Are you looking for a way to invest in stocks that offers both growth and income?

Dividend investing can be a great way to achieve this, but there are challenges. This article explores how multi-factor analysis and fundamental research can be used to enhance dividend investing and help you get the most out of your investments. We’ll also discuss the flaws in dividend ETFs and mutual funds and why they can be a less-than-ideal choice for investors.

So if you’re looking for a better way to invest in dividend stocks, read on to find out more.

Stock dividends are attractive for investors seeking growth and income

Dividend payments offer regular, reliable income to the investor without sacrificing overall portfolio performance. By investing in stocks that pay dividends, investors can gain access to a steady stream of income while still being able to benefit from potential capital gains if stock prices rise.

Dividend payments can also act as a hedge against inflation as they aim to increase over time, helping prevent the investor’s purchasing power from eroding by rising prices.

What is the best way to invest in dividend stocks?

For investors who want to maximize potential returns while minimizing risk, it is important that they thoroughly research each individual stock before investing. This includes analyzing the company’s financial statements and performance history as well as carefully assessing the current economic environment and any other relevant factors that could affect the stock’s future performance. Applying multi-factor analysis can also help identify potential opportunities and risks associated with each dividend stock in order to ensure optimal returns on investment.

We recommend both top-down and bottom-up approaches to researching companies.

- Top-down analysis assesses macroeconomic factors such as industry trends and economic cycles.

- Bottom-up analysis looks at individual company factors such as profitability, valuation, momentum, and growth.

A combination of these two approaches can help identify quality stocks with attractive dividend yields that meet the investor’s goals for growth and income generation.

There are flaws in mutual funds and dividend exchange-traded funds (ETFs)

Investing in dividend stocks is a great way to diversify a portfolio and generate income, but there are some drawbacks when investing in mutual funds or dividend ETFs. Many of these investment vehicles limit diversification by focusing too much on current yield. This can limit the potential for total return potential of the portfolio, i.e., income plus growth. It can also lead to a concentrated portfolio with many similar stocks in slow-growing industries. This lack of diversification can cause higher volatility and increased risk if one sector performs poorly.

Incorporating multiple factors into our investment strategy can help Signet make informed decisions about which stocks to buy or sell.

To overcome the limitations of mutual funds and dividend ETFs, Signet turns to multi-factor analysis when researching potential holdings. This involves examining several factors at once, such as macroeconomic data, company financials, valuations, forward estimates, technical indicators, market trends, etc., in order to identify potential opportunities or risks associated with each stock. By considering multiple factors when making decisions rather than relying solely on current yield, we seek to better manage risk and increase expected returns over time.

