Global economy

Forecasting for 2024, economists anticipate positive, but moderate, economic growth, while citing that the current level of interest rates could lead to challenges in consumer spending, real estate, and corporate investment. Overseas, global unrest — which could potentially destabilize the energy market — is also a concern.

Nevertheless, productivity gains from continued automation and adoption of AI shall support long-term sustainable economic growth. The combination of population growth and productivity improvements are the key ingredients in creating more prosperity in the US and around the world.

Below we highlight 2024 economic projections from Goldman Sachs and JP Morgan. The projections should always be taken with a grain of salt. The most important thing about them is to see what trends we should pay attention to and if unexpected ones come up as we progress into the next year.

Projections by Goldman Sachs

- The global economy has outperformed even the most optimistic expectations in 2023. GDP growth is on track to beat consensus forecasts from a year ago by 1pp globally and 2pp in the US, while core inflation is down from 6% in 2022 to 3% sequentially across economies that saw a post-covid price surge.

- More disinflation is in store over the next year. Although the normalization in product and labor markets is now well advanced, its full disinflationary effect is still playing out, and core inflation should fall back to 2-2½% by end-2024.

- GS continues to see only limited recession risk and reaffirm their 15% US recession probability. They expect several tailwinds to global growth in 2024, including strong real household income growth, a smaller drag from monetary and fiscal tightening, a recovery in manufacturing activity, and an increased willingness of central banks to deliver insurance cuts if growth slows.

- Most major DM central banks are finished hiking, in our view. However, our baseline forecast for a strong global economy project that rate cuts probably won’t arrive until 2024H2. When rates do settle, GS expects central banks to leave policy rates above their current estimates of long-run sustainable levels.

- The Bank of Japan will likely start moving to exit yield curve control in the spring before formally exiting and raising rates in 2024H2, assuming inflation remains on track to exceed its 2% target. Near-term growth in China should benefit from further policy stimulus, but China’s multi-year slowdown will likely continue.

- The transition to a higher interest rate environment has been bumpy, but investors now face the prospect of much better forward returns on fixed income assets. The big question is whether a return to the pre-GFC rate backdrop is an equilibrium. The answer is more likely to be yes in the US than elsewhere, especially in Europe where sovereign stress might reemerge. Without a clear challenge to the US growth story, the dollar is likely to remain strong.

Projections by JP Morgan

- Global GDP growth slows to a below-potential pace. After accelerating to a 2.8% gain this year, we expect global growth to slow to a below-potential 2%ar in 1H24. Along with a continued drag from tight monetary policy and rising yields, the fading of this year’s significant positive shocks should weigh on overall growth.

- The service sector cools and manufacturing remains soft. Growth rotated sharply towards the service sector over the past year, but normalization of the COVID-depressed parts of services is now over. In addition to contributing to slower GDP growth, a moderating service sector should be a catalyst for slowing global employment growth. At the same time, global industry is unlikely to see much lift in the coming months, as final goods demand growth looks to have struggled in the latest data.

- Developed markets (DM) underperform Emerging markets (EM). While the DM is set to slow to a below-potential pace of growth in 1H24, the EM is set to outperform in response to policy easing and fading food inflation. Fiscal supports in China also are providing support for growth. The result will be a sluggish global economy no longer fueled by US exceptionalism.

- Core inflation should remain sticky at 3%. The central condition for a recession dynamic to take shape is inflation that fails to give sufficient comfort to central banks to relax their restrictive stances. Although headline inflation is expected to drop next year, we look for tight labor markets and a shift in inflation psychology to keep core inflation at around 3%, largely because of continued upward pressure on labor costs and service prices.

- Central banks likely to stay higher-for-longer. In the face of sticky inflation, current market expectations for an early start to DM easing cycles are likely to be disappointing. Rather than cuts, our global baseline assumes central bank rhetoric will need to maintain their tightening bias, a development that will put upward pressure on short-term interest rates and lead to an additional tightening of financial conditions.

- Supply softens with demand. In our boil the frog scenario, the recent pickups in productivity growth (in the US) and labor supply growth (more broadly) are expected to fade. If realized, supply-demand imbalances will likely percolate back to the surface, diminishing disinflationary pressures and lifting inflation expectations.

