buffeted by multiple adverse shocks during the first half of 2022. Healthy private sector balance sheets provided a cushion that will be reinforced in the second half of the year by fading supply-side drags and additional fiscal stimulus.

Second, inflation is falling but not set to return to central bank comfort zones as rising labor costs and shifting inflation psychology will partially offset the fading of energy and pandemic-related price pressures.

Finally, central banks have moved aggressively this year (policy rates outside China are up 156bp) but are not done. JPM expects further 125bp rate increases from the Fed, BoE, and ECB by year-end, based on the judgment that they belatedly recognize that the inflation process has changed in a manner that requires restrictive stances. The price of skirting recession will be hawkish central banks, sluggish growth, and limited disinflation. A growing concern is that this environment convinces central banks that sluggish growth is not sufficient to bring inflation back to target and that their additional tightening becomes the catalyst for an early end to the expansion.

Tracking this top-down global forecast is complicated by the emergence of widely divergent regional impulses. Global recessions have consistently started in the United States, and the latest news showing US recession risks abating is an important global signal. While overall global forecasts improve, recent developments point to Europe sliding into a deeper than an anticipated downturn. Incoming activity readings do not distinguish the US and Europe; both regions look to be delivering modest growth amid solid labor market performance this quarter. However, the fall in European sentiment is more severe amid a still-building natural gas shock.

With the US looking resilient and Europe expected to contract, China will play a key role in determining where the global expansion is heading according to J.P. Morgan. For the current quarter a significant reopening bounce is already evident in activity readings. But the latest data also point to a potential sharp loss of momentum as we look toward the next quarter. Weakness in housing looks to be intensifying and is combining with softness in service-sector activity related to ongoing COVID-related fears. With the latest boost to infrastructure spending set to fade and housing weakness generating constraints on local governments, there is a risk that downward momentum in domestic demand will be magnified by policy tightening. Policymakers appear to recognize these risks and are now on the move.

On the heels of last week’s PBOC rate cuts, the State Council announced a new round of stimulus measures to support central government infrastructure projects, local government bond issuance, and energy sector investments to ensure a stable power supply. This August new stimulus package, along with the easing measures in June and July, provides ¥1.5 trillion (1.2% of GDP) cushion against an impending fiscal funding gap. While it removes the risk that government policy magnifies a growth slowdown, it is not likely to keep growth from moderating substantially next quarter.

Stock market and the earnings season

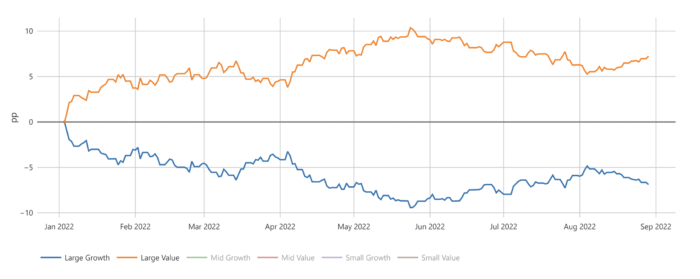

A potential economic slowdown prompted market participants to re-evaluate their preferences towards Growth companies and we saw the profitable and money-making GARP sub-group outperforming through mid-August, only to reverse the course again (see Large Growth vs. Value graph below).

Large Value vs. Growth relative performance YTD 2022

Source: Signet Financial Management, LLC

With the earnings season pretty much behind us, we can breathe with relief — earnings and projections came out stronger than had been feared. The market participants are laser-focused on the interest rate dynamics. With interest rates climbing again — the market saw all asset classes trend lower at the end of August.

The dynamics of interest rates is important to short-term market dynamics but should mean very little to long-term investors. As the market anticipates the Fed to start lowering the rates next year, longer-term prospects of fundamentally strong companies should become more and more attractive, and their performance should divert from the money-losing fundamentally weak counterparts.

A sensible approach to active management should help our multifactor equity strategies during the current decade. Index-oriented investors should probably consider diversifying into multifactor active strategies, so they don’t have all the eggs in one passive investment philosophy basket. Passive and active approaches are cyclical, and we are coming out of a very strong passive decade (very reminiscent of 2000–2010 scenario where broader market returns were nothing to write home about).

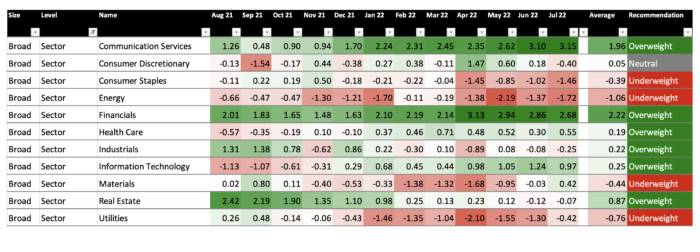

Recently we rebalanced some of our actively managed equity strategies. We made very few changes because our portfolios already contain fundamentally strong companies. We did emphasize Financials as the sector typically flourishes during higher interest rates environments and Healthcare — an attractively valued defensive sector. Signet’s proprietary sector forecast (see the heatmap below) displays a visible preference toward cyclicals (Financials and Communications — the strongest) and we believe the classic defensive sectors (Staples and Utilities) are overvalued. Such a forecast speaks to continued strength in selective areas of the markets.

Economic sector forecast August 2022

Source: Signet Financial Management, LLC

The information and opinions included in this document are for background purposes only, are not intended to be full or complete, and should not be viewed as an indication of future results. The information sources used in this letter are: WSJ.com, Jeremy Siegel, Ph.D. (Jeremysiegel.com), Goldman Sachs, J.P. Morgan, Empirical Research Partners, Value Line, BlackRock, Ned Davis Research, First Trust, Citi research, HSBC, and Nuveen.

IMPORTANT DISCLOSURE

Past performance may not be indicative of future results.

Different types of investments and investment strategies involve varying degrees of risk, and there can be no assurance that their future performance will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

The statements made in this newsletter are, to the best of our ability and knowledge, accurate as of the date they were originally made. But due to various factors, including changing market conditions and/or applicable laws, the content may in the future no longer be reflective of current opinions or positions.

Any forward-looking statements, information, and opinions including descriptions of anticipated market changes and expectations of future activity contained in this newsletter are based upon reasonable estimates and assumptions. However, they are inherently uncertain, and actual events or results may differ materially from those reflected in the newsletter.

Nothing in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice. Please remember to contact Signet Financial Management, LLC, if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and/or services. No portion of the newsletter content should be construed as legal, tax, or accounting advice.

A copy of Signet Financial Management, LLC’s current written disclosure statements discussing our advisory services, fees, investment advisory personnel, and operations are available upon request.