US economics, inflation, and the Fed

The March price data showed a moderation in headline inflation. On the heels of a benign 0.1% increase in the Consumer Price Index (CPI), the Labor Department’s companion report revealed that the Producer Price Index (PPI) fell 0.5%. On a 12-month basis, the CPI and PPI rose 5.0% and 2.7%, respectively, both notably below recent high-water marks.

So why have these inflation reports not changed the narrative about the Federal Reserve’s next monetary policy decision? That is because when looking beyond the headline figures, inflation remains sticky according to Value Line. The core CPI, which excludes the more volatile food and energy components, rose a stronger-than-expected 5.6% last month. The New York Federal Reserve’s Survey of Consumer Expectations expects the inflation rate to be 4.7% one year from now, still well above the Fed’s target rate of 2.0%.

The consensus is that the central bank will raise the federal funds rate by a quarter point, to 5.00%-5.25%, at its May monetary policy meeting.

Higher interest rates are impacting the economy. This is evident in contracting manufacturing activity, slowing non-manufacturing (services) growth, and declining home sales. The Fed also is closely monitoring the health of the consumer sector, which was the backbone of the economic recovery from the COVID-19 pandemic. The 1% decline in March retail sales may indicate that the U.S. consumer is now feeling the ill effects of inflation and the resultant higher borrowing costs.

Global economy

J.P. Morgan emphasizes that the disconnect between perceptions and reality around economic performance has widened in recent weeks. In the April World Economic Outlook, the IMF expresses widespread concern about a “global economy that appears poised for a gradual recovery” but that remains “quite fragile,” and notes that “downside risks dominate.” Meanwhile, the Federal Reserve staff recently joined their counterparts at the Bank of England in forecasting a recession to take hold this year. US private sector forecasters take a similar view as the April Blue Chip consensus projects declines in US GDP both this and next quarter.

The reality is that the global economy delivered boomy 1Q23 growth and momentum remained firm as the quarter ended. As anticipated, China posted a double-digit annualized 1Q GDP gain, and US GDP expanded at a less-than-anticipated but nevertheless positive 1.1% rate in the first quarter of 2023.

With risks to our forecast for a 1% per annum gain in Western Europe skewed to the upside, global GDP is on track to rise faster than at a faster 4% per annum last quarter. Outside the first year of recovery from the last two deep recessions, this will represent the strongest quarterly gain in nearly two decades.

China’s reopening lift may soon fade along with several transitory factors flattering US growth at the start of the year. J.P. Morgan highlights at least three signals that challenge the fragility narrative.

First and foremost, the global economy’s performance shows that monetary tightening is not the only game in town as a fading of last year’s negative shocks is providing a material lift to 2023 growth.

Second, the underlying health of the private sector is evident in the still strong employment and consumer spending gains despite the sharp drop in private sector confidence in 2H22. Finally, nominal GDP likely grew faster than 7% per annum last quarter globally (and roughly 6% — in the developed markets). The income generated from these unexpectedly large gains will promote resilience in the coming quarters.

Earning season and stock market

First-quarter earnings season is heating up. Investors were particularly interested in the results from the banking industry, which has dealt with turmoil created by the collapse of a few regional banks in March. The results were mixed, with most of the big banks beating profit prognostications, but also warning that conditions may deteriorate if a recession unfolds. On a positive note, several smaller regional banks did not show a notable drop in deposits, which caused the liquidity drain at the now-defunct Silicon Valley Bank according to Value Line.

Professor Siegel of Wharton Business School points out that stocks have really held in quite well with all this prevailing pessimism. He has seen patterns of morning selling and buying coming in the afternoon. As measured by the CBOE Volatility Index (VIX) fear gauge, volatility levels are falling.

Rebounding productivity might keep these earnings and margins safeguarded. Procter & Gamble’s (P&G) earnings report showcased why stocks are good hedges against inflation. P&G’s earnings and revenue came in strong from price increases, even though unit sales (volume) came in lower.

On the other side of price hikes in the Consumer Staples sector, we saw an early sign of price cuts competing for market share and growth with Tesla lowering the price points for electric vehicles (EVs). Tesla traded down on its earnings report and these price cuts and that weighed on the NASDAQ where Tesla is a large weight. Whether P&G raising prices or Tesla lowering them is more indicative of the broad trend in inflation will be something to watch carefully.