- Business shows limited appetite to cushion. In an environment of expected profit margin compression and tight financial conditions, we expect business attitudes to gradually turn cautious, leading to a stall in capex and hiring. Once this begins, a negative feedback loop between business caution and moderating household income growth will significantly raise recession vulnerability.

Global markets

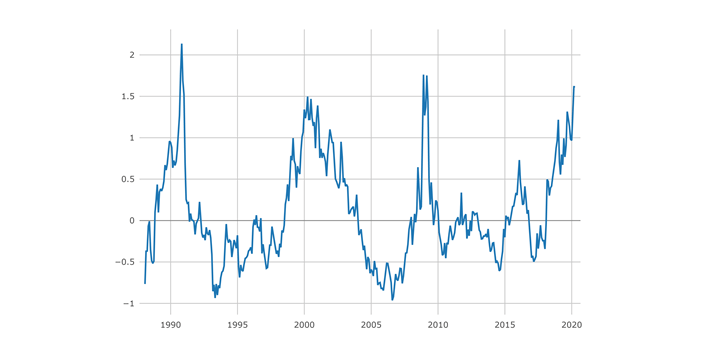

Bonds

For the second year in a row, developed market government bonds are on course to deliver disappointing returns. We agree with Goldman Sachs that 2024 should see a return to at least modest positive returns, and we think the case for longer-dated bonds — and some duration risk — in portfolios has been improving.

The value of bonds as a recession hedge has also been improving. If inflation risks subside and economic growth becomes a bigger risk, the value of bonds as a recession hedge should grow. With growth risks higher outside the US, Europe-US rates spreads may remain wide so the stronger case for duration applies outside the US too.