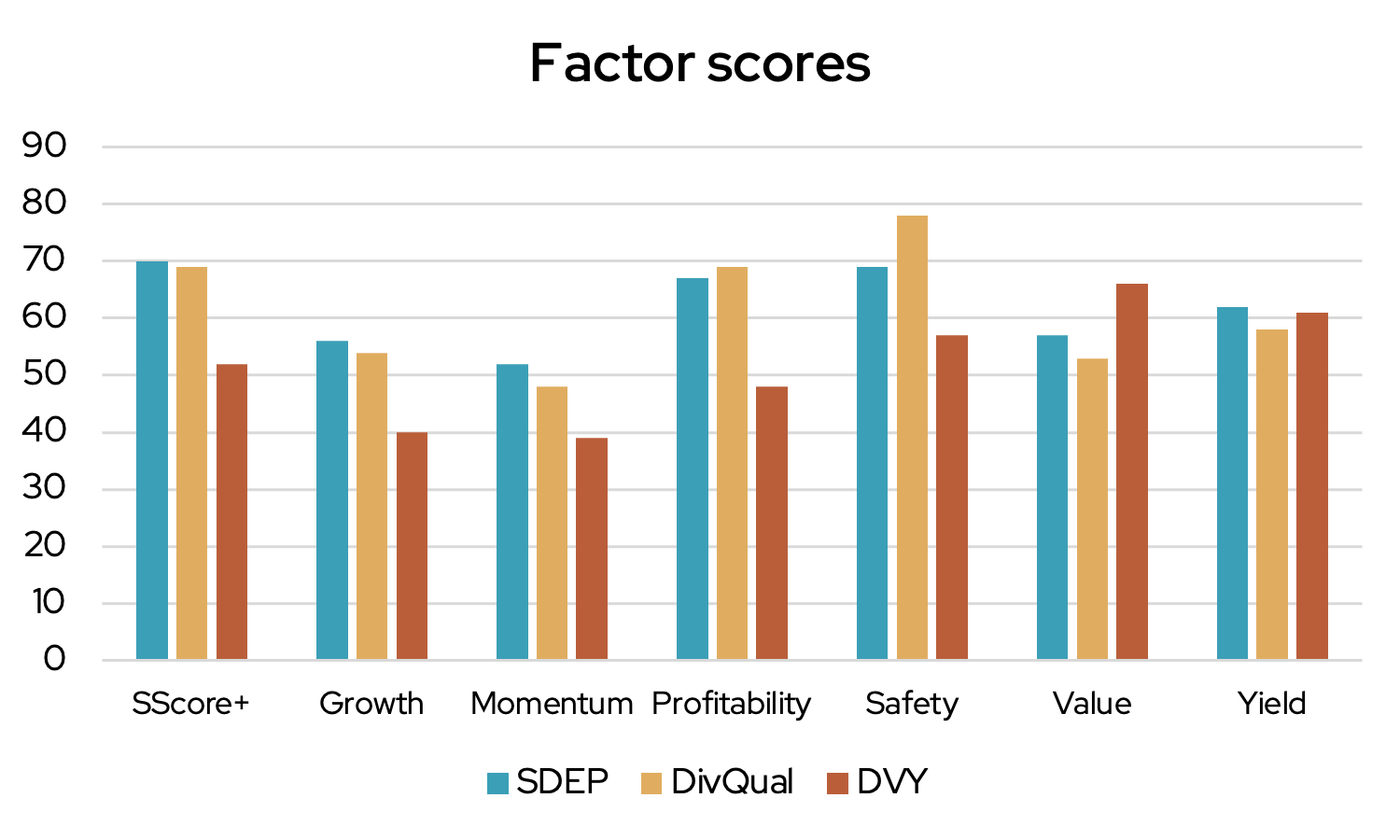

The chart below compares factor scores from Signet’s dividend portfolios to a popular stock dividend ETF, iShares select dividend ETF (symbol DVY). Signet’s strategies (Strategic dividend portfolio — SDEP, and Dividend quality portfolio — DivQual) score higher in overall score (SScore+) and also across important factors such as growth, momentum, profitability, and safety. DVY only scores slightly higher in the value factor. This reiterates our point that many dividend ETFs are over-exposed to cheap stocks and concentrated in a few sectors such as financials and utilities, and underweight important sectors such as technology and healthcare.

Source: Signet Financial Management, LLC. The factor scores show how Signet’s dividend portfolios and the iShares select dividend ETF are each exposed to individual factors. The SScore+ is a proprietary overall score that rates each portfolio across multiple factors.

Investing in a portfolio of dividend stocks can be an effective way to generate consistent income and long-term capital appreciation potential.

Dividend investing is particularly attractive for investors looking to diversify their portfolios and protect against market volatility.

Investing in stock dividends provides investors with a unique opportunity to create a diversified portfolio composed of both high-quality growth stocks and steady sources of income generation through regular dividend payments.

Signet’s dividend strategies seek to capture capital appreciation from rising prices as well attractive yields. Furthermore, a multi-factor framework to construct a portfolio of dividend stocks has advantages over strategies used with typical ETFs and mutual funds.

To learn more about dividend investing and whether it is right for you, contact your Signet advisor or Steve Tuttle directly at +1 800-390-2755 or stuttle@signetfm.com.