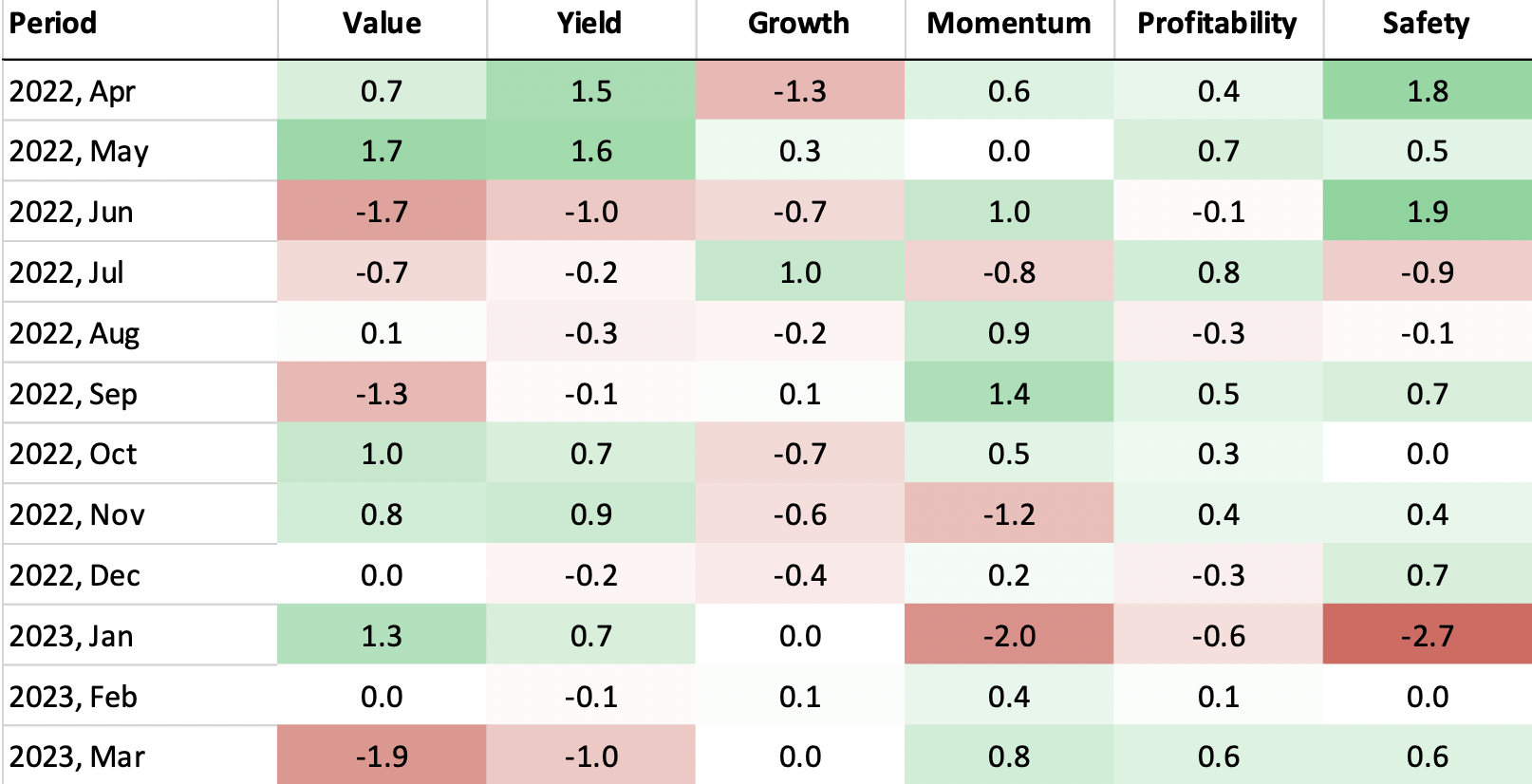

Signet major factor groups point to an interesting dynamic: while Value and Yield compete with Growth, Profitability, and Safety (the major characteristics of Quality stocks) have shown relatively consistent performance over the last 12 months (see the heat map of the relative performance of major factor groups).