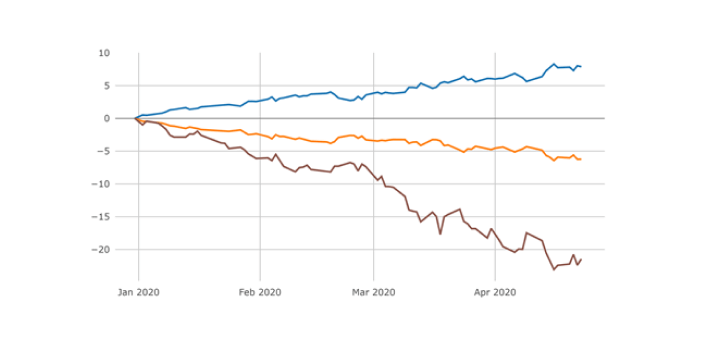

Stocks

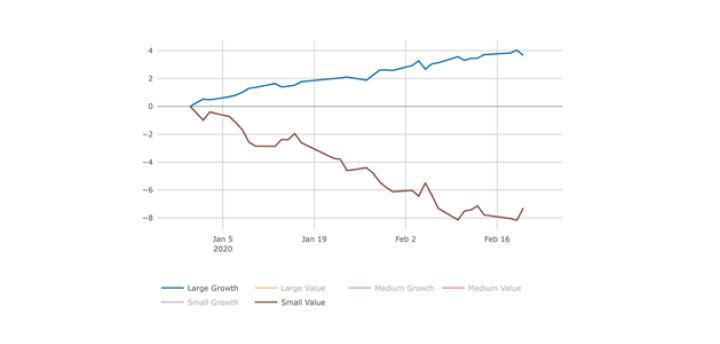

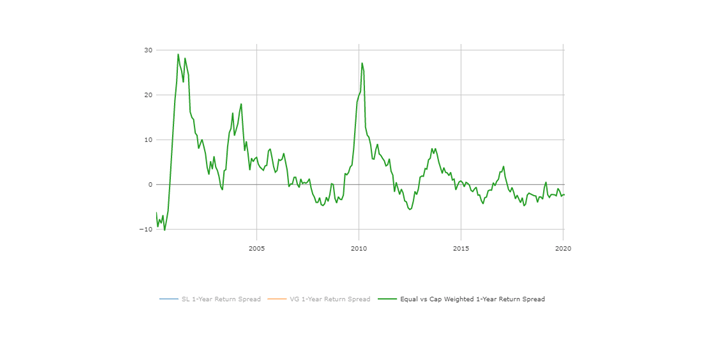

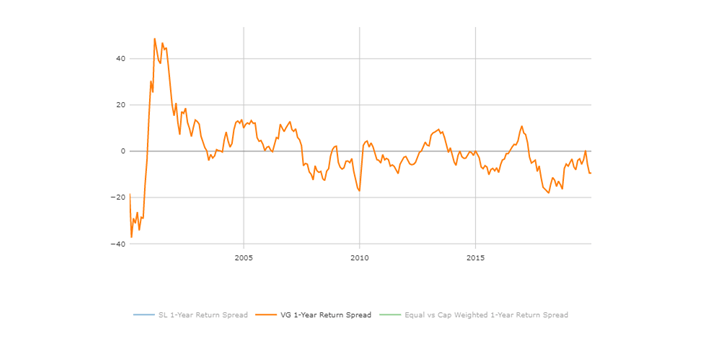

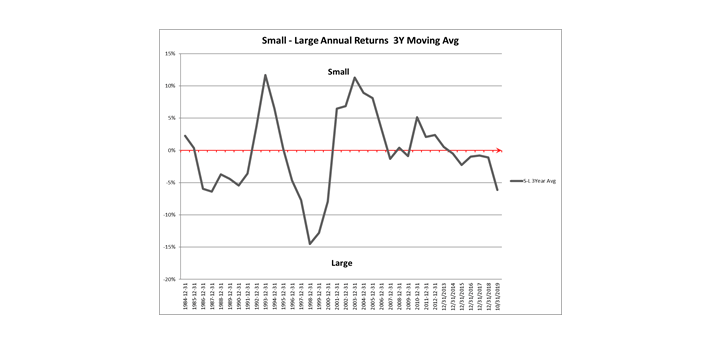

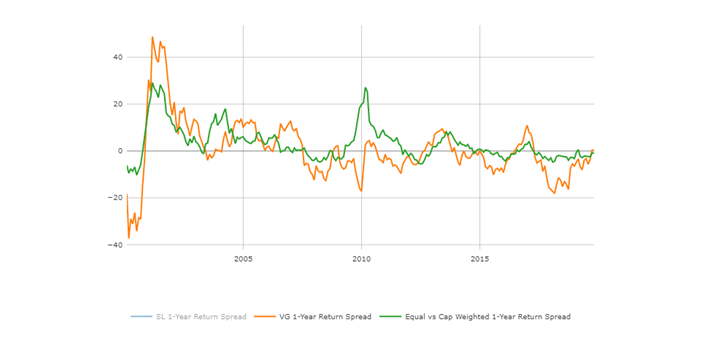

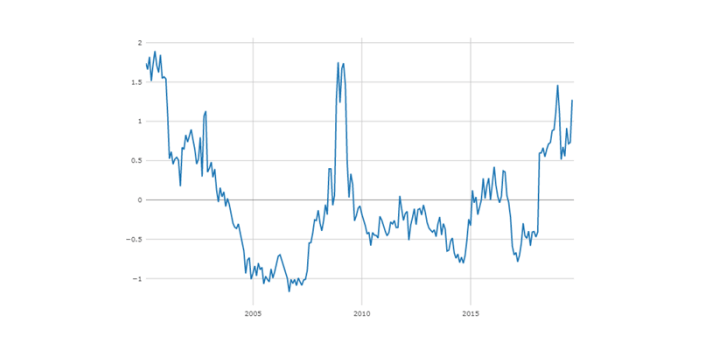

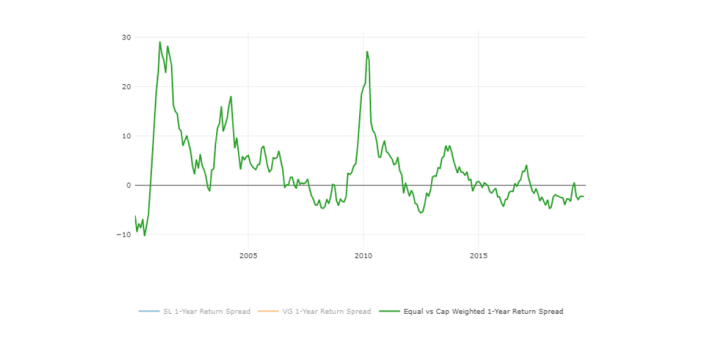

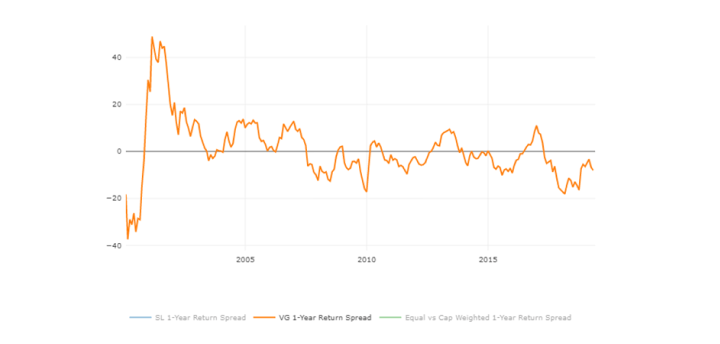

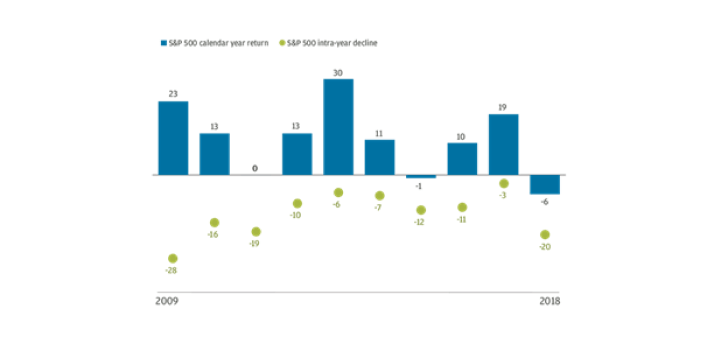

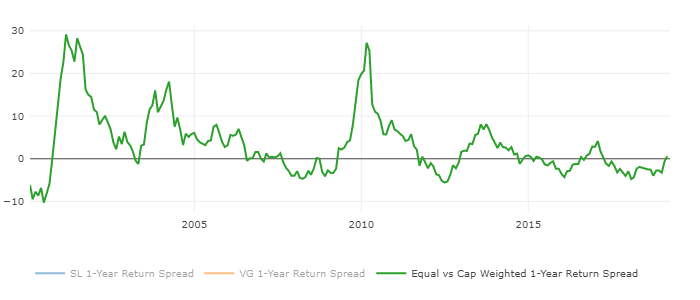

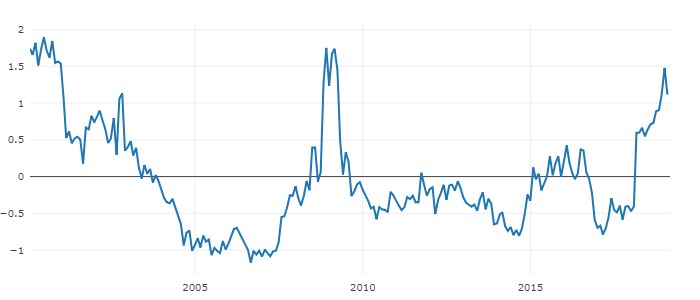

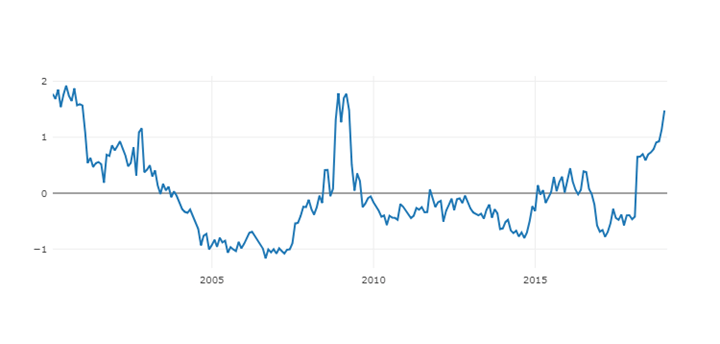

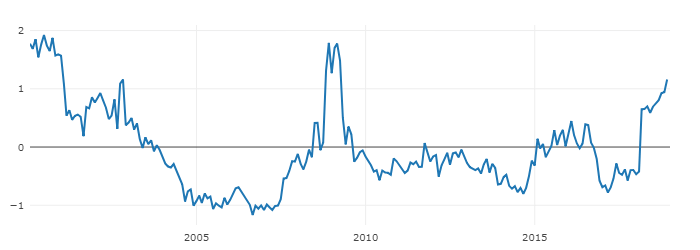

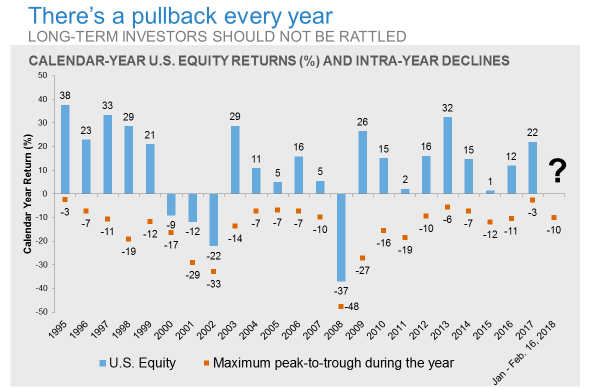

The US equities outperformed all the major assets in 2023 at the time we went to print. The outperformance has been driven almost entirely by the large tech and AI-exposed companies. Both the equal-weighted S&P 500 and smaller-cap indices lagged large-cap stocks on the year. 2024 might have similar dynamics. US equity valuations still represent a drag on the forward return profile. Those valuation constraints and the risk that stronger-than-expected growth would lead to higher rates still place limits on the likely upside from equities. But in some respects, the story looks a bit more positive than it was a year ago. The consensus forecasts for stable unemployment rates, anchored yields, and falling core inflation are a somewhat larger tailwind for equities than they were last year.

On the valuation front, things are not homogeneous. First, outside US mega-caps “earnings yields” look less stretched versus history according to Goldman Sachs, and in many places valuations have improved relative to last year. Second, for mega-cap tech, 5-year forward earnings yield also looks quite reasonable