US economics, inflation, and the Fed

As we progress into the year, inflationary pressures seem to be gradually waning. The Consumer Price Index (CPI) was up by 6.0% during February, year over year, which was an improvement from the January figure. Moreover, the monthly Producer Price Index (PPI) provided a favorable reading as well. Value Line points out that disinflation can be seen in several areas, including the critical energy category.

Specifically, the price of crude oil has fallen under the $70-a-barrel mark. Energy is heavily utilized by consumers and businesses, so the decline is significant for prices overall. In addition, the February employment report showed upward pressure on wages may be easing.

The Fed recently hiked the interest rate by a quarter point and lowered its 2023 GDP projections down to 0.4%. Most economists project Q1 GDP to annualize between 2% and 3%. But if 2023 full-year GDP growth is 0.4%, the economy must average negative growth over the next three quarters.

According to Professor Siegel of Wharton Business School, these Fed forecasts are therefore predicting a recession. Unless there is another complete collapse of productivity, the Fed is also predicting negative job growth for the next nine months and a rise in the unemployment rate to 4.6%.

The Federal Reserve is in a difficult position. Despite some progress, inflation remains above the central bank’s 2% target rate, and it is unclear if that goal can be reached without risking a recession or systemic disruptions. For instance, some regional banks have been buckling as rising interest rates depressed balance sheets and led to liquidity shortfalls. These developments may influence the Fed, which not too long ago struck a more hawkish tone.

Professor Siegel reiterates: “it has been reported that the bank stress tests only “stressed” banks up to a 2% Fed funds rate when the Fed’s projections showed increases two to three times higher. That is another Fed failure. Even ignoring the regulatory mishaps that are taking place from the Federal Reserve Bank of San Francisco, the failure to test bank balance sheets above a 2% Fed funds rate is perhaps as big a mistake as not hiking rates in 2021 despite the explosion in the money supply. The risk of recession has increased clearly. Maybe the markets will knock sense into the Fed.” Professor Siegel thinks the Fed will lower rates by the end of the year and perhaps ease very rapidly.

Global economy

Higher interest rates have slowed the pace of new construction around the developed markets (DM). The weakness in housing activity is exacerbated by a tightening in lending standards and a weakening of demand in both developed and emerging markets (EM).

The banking sector stress now unfolding in the US and Western Europe will magnify this drag. Less appreciated, however, has been the boost to growth from the fading of last year’s drags: pandemic-related supply dislocations and the Russian invasion of Ukraine. These lifts are dominating current quarter growth performance, according to J.P. Morgan. The benefit from sliding global goods price inflation is boosting global retail spending.

Around the globe, China’s reopening bounce is gathering steam alongside a European rebound from its energy price shock. As a result, global GDP growth is tracking a whole percentage point above its potential pace this quarter despite the tightening drag (3.6% growth annual growth in Q1).

So, DM central banks face a dilemma: how quickly to slow interest rate hikes, guiding toward a pause where a sustained higher-for-longer policy stance might gradually deliver disinflation while avoiding recession. However, their patience is being challenged by higher-than-expected core inflation readings and continued tightness in labor markets. But bank sector stress has tempered any hawkish reaction to the latest inflation news.

Time and monetary policy are likely to remain key factors undermining the expansion. The benefits of China’s reopening and the slide in global goods price inflation should fade during 2H23 while the absence of central bank easing (in the face of elevated inflation) and tightening credit should build.

A history lesson on banking shocks

Recently the major news surrounded regional US banks. According to Empirical Research Partners, the regional banks, a less-regulated part of that industry, have been the lenders of choice in recent years.

The large-cap public banks, that number less than two dozen, accounted for 17.5% of the industry’s entire loan book in 2019 and thereafter they sourced around 40% of all loan growth. They were an engine for the booming deposit growth of the period too, sourcing a quarter of it, compared to their 15% share of the base. Their importance to the system’s credit creation and the likelihood of tighter regulation of them raises the latest crisis to the level of a macroeconomic event.

At the moment, the Fed seems determined to contain the problem of mismatched durations between assets and liabilities. The future will tell whether we have more than a handful of troubled banks with poor investment decision-making.