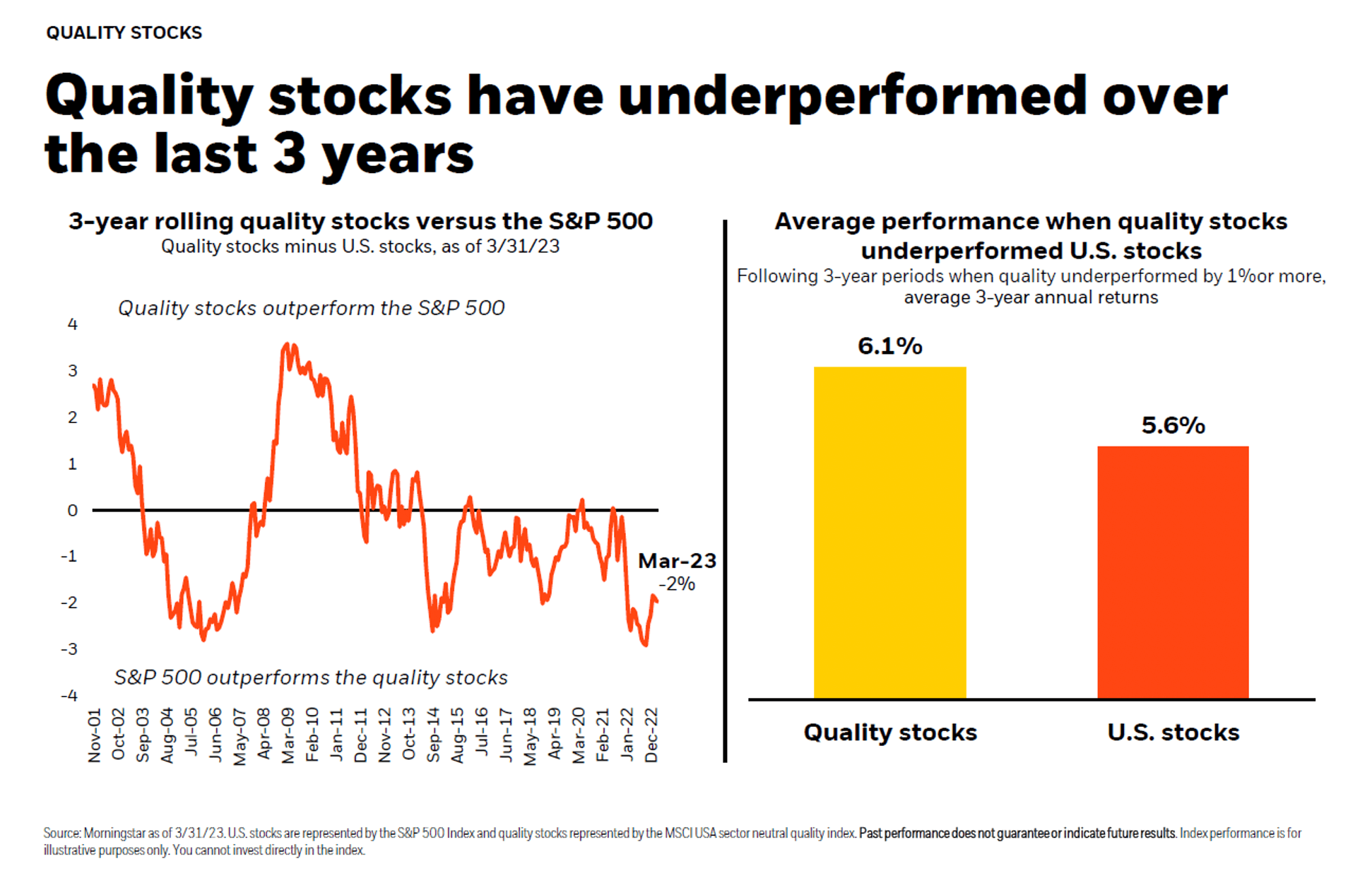

According to BlackRock research the years of underperformance of quality stocks usually are followed by the years of outperformance (see the illustration below). We at Signet follow our multi-factor discipline and pay huge attention to the quality characteristics of individual stocks and funds we deploy in our strategies. Growth at Reasonable Price Stocks with good quality are a substantial part of all our actively managed portfolios and tactical shifts in our more passive allocations.

The information and opinions included in this document are for background purposes only, are not intended to be full or complete, and should not be viewed as an indication of future results. The information sources used in this letter are: WSJ.com, Jeremy Siegel, Ph.D. (Jeremysiegel.com), Goldman Sachs, J.P. Morgan, Empirical Research Partners, Value Line, BlackRock, Ned Davis Research, First Trust, Citi research, HSBC, and Nuveen.

IMPORTANT DISCLOSURE

Past performance may not be indicative of future results.

Different types of investments and investment strategies involve varying degrees of risk, and there can be no assurance that their future performance will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

The statements made in this newsletter are, to the best of our ability and knowledge, accurate as of the date they were originally made. But due to various factors, including changing market conditions and/or applicable laws, the content may in the future no longer be reflective of current opinions or positions.

Any forward-looking statements, information, and opinions including descriptions of anticipated market changes and expectations of future activity contained in this newsletter are based upon reasonable estimates and assumptions. However, they are inherently uncertain, and actual events or results may differ materially from those reflected in the newsletter.

Nothing in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice. Please remember to contact Signet Financial Management, LLC, if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and/or services. No portion of the newsletter content should be construed as legal, tax, or accounting advice.

A copy of Signet Financial Management, LLC’s current written disclosure statements discussing our advisory services, fees, investment advisory personnel, and operations are available upon request.