versus forward real bond returns if the expected growth profiles can be delivered. Third, parts of the cyclical universe including energy offer attractive earnings yields. Fourth, dispersion is likely to remain high and focus on company “alpha” may continue to be rewarded. We think that in a “higher for longer” world, strong balance sheet companies and larger companies still have scope to extend their outperformance on average. We remain big proponents of a barbell approach: keeping some exposure to the US mega-caps alongside exposure to some of the more beaten-down cyclical areas.

Balancing portfolios

Although the macro environment still presents significant challenges, the good news is that investors face more options than before given the return to more normal levels of yields. The balance between macro tailwinds and valuations may limit the return story in riskier assets. But even so, consensus forecasts envisage modest positive returns for bonds, credit, equities, and a bit more than that in commodities.

Each asset class offers protection against at least one key tail risk: bonds should perform well if recession risks rise; and equities and EM could outperform if the inflation environment eases more rapidly and central banks reverse some of their recent tightening more quickly than is currently expected.

In 2023, cash represented a high hurdle for other assets to beat. While front-end yields still look very attractive, a more balanced asset exposure should probably replace the focus on cash that dominated in 2023, including a greater role for duration in portfolios.

The information and opinions included in this document are for background purposes only, are not intended to be full or complete, and should not be viewed as an indication of future results. The information sources used in this letter are: WSJ.com, Jeremy Siegel, Ph.D. (Jeremysiegel.com), Goldman Sachs, J.P. Morgan, Empirical Research Partners, Value Line, BlackRock, Ned Davis Research, First Trust, Citi research, HSBC, and Nuveen.

IMPORTANT DISCLOSURE

Past performance may not be indicative of future results.

Different types of investments and investment strategies involve varying degrees of risk, and there can be no assurance that their future performance will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

The statements made in this newsletter are, to the best of our ability and knowledge, accurate as of the date they were originally made. But due to various factors, including changing market conditions and/or applicable laws, the content may in the future no longer be reflective of current opinions or positions.

Any forward-looking statements, information, and opinions including descriptions of anticipated market changes and expectations of future activity contained in this newsletter are based upon reasonable estimates and assumptions. However, they are inherently uncertain, and actual events or results may differ materially from those reflected in the newsletter.

Nothing in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice. Please remember to contact Signet Financial Management, LLC, if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and/or services. No portion of the newsletter content should be construed as legal, tax, or accounting advice.

A copy of Signet Financial Management, LLC’s current written disclosure statements discussing our advisory services, fees, investment advisory personnel, and operations are available upon request.