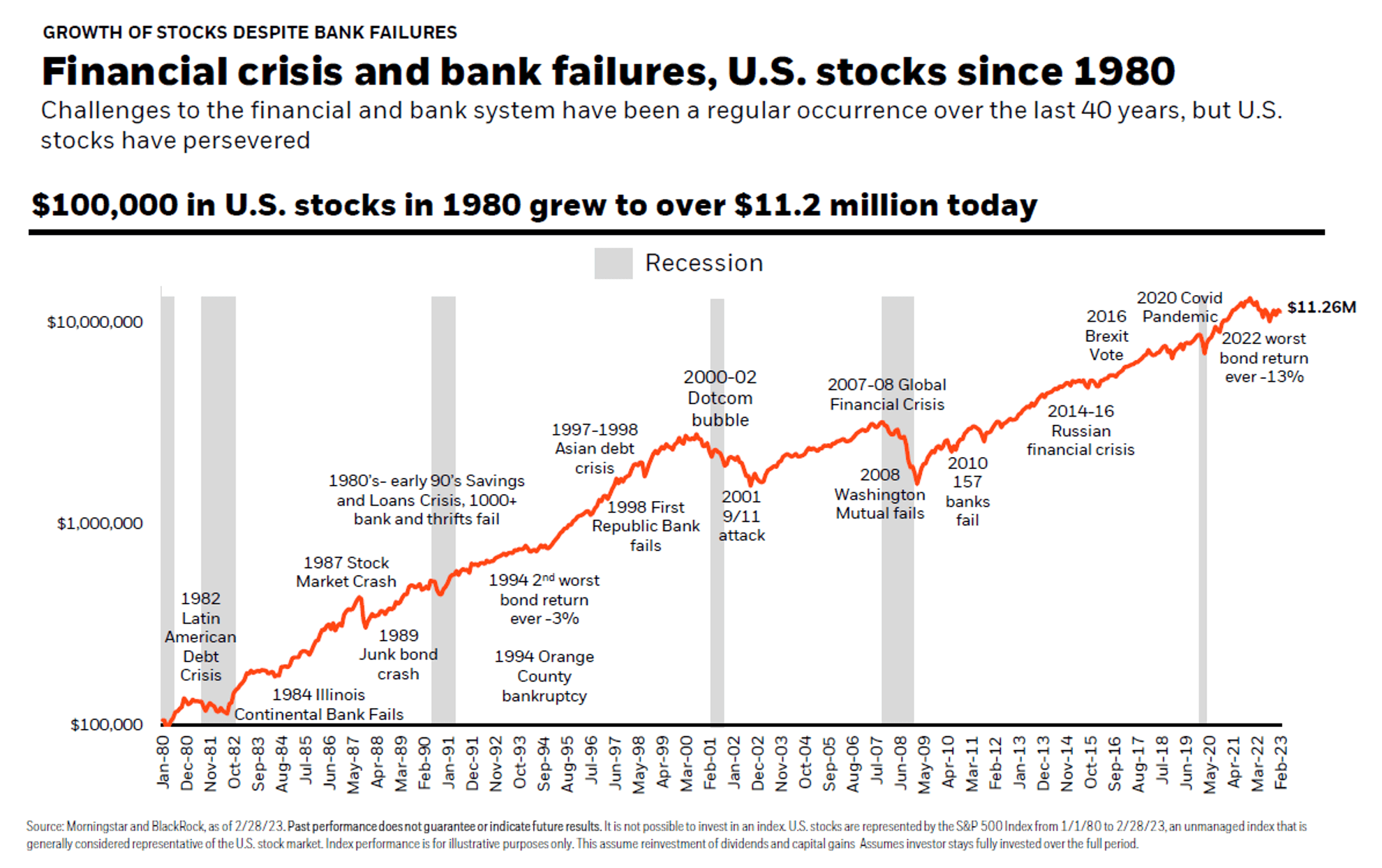

Despite some concerns, if history is any indicator, the banking crises come and go, but the equity market keeps going up. See BlackRock’s illustration below:

The information and opinions included in this document are for background purposes only, are not intended to be full or complete, and should not be viewed as an indication of future results. The information sources used in this letter are: WSJ.com, Jeremy Siegel, Ph.D. (Jeremysiegel.com), Goldman Sachs, J.P. Morgan, Empirical Research Partners, Value Line, BlackRock, Ned Davis Research, First Trust, Citi research, HSBC, and Nuveen.

IMPORTANT DISCLOSURE

Past performance may not be indicative of future results.

Different types of investments and investment strategies involve varying degrees of risk, and there can be no assurance that their future performance will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

The statements made in this newsletter are, to the best of our ability and knowledge, accurate as of the date they were originally made. But due to various factors, including changing market conditions and/or applicable laws, the content may in the future no longer be reflective of current opinions or positions.

Any forward-looking statements, information, and opinions including descriptions of anticipated market changes and expectations of future activity contained in this newsletter are based upon reasonable estimates and assumptions. However, they are inherently uncertain, and actual events or results may differ materially from those reflected in the newsletter.

Nothing in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice. Please remember to contact Signet Financial Management, LLC, if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and/or services. No portion of the newsletter content should be construed as legal, tax, or accounting advice.

A copy of Signet Financial Management, LLC’s current written disclosure statements discussing our advisory services, fees, investment advisory personnel, and operations are available upon request.